Deciphering Inflation Rates: A Comprehensive Analysis

Unveiling the Complexity of Inflation Rate Analysis

In the realm of economics, understanding inflation rates is paramount for policymakers, businesses, and the general public alike. This article delves into the intricacies of inflation rate analysis, exploring its importance, methodologies, and the impact it has on various facets of the economy.

The Significance of Inflation Rate Analysis

Inflation is a key economic indicator that measures the rate at which the general level of prices for goods and services is rising. Analyzing inflation rates provides insights into the overall health of an economy. Policymakers use this data to make informed decisions, businesses strategize for price changes, and consumers adjust their spending habits. It is, therefore, a critical metric in the economic landscape.

Methodologies in Inflation Rate Calculation

Calculating inflation rates involves complex methodologies, often relying on price indices such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). These indices track changes in the prices of a basket of goods and services over time. Understanding the nuances of these methodologies is essential for accurate and meaningful inflation rate analysis.

Impact on Consumer Behavior

Inflation rates have a direct impact on consumer purchasing power. As prices rise, the real value of money diminishes, influencing spending habits. Analyzing inflation rates helps forecast how consumer behavior might change, allowing businesses to adapt their strategies accordingly. This insight is particularly valuable in sectors heavily reliant on consumer spending.

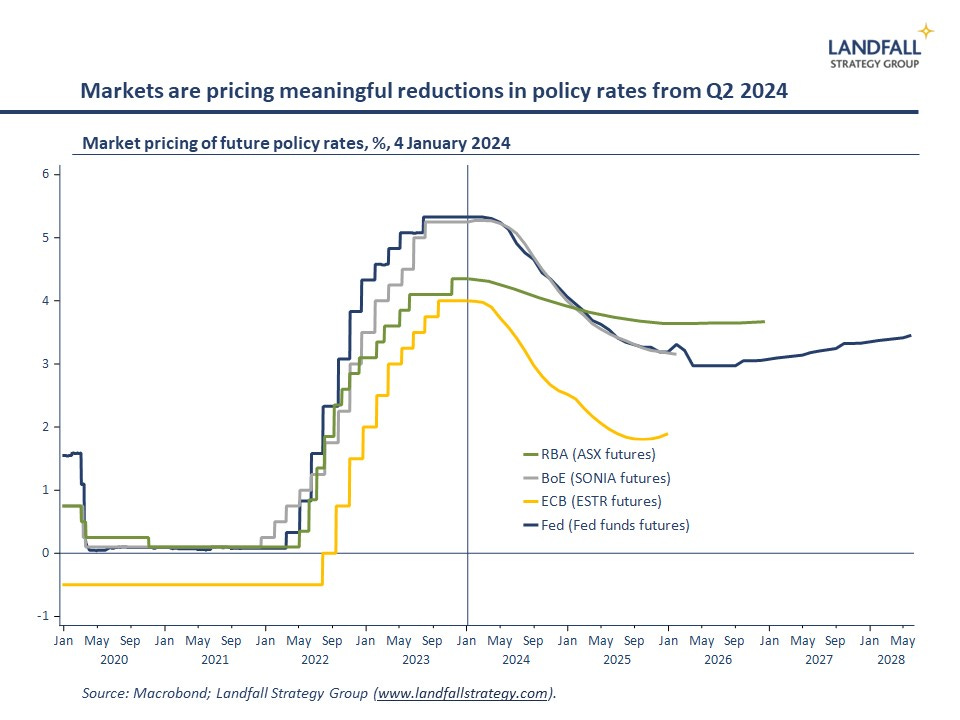

Policy Implications and Central Bank Strategies

Central banks play a pivotal role in managing inflation through monetary policies. Inflation rate analysis guides central banks in setting interest rates and other measures to control inflation. An understanding of these analyses is crucial for policymakers to strike the delicate balance between stimulating economic growth and preventing runaway inflation.

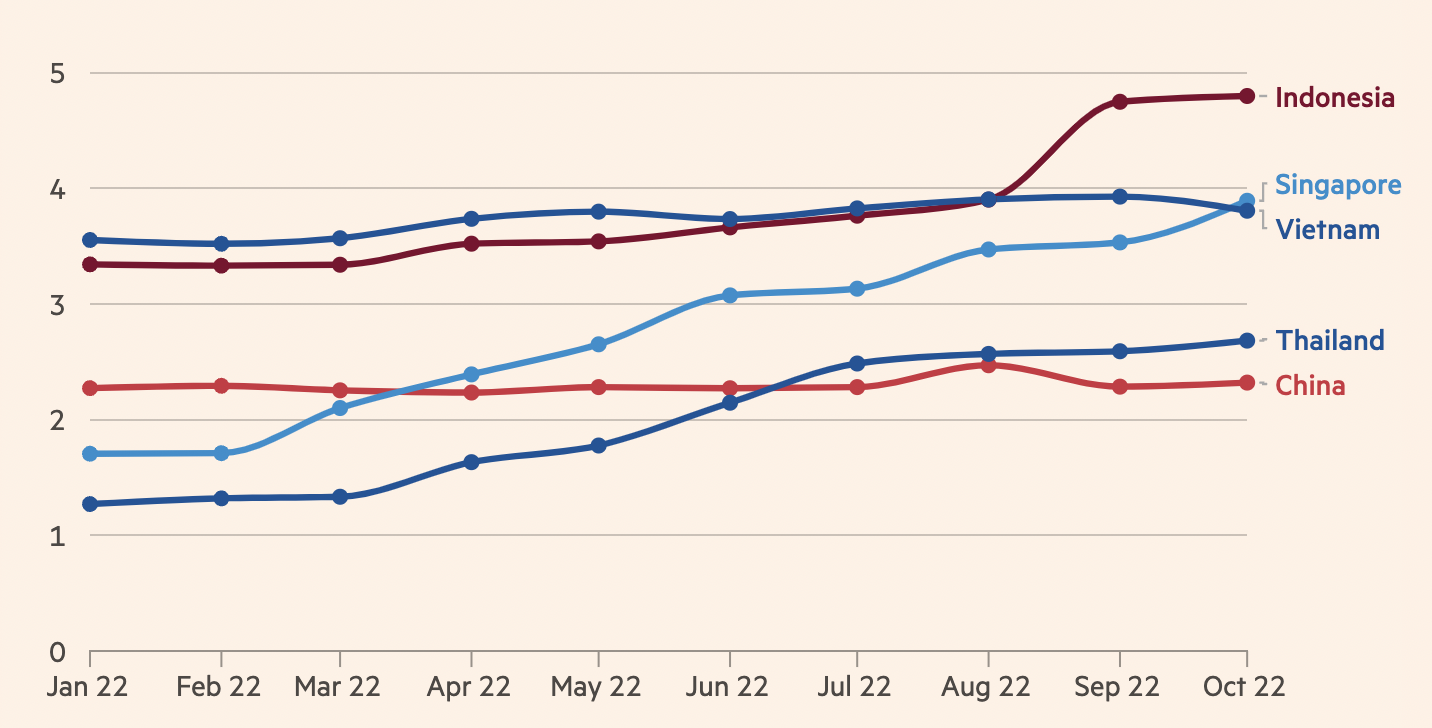

Global Perspectives on Inflation

In a globalized world, inflation rate analysis extends beyond national borders. Fluctuations in inflation rates can be interconnected, impacting international trade, investment, and financial markets. A holistic analysis that considers global economic dynamics is essential for a comprehensive understanding of inflation and its implications.

Inflation Rate Analysis for Investment Strategies

Investors closely monitor inflation rates as they significantly affect investment returns. Different asset classes respond differently to inflation. Equities, real estate, and commodities are among the assets impacted by changing inflation scenarios. In-depth analysis enables investors to tailor their portfolios for optimal performance in various inflationary environments.

Inflation Forecasting for Businesses

Businesses must anticipate inflation trends to make informed decisions about pricing, production, and overall strategy. Analyzing inflation rates allows businesses to forecast cost increases, adjust pricing models, and implement strategies to maintain profitability. Proactive inflation rate analysis is a cornerstone of sound business planning.

Adapting to Technological Innovations in Analysis

As technology advances, so do the tools available for inflation rate analysis. Machine learning, data analytics, and predictive modeling contribute to more accurate and timely analyses. Embracing these technological innovations enables economists, analysts, and businesses to stay ahead in an ever-evolving economic landscape.

Participate in the Conversation: Inflation Rate Analysis Summit

For a deeper