Managing Economic Swings: Inflation Rate Variability Strategies

Unraveling Economic Dynamics: Strategies for Inflation Rate Variability

In the intricate world of economics, the variability of inflation rates poses challenges and opportunities for individuals, businesses, and policymakers. This article explores the strategies employed to navigate the fluctuations inherent in inflation rates.

The Nature of Inflation Rate Variability

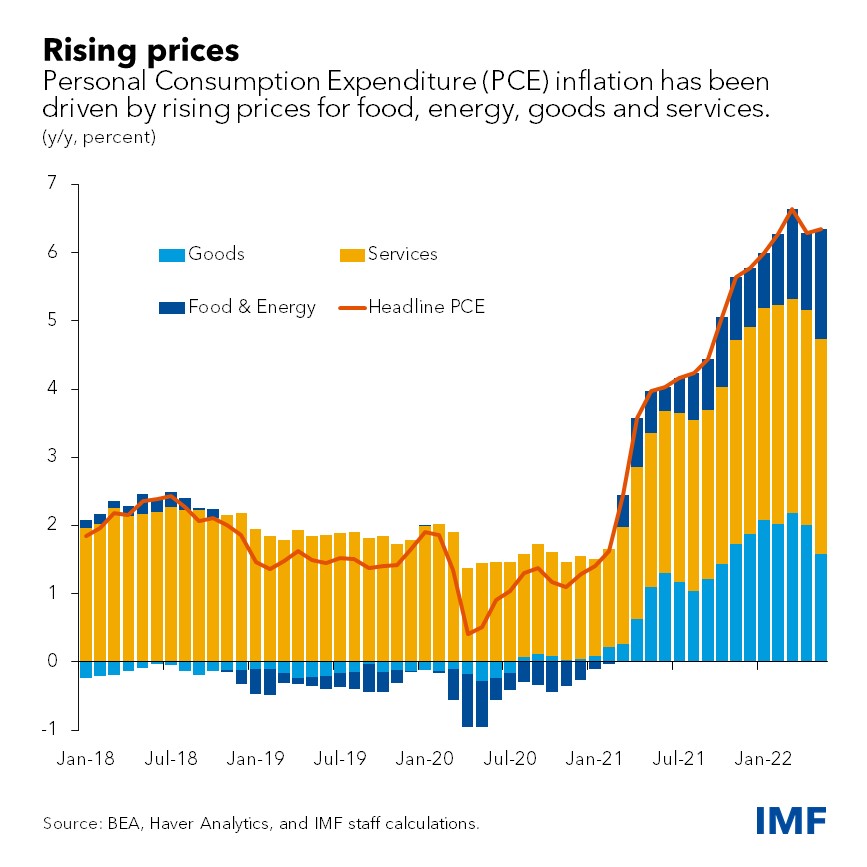

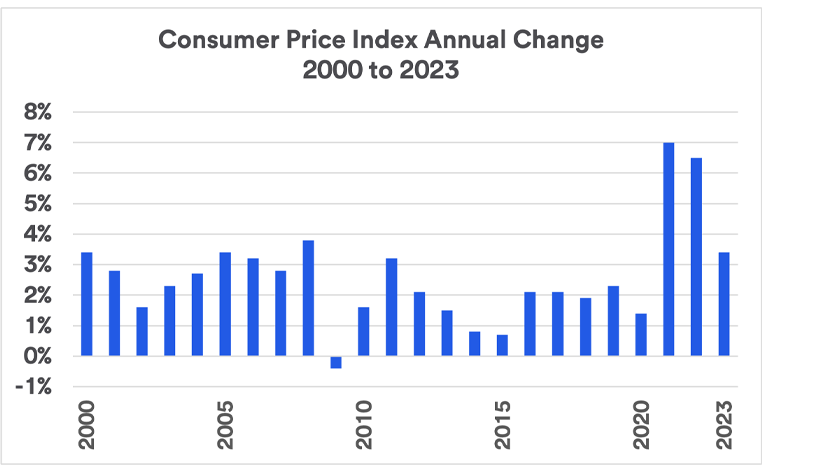

Inflation rate variability refers to the fluctuations and unpredictability in the general price level of goods and services over a given period. This inherent variability can be influenced by a myriad of factors, including supply and demand imbalances, global economic conditions, and geopolitical events.

Implications for Consumer Behavior

The variability of inflation rates has direct implications for consumer behavior. Rapid or unpredictable changes in prices can influence purchasing patterns, impacting the decisions consumers make. Understanding and adapting to these fluctuations is crucial for businesses aiming to align their strategies with the dynamic nature of consumer demand.

Businesses’ Adaptive Strategies

For businesses, the key lies in developing adaptive strategies to navigate inflation rate variability. This may involve flexible pricing models, robust supply chain management, and the ability to swiftly adjust operations in response to changing economic conditions. Businesses that can adapt to inflation rate variability are better positioned for long-term success.

Investment Considerations in a Variable Environment

Investors face the challenge of constructing resilient portfolios in the face of inflation rate variability. Assets that historically perform well during periods of inflation, such as real estate or commodities, may become more attractive. Diversification and a keen understanding of how inflation rate variability impacts different sectors are fundamental to successful investment strategies.

Government Policies for Stability

Governments play a critical role in managing inflation rate variability through various policies. Central banks may adjust interest rates, implement fiscal measures, or employ other tools to stabilize prices. Crafting and implementing effective policies require a nuanced understanding of the factors contributing to inflation rate variability.

International Collaboration in a Variable Landscape

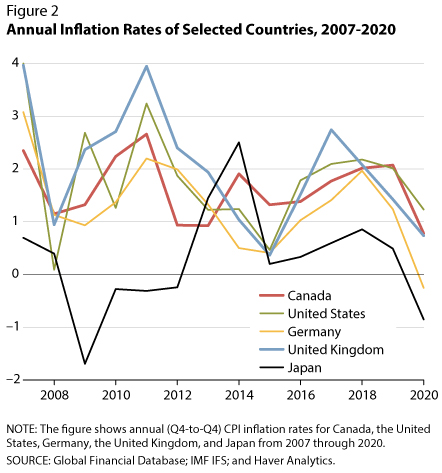

In an interconnected global economy, inflation rate variability is not confined to national borders. International collaboration becomes crucial in addressing the challenges posed by fluctuations in inflation rates. Coordination among nations and global institutions is necessary to foster stability in the face of economic uncertainties.

Deep Dive into Inflation Rate Variability

For an in-depth analysis of current inflation rate variability and strategies to navigate it, explore Inflation Rate Variability. This resource provides valuable insights and expert perspectives, aiding readers in understanding the intricacies of inflation rate fluctuations.

Building Economic Resilience

In the face of inflation rate variability, building economic resilience is paramount. This involves not only understanding and responding to short-term fluctuations but also developing long-term strategies that promote stability. Resilient economies are better equipped to withstand the challenges posed by a variable inflation landscape.

Conclusion: Navigating the Economic Seas

In conclusion, managing inflation rate variability requires a combination of strategic foresight, adaptability, and collaborative efforts. Whether you are a consumer, business owner, investor, or policymaker, staying informed about inflation rate trends and implementing strategies to navigate variability is essential for economic success in our ever-changing

:max_bytes(150000):strip_icc()/dotdash-worst-hyperinflations-history-Final-4ba22e3b5a0e41668ecb8e30051f7a49.jpg)