Navigating Economic Stability Through Inflation Management Strategies

In the ever-changing landscape of finance, the impact of inflation on economic stability cannot be overstated. Implementing effective inflation management strategies is crucial for businesses, investors, and individuals seeking to safeguard their financial well-being.

Understanding the Dynamics of Inflation

Before delving into management strategies, it’s essential to grasp the dynamics of inflation. Inflation refers to the general increase in prices over time, leading to a decline in the purchasing power of money. Understanding the causes and consequences of inflation sets the stage for implementing effective management measures.

Proactive Monitoring of Economic Indicators

One cornerstone of successful inflation management is the proactive monitoring of economic indicators. Key metrics such as consumer price indices, wage growth, and producer price indices offer valuable insights into the inflationary pressures within an economy. Regular analysis provides an early warning system for potential inflationary trends.

Central Bank Policies and Interest Rate Management

Central banks play a pivotal role in managing inflation through monetary policies. Adjusting interest rates is a common tool used to influence inflation. By raising or lowering interest rates, central banks aim to control spending and lending, thereby impacting inflation. Understanding these policies is crucial for businesses and investors navigating inflationary environments.

Strategic Investment Diversification

Diversifying investments is a proven strategy to manage inflation risks. Allocating assets across various classes, such as stocks, bonds, and real assets, helps spread risk and enhances the overall resilience of a portfolio. Strategic diversification aligns investments with the potential impacts of inflation on different asset classes.

Inflation-Linked Securities as a Hedge

Incorporating inflation-linked securities into investment portfolios can serve as a direct hedge against inflation. These securities, whose returns are linked to inflation indices, provide a level of protection as they adjust for changes in purchasing power. Including such instruments can add a layer of defense in inflationary environments.

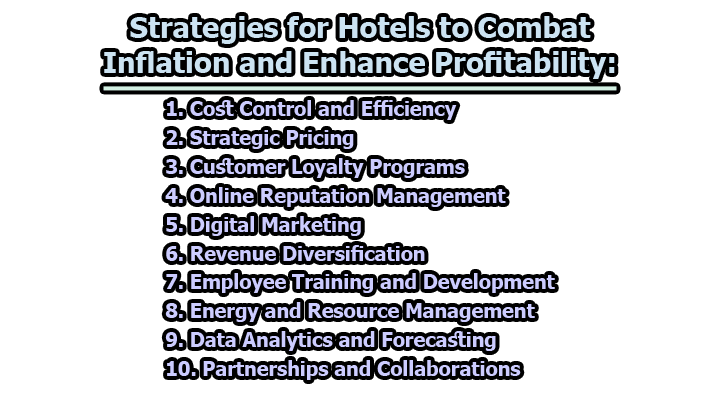

Negotiating Inflationary Pressures in Business

For businesses, managing inflation involves strategic pricing, cost management, and supply chain resilience. Implementing pricing strategies that account for potential cost increases, negotiating favorable supplier contracts, and optimizing operational efficiency are critical components of effective inflation management for businesses.

Employing Technology and Innovation

Embracing technology and innovation can be instrumental in managing inflationary pressures. Automation and advanced technologies can enhance operational efficiency, reducing costs and mitigating the impact of inflation. Innovative solutions contribute to adaptability in the face of economic uncertainties.

Educational Initiatives for Informed Decision-Making

Empowering individuals and businesses with financial literacy is a proactive approach to managing inflation. Educational initiatives aimed at enhancing understanding of economic dynamics, inflationary risks, and investment strategies enable informed decision-making. A well-informed population is better equipped to navigate the challenges posed by inflation.

Strategies for Long-Term Economic Resilience

Effective inflation management goes beyond short-term fixes. It involves the formulation and implementation of strategies that ensure long-term economic resilience. Whether through investment diversification, policy advocacy, or fostering a culture of innovation, a comprehensive approach is essential for sustained economic stability.

Exploring In-Depth Insights at Inflation Management Strategies

For a more detailed exploration of strategies and insights related to inflation management, visit Inflation Management Strategies. Staying informed and proactive in applying these strategies is key to successfully navigating the dynamic economic landscape and achieving long-term financial well-being.