Mastering the Art: Precision in Inflation Forecast Accuracy

In the ever-evolving landscape of finance, the accuracy of inflation forecasts holds significant implications for businesses, policymakers, and investors. This article delves into the importance of achieving precision in inflation forecasts and explores strategies for enhancing forecast accuracy.

The Significance of Accurate Inflation Forecasts

Accurate inflation forecasts serve as a compass for economic decision-making. Businesses rely on these forecasts for pricing strategies, investment decisions, and supply chain planning. Policymakers utilize inflation projections to formulate effective monetary and fiscal policies. Investors, too, base their decisions on these forecasts to navigate the financial markets.

Challenges in Inflation Forecasting

Inflation forecasting is inherently challenging due to the complex and dynamic nature of economic factors. Fluctuations in demand, supply shocks, and unforeseen events contribute to the difficulty in predicting inflation accurately. Evaluating the challenges in forecasting sets the stage for developing strategies that enhance precision.

The Role of Economic Indicators

Economic indicators play a crucial role in the accuracy of inflation forecasts. Key indicators such as consumer price indices, employment data, and interest rates provide valuable insights. Analyzing the relationship between these indicators and inflation trends contributes to more informed and accurate forecasting models.

Central Bank Guidance and Monetary Policy

Guidance from central banks regarding monetary policy direction significantly influences inflation forecasts. The clear communication of policy intentions, interest rate decisions, and inflation targets provides valuable information for forecasters. Understanding the impact of central bank policies on inflation enhances the accuracy of forecasts.

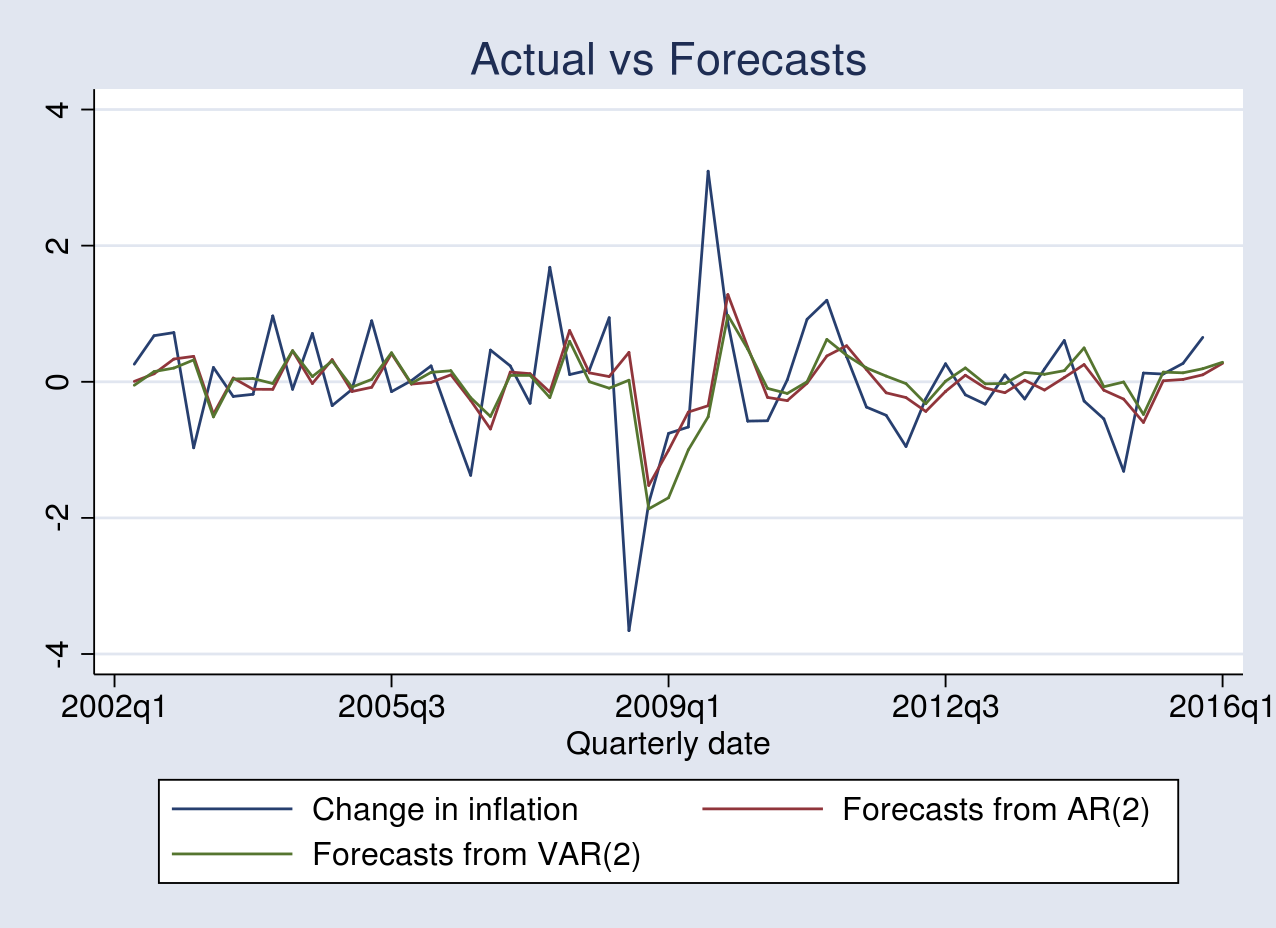

Data Analytics and Advanced Forecasting Models

The integration of data analytics and advanced forecasting models is pivotal for improving accuracy. Utilizing big data, machine learning, and predictive analytics enhances the precision of inflation forecasts. Incorporating these technological tools allows forecasters to analyze vast datasets and identify subtle patterns that contribute to more accurate predictions.

Global Perspectives and International Factors

In an interconnected global economy, international factors play a substantial role in domestic inflation. Global events, trade dynamics, and geopolitical shifts can influence inflation trends. Evaluating these international factors provides a broader perspective for forecasters, enhancing the accuracy of inflation predictions.

Risk Management Strategies for Forecasting Uncertainties

Given the inherent uncertainties in economic forecasting, risk management strategies are crucial. Scenario analysis, sensitivity testing, and acknowledging potential outlier events contribute to a more robust forecasting framework. Developing strategies to manage and mitigate forecast uncertainties is key to achieving accuracy.

Continuous Monitoring and Real-Time Adjustments

In the dynamic economic environment, continuous monitoring is essential for accurate forecasts. Regularly updating models, incorporating new data, and adjusting predictions in real-time based on emerging trends enhance forecast accuracy. The ability to adapt to changing economic conditions is a hallmark of precise forecasting.

The Role of Forecast Transparency

Transparency in the forecasting process is vital for building trust and credibility. Clearly communicating the assumptions, methodologies, and potential uncertainties associated with forecasts allows stakeholders to make informed decisions. Forecast transparency fosters a collaborative approach to economic planning and decision-making.

Accessing Tools for Inflation Forecasting Insights

For stakeholders seeking accurate inflation forecasts, platforms like rf-summit.com offer valuable tools and insights. Access to real-time analyses, expert opinions, and in-depth discussions enhances the ability to stay informed and make decisions based on the latest information.

In conclusion, mastering inflation forecast accuracy is an ongoing process that requires a combination of economic understanding, technological tools, and adaptive strategies. From economic indicators to risk management and transparency, each component contributes to the precision of forecasts. Visit Inflation Forecast Accuracy for continuous updates and insights into refining inflation forecasts for more informed decision-making.