Decoding Economic Signals: In-Depth Analysis of Inflation Outlook Assessments

In the realm of finance, understanding the future trajectory of inflation is paramount for making informed decisions. This article delves into the intricacies of inflation outlook assessments, exploring their significance and providing insights for businesses, investors, and policymakers.

The Importance of Inflation Outlook Assessments

Inflation outlook assessments are a proactive measure to predict and analyze the future direction of inflation rates. This analysis holds immense importance for various stakeholders, serving as a guide for monetary policies, investment strategies, and business planning. A thorough assessment provides a roadmap for navigating the economic landscape.

Economic Indicators: Key Metrics for Assessment

To conduct effective inflation outlook assessments, economists and analysts rely on a range of economic indicators. These include consumer price indices, employment data, interest rates, and GDP growth. Examining these metrics allows for a comprehensive evaluation of the factors influencing inflation and aids in forming a nuanced outlook.

Central Bank Policies and Their Impact on Inflation Outlook

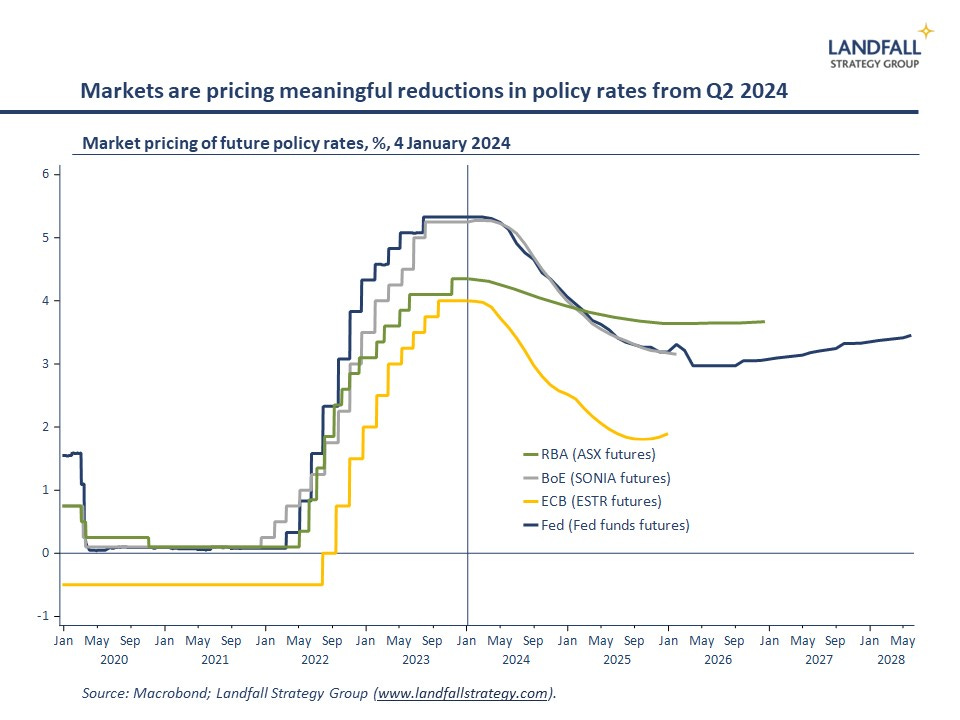

Central banks play a pivotal role in shaping inflation outlooks through monetary policies. Interest rate adjustments, open market operations, and quantitative easing are tools used by central banks to manage inflation. Analyzing central bank policies provides valuable insights into potential inflationary pressures or efforts to control inflation.

Global Economic Trends: A Lens into the Future

Inflation outlook assessments extend beyond national borders, requiring an examination of global economic trends. International trade dynamics, geopolitical events, and currency movements can all influence inflation rates. A holistic assessment considers the interconnectedness of economies to provide a more accurate outlook.

Investor Strategies: Navigating Uncertainties with Insights

Investors heavily rely on inflation outlook assessments to formulate their strategies. Anticipating inflation trends helps investors allocate assets effectively, choose suitable investment vehicles, and adjust risk profiles. In a dynamic market, having insights into the inflation outlook is a valuable tool for making informed investment decisions.

Business Planning: Adapting to Changing Economic Conditions

For businesses, the ability to adapt to changing economic conditions is crucial. Inflation outlook assessments guide strategic planning by influencing pricing models, supply chain decisions, and overall financial strategies. Businesses that integrate these assessments into their planning are better equipped to navigate uncertainties.

Inflation Outlook Assessments – A Link to Informed Decisions

For a more in-depth exploration of inflation outlook assessments, visit Inflation Outlook Assessments. This resource offers expert insights, analyses, and discussions on the nuances of predicting and navigating inflation trends. Accessing such information is integral for businesses, investors, and policymakers aiming to make informed decisions.

Consumer Behavior: Understanding the Impact of Inflation

Inflation outlook assessments have a direct bearing on consumer behavior. As prices rise or fall, consumer confidence and spending patterns are influenced. A positive outlook may boost consumer spending, while uncertainty about the future may lead to cautious behavior. Understanding these dynamics is essential for businesses in various industries.

Risk Management Strategies in the Face of Uncertainty

Uncertainty in the economic landscape necessitates robust risk management strategies. Businesses and investors must be prepared for various inflation scenarios. This may involve diversifying portfolios, adopting flexible pricing models, and establishing contingency plans to mitigate the potential impacts of inflation.

Policy Responses: Governments Adapting to Inflation Trends

Governments, armed with inflation outlook assessments, can tailor policy responses accordingly. Fiscal measures, such as taxation and spending policies, may be adjusted to influence inflation rates. A proactive approach to policy-making based on comprehensive assessments contributes to economic stability.

Conclusion: Navigating Tomorrow with Informed Insights

In conclusion, navigating the economic landscape requires a forward-looking approach facilitated by inflation outlook assessments. Whether for investors shaping their portfolios, businesses planning their strategies, or policymakers formulating economic policies, these assessments provide a crucial foundation for informed decision-making. Resources like Inflation Outlook Assessments offer a wealth of insights, empowering stakeholders to navigate uncertainties and build resilient strategies for the future.