Navigating Economic Future: The Crucial Role of Inflation Forecast Accuracy

In the dynamic landscape of economics, the accuracy of inflation forecasts holds tremendous significance for informed decision-making by individuals, businesses, and policymakers. This article delves into the intricacies of achieving precision in projecting inflation and its far-reaching implications.

The Importance of Accurate Inflation Forecasts

Accurate inflation forecasts provide a roadmap for economic planning and decision-making. Whether it’s individuals managing personal finances, businesses making strategic moves, or policymakers formulating effective economic policies, having a reliable projection of inflation is essential for anticipating trends and adjusting strategies accordingly.

Methodologies in Forecasting Inflation

Forecasting inflation involves employing various methodologies, considering economic indicators, historical trends, and external factors. Analysts may use statistical models, econometric techniques, and qualitative assessments to make predictions. The challenge lies in selecting the most appropriate methods and refining them to enhance the accuracy of forecasts.

Implications for Monetary Policy

Central banks, tasked with maintaining price stability, heavily rely on accurate inflation forecasts. Precise projections enable central bankers to implement appropriate monetary policies, adjusting interest rates and liquidity to either stimulate or cool down the economy. The effectiveness of these policies hinges on the reliability of inflation forecasts.

Business Strategies in a Predictive Environment

For businesses, operating in an environment where inflation is accurately forecasted is advantageous. Accurate projections empower businesses to anticipate cost fluctuations, adjust pricing strategies, and make informed decisions about investments and expansions. This strategic foresight contributes to better risk management and financial planning.

Consumer Confidence and Informed Decisions

Accurate inflation forecasts play a vital role in shaping consumer confidence. When individuals have a clear understanding of future inflation trends, they can make more informed decisions about spending, saving, and investing. This, in turn, influences overall economic health, as consumer behavior drives a significant portion of economic activity.

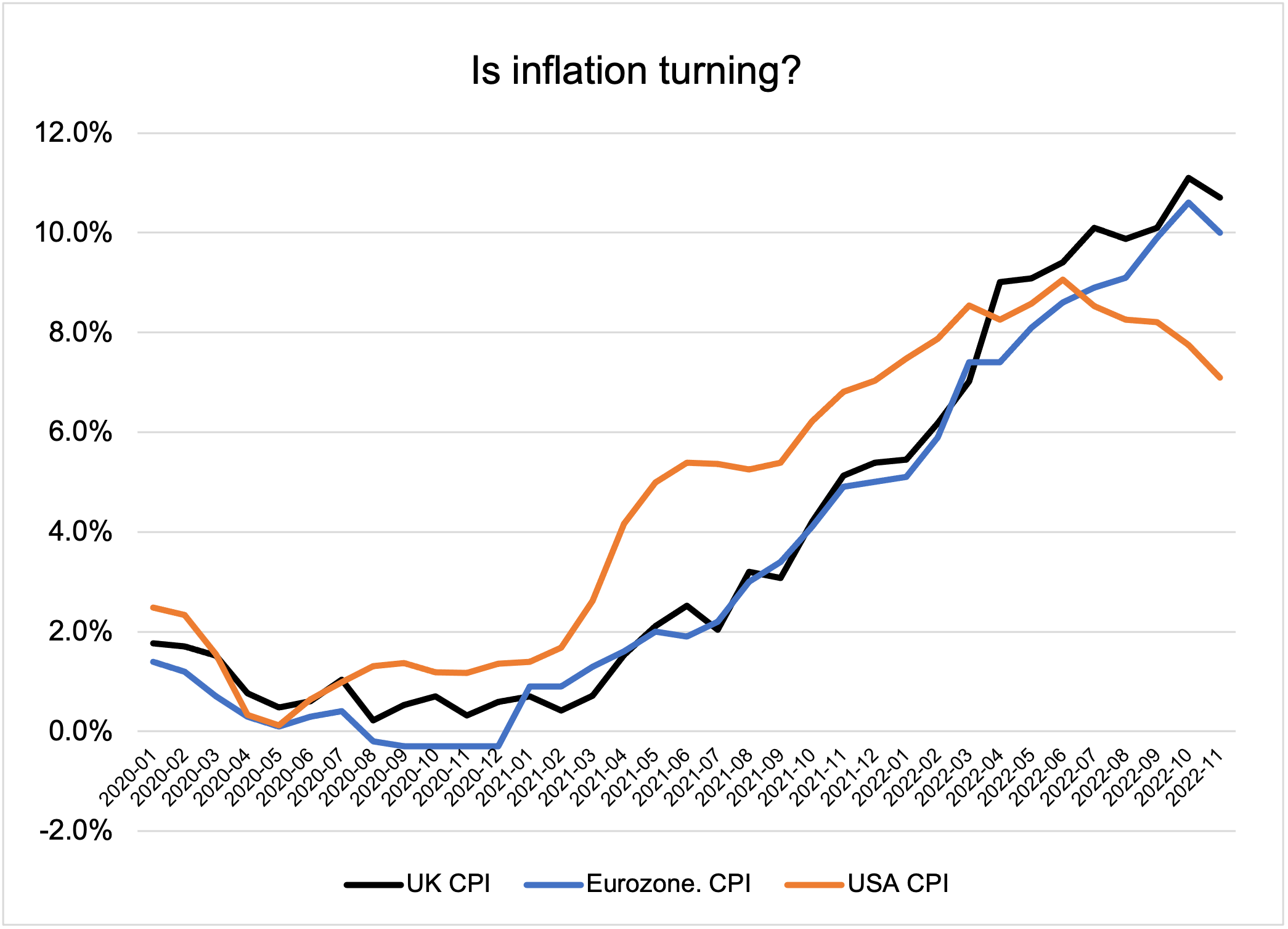

The Challenge of External Factors

While forecasting techniques continue to evolve, external factors remain a challenge in achieving inflation forecast accuracy. Geopolitical events, natural disasters, or unexpected economic shocks can disrupt projections. The ability to integrate these unpredictable elements into forecasting models is essential for enhancing accuracy.

Continuous Improvement in Forecasting Models

The pursuit of accuracy in inflation forecasts is an ongoing process. Continuous improvement in forecasting models involves incorporating new data sources, refining algorithms, and adapting to changes in the economic landscape. The dynamic nature of markets requires a commitment to staying at the forefront of forecasting methodologies.

In-Depth Exploration of Inflation Forecast Accuracy

For an in-depth exploration of current trends in inflation forecast accuracy and expert insights, explore Inflation Forecast Accuracy. This resource provides valuable information to help individuals, businesses, and policymakers stay abreast of the latest developments in forecasting.

Collaborative Efforts for Enhanced Accuracy

In conclusion, achieving precision in inflation forecasts requires collaborative efforts from economists, policymakers, businesses, and individuals. As technology advances and methodologies evolve, the collective pursuit of accurate projections contributes to a more stable and resilient economic future. In a world shaped by the accuracy of economic predictions, the quest for improving inflation forecast accuracy remains a shared endeavor.