Hyperinflation Alert: Recognizing Warning Signs

Unraveling the Shadows: Hyperinflation Warning Signs

In the realm of economics, hyperinflation poses a severe threat to economies and individuals alike. Recognizing the warning signs of hyperinflation is crucial for policymakers, businesses, and the general public. This article explores the indicators that serve as red flags in identifying the onset of hyperinflation and the strategies to navigate these challenging economic waters.

Understanding Hyperinflation

Hyperinflation is an extreme form of inflation characterized by rapid and uncontrollable price increases. While inflation is a natural part of economic cycles, hyperinflation represents an alarming scenario where prices skyrocket, eroding the value of currency at an unprecedented rate. Understanding the distinction between moderate inflation and hyperinflation is the first step in identifying warning signs.

Rapid Currency Devaluation

One of the primary warning signs of hyperinflation is the rapid devaluation of the national currency. When the value of a currency plummets, prices for goods and services surge. This devaluation often results from excessive money supply growth, leading to a loss of confidence in the currency’s purchasing power.

Spiraling Prices and Soaring Costs

Hyperinflation is characterized by spiraling prices, with costs of goods and services increasing at an exponential rate. Daily price hikes become a norm, and businesses find themselves caught in a cycle of continuously adjusting prices to keep up with inflation. Observing these spiraling costs is a key indicator of hyperinflation warning signs.

Loss of Confidence in the Currency

As hyperinflation takes hold, public confidence in the national currency rapidly erodes. Individuals and businesses may seek alternative forms of currency or assets to preserve their wealth. The loss of faith in the stability of the currency further accelerates the downward spiral, creating a self-perpetuating cycle of economic instability.

Economic and Social Unrest

Hyperinflation often brings about economic and social unrest. As the cost of living soars, individuals and households struggle to afford basic necessities. This distress can lead to protests, strikes, and civil unrest as citizens demand economic stability and relief from the burdens imposed by hyperinflation.

Government Money Printing

Excessive money printing by the government is a major contributor to hyperinflation. When authorities resort to printing money to meet budgetary shortfalls or finance debts, it floods the market with excess currency, triggering a rapid devaluation. Monitoring government fiscal policies is crucial in identifying hyperinflation warning signs.

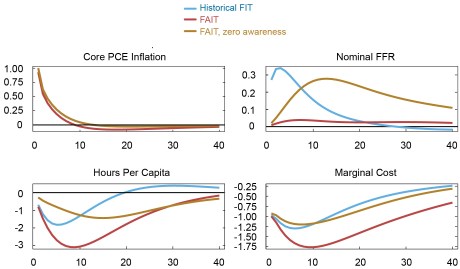

Ineffective Monetary Policies

In times of hyperinflation, traditional monetary policies often prove ineffective. Central banks may struggle to control inflation through interest rate adjustments or other conventional measures. The inability of monetary policies to curb hyperinflation underscores the severity of the economic challenge.

Impact on Savings and Investments

Hyperinflation can devastate savings and investments. The real value of savings dwindles rapidly, eroding the financial security of individuals. Investors grapple with the challenge of preserving wealth in an environment where traditional investment vehicles may offer little protection against the onslaught of hyperinflation.

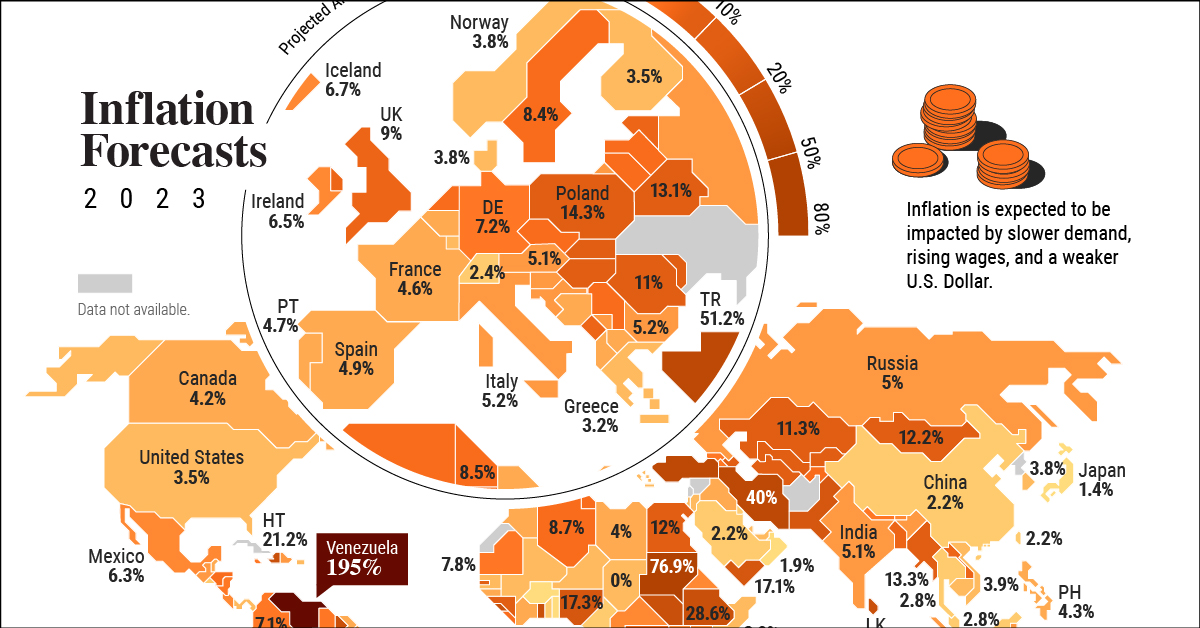

Global Economic Ramifications

The consequences of hyperinflation are not confined within national borders. Global markets and international trade can be significantly impacted. Hyperinflation warning signs in one

:max_bytes(150000):strip_icc()/dotdash-worst-hyperinflations-history-Final-4ba22e3b5a0e41668ecb8e30051f7a49.jpg)