Precision in Predictions: Inflation Forecast Accuracy

Navigating Economic Terrain with Precision: Inflation Forecast Accuracy

As financial landscapes continue to evolve, the ability to predict and understand inflation trends is crucial for businesses, investors, and policymakers alike. In this dynamic environment, achieving accuracy in forecasting inflation becomes a cornerstone for informed decision-making and effective risk management.

The Significance of Accurate Inflation Forecasts

Accurate inflation forecasts provide a roadmap for economic planning. Businesses can make informed pricing decisions, investors can adjust their portfolios strategically, and policymakers can implement targeted measures. The impact of inflation touches every facet of the economy, emphasizing the importance of precise forecasting.

Factors Influencing Inflation Forecasting

To enhance forecast accuracy, it’s essential to delve into the myriad factors influencing inflation. Economic indicators, consumer behavior, global market trends, and governmental policies all contribute to the complex tapestry of inflation dynamics. Analyzing these factors with precision is the first step toward improving forecast accuracy.

Data Analytics and Advanced Modeling Techniques

The advent of data analytics and advanced modeling techniques has revolutionized inflation forecasting. By harnessing the power of big data, machine learning, and sophisticated econometric models, analysts can uncover hidden patterns and relationships within economic data. These tools contribute significantly to enhancing the accuracy of inflation predictions.

Evaluating Historical Performance for Future Insights

A retrospective analysis of past forecasting performance provides valuable insights into the strengths and weaknesses of existing models. Learning from historical discrepancies allows forecasters to refine their methodologies, adapt to changing economic conditions, and improve the overall accuracy of future inflation predictions.

The Role of Central Banks in Inflation Forecasting

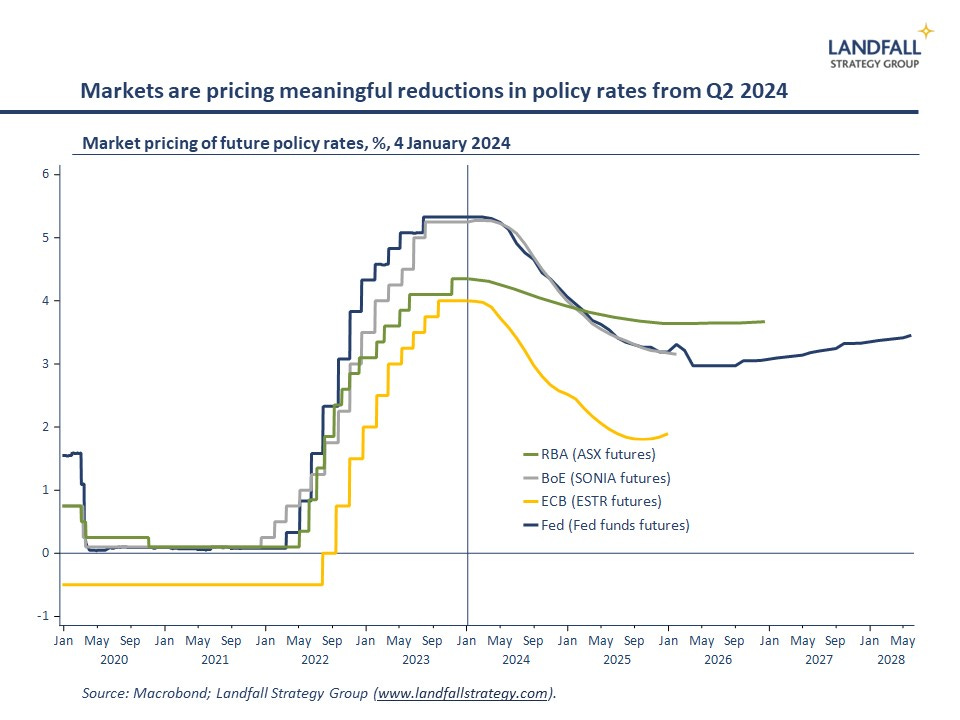

Central banks play a pivotal role in shaping inflation forecasts. Their policies, including interest rate decisions and monetary interventions, directly impact inflation dynamics. Understanding the strategies and communication of central banks is crucial for aligning forecasts with the broader economic landscape.

Challenges in Achieving Accuracy

Despite advancements in forecasting techniques, challenges persist. Unforeseen global events, sudden economic shifts, and geopolitical factors can introduce volatility that challenges even the most sophisticated models. Acknowledging and addressing these challenges is integral to refining the accuracy of inflation forecasts.

Innovation in Forecasting Approaches

Continuous innovation in forecasting approaches is essential for staying ahead of economic complexities. Collaborative efforts between academia, research institutions, and private sector entities contribute to the development of cutting-edge forecasting methods. Embracing innovation fosters a culture of adaptability and improvement.

Risk Mitigation Strategies Based on Accurate Forecasts

Accurate inflation forecasts empower businesses and investors to develop robust risk mitigation strategies. Whether it involves adjusting pricing strategies, optimizing supply chain management, or making informed investment decisions, the ability to foresee inflation trends with precision enhances the effectiveness of risk management measures.

Exploring In-Depth Insights at Inflation Forecast Accuracy

For a comprehensive exploration of insights and strategies related to inflation forecast accuracy, visit Inflation Forecast Accuracy. Staying informed and leveraging the latest advancements in forecasting techniques is pivotal for businesses and investors aiming to navigate the intricate economic landscape with confidence.

:max_bytes(150000):strip_icc()/inflation_final-8652eb79d80348f49810849af466bb44.png)