Navigating the Landscape: Global Inflationary Pressures

In the interconnected world of finance, global inflationary pressures have become a central theme shaping economic landscapes. This article explores the multifaceted nature of these pressures, their origins, and the strategies businesses, investors, and policymakers employ to navigate the challenges they present.

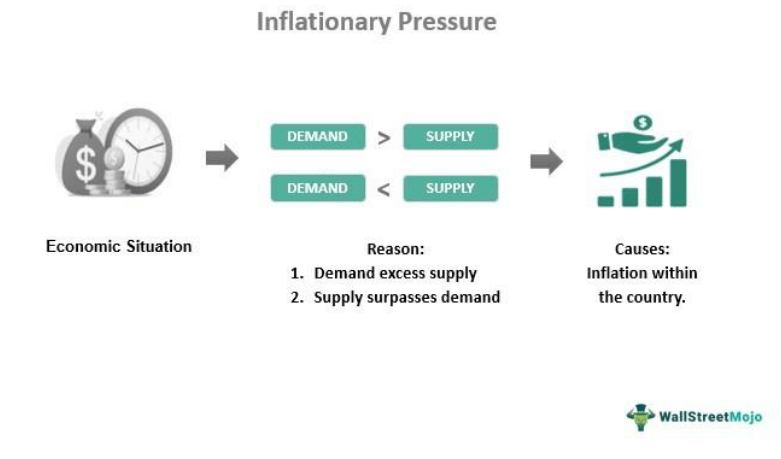

Understanding the Global Inflation Landscape

Before delving into the impact of global inflationary pressures, it’s crucial to understand the broader economic landscape. Inflation, the sustained increase in the general price level of goods and services over time, can be influenced by various factors, both domestic and international. Understanding these dynamics is fundamental for navigating the complexities of global inflationary pressures.

Contributing Factors to Global Inflation

Global inflationary pressures result from a combination of factors. Fluctuations in currency values, geopolitical events, supply chain disruptions, and changes in global demand all contribute to the intricate web of influences shaping inflation on a global scale. A comprehensive understanding of these factors is essential for businesses and investors seeking to anticipate and respond to inflationary pressures.

Currency Exchange Rates and Inflation Linkage

One significant channel through which global inflationary pressures manifest is currency exchange rates. Changes in exchange rates can impact the prices of imported goods and services, influencing inflation levels in various countries. Businesses engaged in international trade and investors with global portfolios must monitor currency dynamics to grasp the interconnected nature of inflation.

Global Supply Chain Disruptions: An Inflation Catalyst

The modern economy’s reliance on intricate global supply chains introduces a vulnerability to inflationary pressures. Disruptions in the supply chain, whether due to natural disasters, geopolitical tensions, or global health crises, can lead to shortages and increased production costs. The resulting inflationary pressures ripple through the interconnected web of the global economy.

Central Banks and Coordinated Responses

Central banks worldwide play a crucial role in addressing global inflationary pressures. Coordinated responses involving interest rate adjustments, monetary policy measures, and international cooperation aim to stabilize inflation and foster economic resilience. The effectiveness of these responses relies on collaboration among central banks and a shared commitment to managing inflation on a global scale.

Impact on Developing Economies

Global inflationary pressures often disproportionately affect developing economies. These nations may face challenges in managing inflation due to external factors beyond their control, such as volatile commodity prices and fluctuating exchange rates. Strategies for mitigating the impact on developing economies involve international support, targeted policies, and building economic resilience.

Investment Strategies in a Globalized World

For investors navigating a globalized world, understanding and adapting to global inflationary pressures is paramount. Diversification across asset classes, consideration of currency risks, and staying informed about global economic trends are crucial aspects of developing resilient investment strategies. A proactive approach enables investors to optimize returns amidst evolving global inflation dynamics.

Consumer Behavior in Response to Global Inflation

Global inflationary pressures influence consumer behavior on a worldwide scale. Changes in prices, particularly for essential goods, can impact purchasing power and consumer confidence. Businesses must adapt their strategies to align with shifting consumer behaviors, considering the broader economic context shaped by global inflationary pressures.

Sustainable Development Goals and Inflation Mitigation

Addressing global inflationary pressures aligns with broader sustainability goals. Mitigating inflation risks contributes to economic stability, supporting efforts to achieve Sustainable Development Goals (SDGs). Policymakers, businesses, and international organizations must collaborate to balance economic growth with the imperative of environmental and social sustainability.

Exploring In-Depth Insights at Global Inflationary Pressures

For a deeper exploration of insights and strategies related to global inflationary pressures, visit Global Inflationary Pressures. Staying informed and actively participating in the ongoing discussion about global inflation is crucial for fostering economic resilience and sustainable development in an interconnected world.