Deciphering Economic Landscapes: Inflationary Trends Overview

In the intricate tapestry of global economics, understanding inflationary trends is paramount for informed decision-making. This article provides a comprehensive overview of inflationary trends, shedding light on their nuances and implications for various stakeholders.

Inflation Dynamics Unveiled: Causes and Characteristics

To comprehend inflationary trends, one must first unravel their dynamics. This section explores the causes and characteristics of inflation, from demand-pull to cost-push factors. Understanding these fundamental aspects lays the groundwork for a more nuanced analysis of the evolving economic landscape.

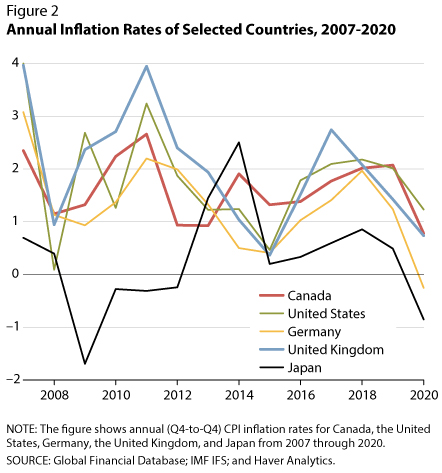

Global Perspectives: Variations in Inflation Trends

Inflation is not a one-size-fits-all phenomenon. This part delves into the variations in inflation trends across the globe. Different regions experience unique economic conditions that influence their inflation rates. Examining these global perspectives provides valuable insights for businesses, investors, and policymakers.

Impact on Consumer Behavior: Adapting to Changing Realities

Inflationary trends directly impact consumer behavior. This section explores how rising prices influence purchasing decisions, savings patterns, and overall consumer confidence. Businesses keen on adapting to changing consumer realities must closely monitor inflationary trends to tailor their strategies accordingly.

Central Banks’ Response: Managing Inflation Proactively

Central banks play a crucial role in managing inflation. This part examines how central banks respond to inflationary trends through monetary policies, including interest rate adjustments and open market operations. Proactive measures by central banks aim to maintain price stability and economic growth.

Market Reactions: Investor Strategies Amidst Inflation

Investors navigate financial markets with a keen eye on inflationary trends. This section discusses how inflation influences investor strategies, impacting asset allocation, risk management, and portfolio diversification. Understanding market reactions to inflation is essential for investors seeking optimal returns in dynamic economic environments.

Government Policies: Balancing Act for Economic Stability

Governments implement policies to balance economic stability in the face of inflationary trends. This part explores fiscal and monetary measures governments employ, from adjusting tax policies to implementing stimulus packages. Striking the right balance is crucial for fostering sustainable economic growth.

Technological Advances: Shaping Inflationary Landscape

Innovation and technology contribute to the evolving landscape of inflationary trends. This section discusses how technological advances impact production costs, supply chains, and overall economic efficiency. Embracing technology becomes a strategic imperative for businesses aiming to navigate inflation with resilience.

Inflation Forecasting: Tools for Anticipating Economic Realities

Anticipating inflationary trends is a complex task, but forecasting tools provide valuable assistance. This part introduces various tools and methodologies used for inflation forecasting, including econometric models and data analytics. Accurate forecasting enables stakeholders to prepare for and mitigate the impact of inflation.

Strategies for Businesses and Individuals: Navigating Uncertainties

Armed with insights from the inflationary trends overview, businesses and individuals can formulate strategies for navigating economic uncertainties. This section discusses adaptive measures, from cost management to investment diversification, that empower stakeholders to thrive in the dynamic landscape shaped by inflationary trends.

For a deeper dive into understanding and navigating inflationary trends, visit Inflationary Trends Overview on the RF Summit platform. Stay informed, adapt to evolving economic landscapes, and make decisions backed by a comprehensive understanding of inflationary trends.