Navigating Costs: Understanding Consumer Price Inflation

:max_bytes(150000):strip_icc()/consumerpriceindex_final-2bbbfc247d8e48c5b73b8b9a3d151a16.png)

Navigating Economic Realities: Understanding Consumer Price Inflation

In the intricate tapestry of economic landscapes, one key thread that significantly impacts consumers and businesses alike is consumer price inflation. This article aims to unravel the complexities of consumer price inflation, exploring its definitions, causes, and the implications it holds for individuals, businesses, and policymakers.

Defining Consumer Price Inflation

Consumer price inflation refers to the sustained increase in the average price level of goods and services that households typically consume. It is a measure of the percentage change in the price index of a basket of consumer goods and services over time. This index includes items such as food, clothing, rent, healthcare, and other everyday expenses.

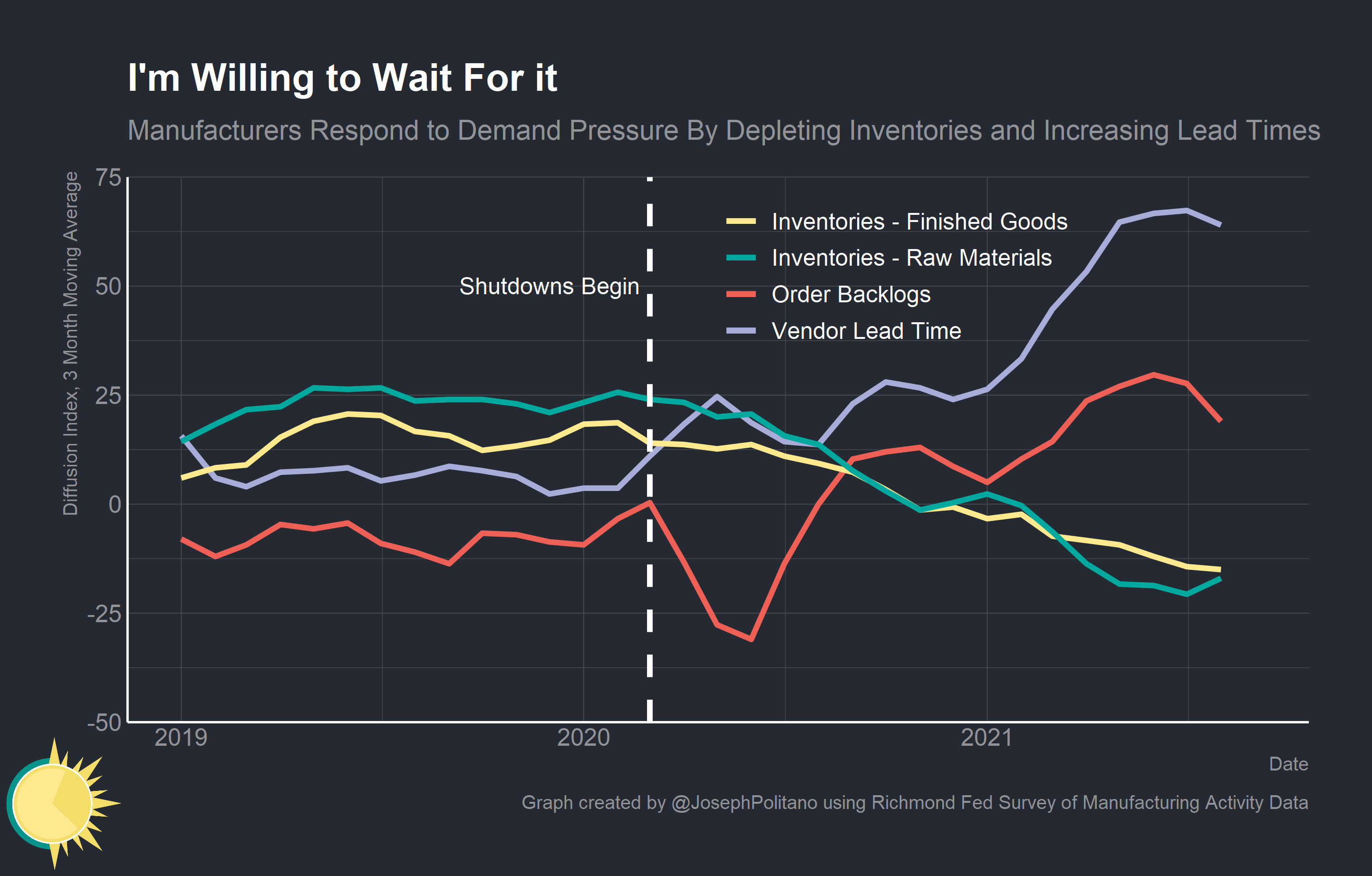

Causes of Consumer Price Inflation

Consumer price inflation can stem from various factors, each influencing the delicate balance between supply and demand in the economy. Demand-pull inflation occurs when consumer demand outpaces the supply of goods and services. Cost-push inflation, on the other hand, results from increased production costs, often triggered by rising raw material prices or supply chain disruptions.

Impact on Purchasing Power

Consumer price inflation directly impacts the purchasing power of individuals. As prices rise, the same amount of money can buy fewer goods and services, reducing the standard of living for consumers. This erosion of purchasing power can lead to challenges in budgeting, planning for the future, and maintaining a stable financial position.

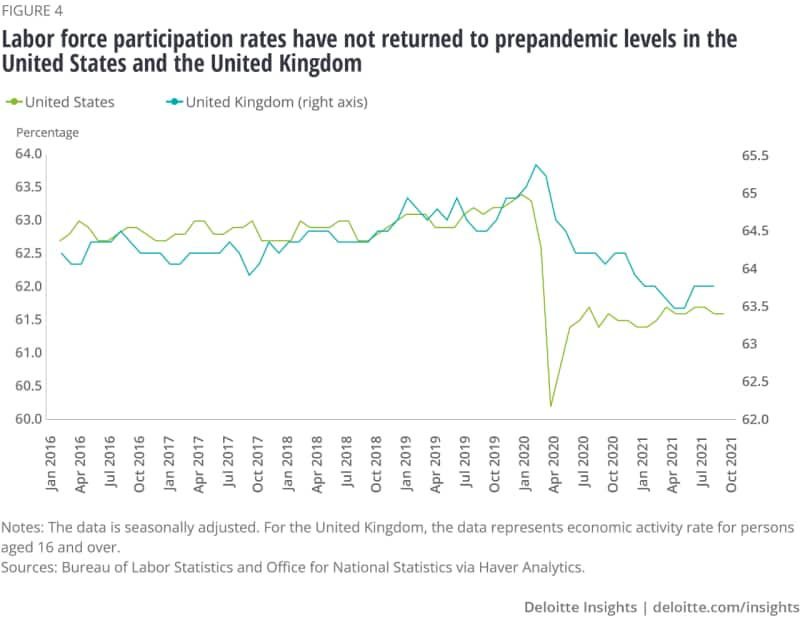

Central Role of Consumer Spending

Consumer spending is a central component of economic activity, and consumer price inflation has a profound impact on this crucial driver. Inflation can influence consumer behavior, altering spending patterns, and affecting overall economic growth. Policymakers closely monitor consumer price inflation to make informed decisions about monetary and fiscal policies.

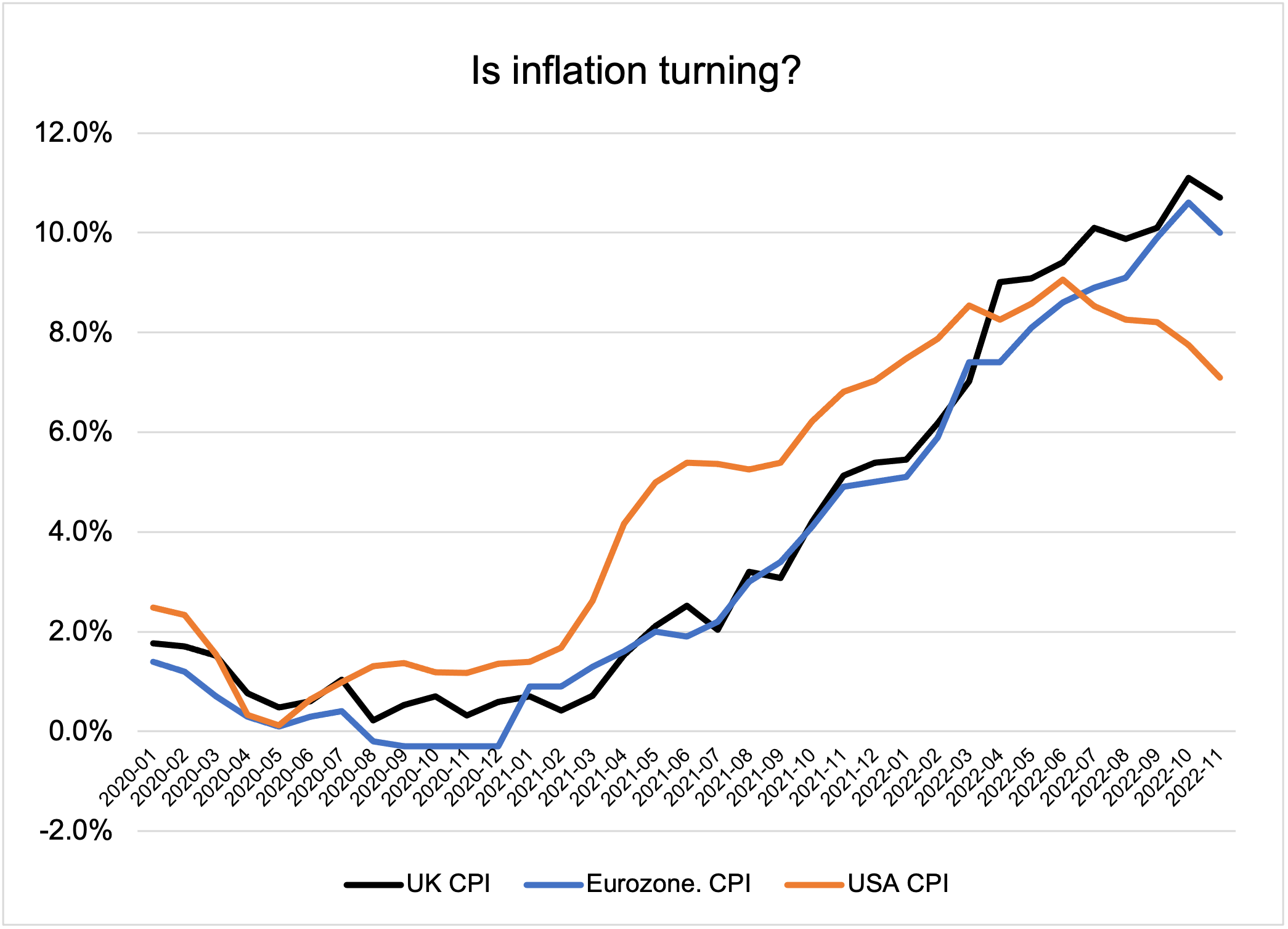

Inflation Measurement: Key Indices

Several key indices are utilized to measure consumer price inflation. The Consumer Price Index (CPI) and the Producer Price Index (PPI) are commonly employed to track changes in prices at the consumer and producer levels, respectively. These indices provide essential data for understanding inflation trends and informing economic policies.

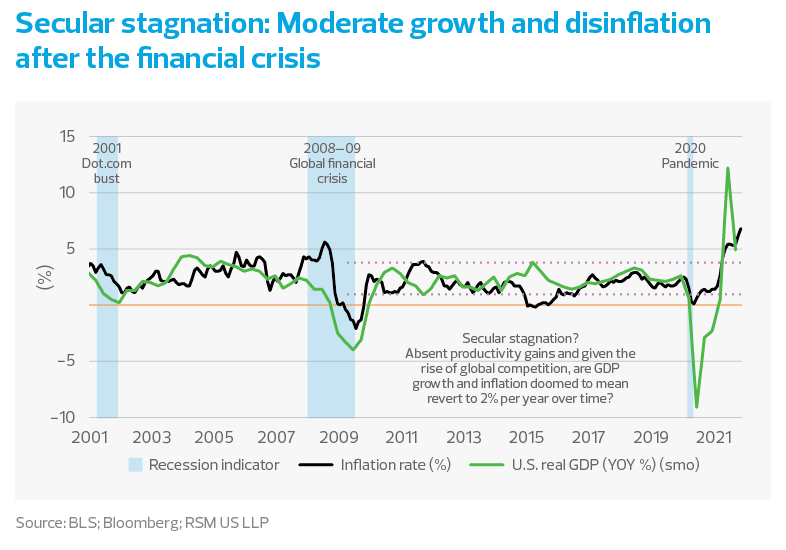

Consumer Price Inflation and Monetary Policy

Central banks play a vital role in managing consumer price inflation through monetary policy. By adjusting interest rates, controlling money supply, and employing various tools, central banks aim to maintain price stability. Striking the right balance is crucial, as overly tight policies can stifle economic growth, while loose policies may contribute to inflationary pressures.

Global Perspective: Exchange Rates and Trade Dynamics

Consumer price inflation is not confined within national borders; it is influenced by global economic dynamics. Fluctuations in exchange rates and international trade dynamics can impact the prices of imported goods. Understanding the global perspective is essential for policymakers and businesses navigating the complexities of consumer price inflation.

Challenges for Fixed-Income Earners

Consumer price inflation poses specific challenges for individuals on fixed incomes, such as retirees or those dependent on fixed salaries. As prices rise, the purchasing power of fixed incomes diminishes, potentially leading to financial strain for these individuals. Planning for inflation becomes a critical