Predicting Inventory Costs Using Technical Evaluation Traits

In my opinion the Doubling Stocks publication helps me solve all of the above questions. Good dividend paying stocks are usually stocks of companies that can endure rough financial times and won’t fluctuate wildly. Almost each household is dependent on a number of of it is medical merchandise You’ll be able to both purchase the stock immediately from prizer or undergo a reduction investing website corresponding to Scottrade or Sharebuilder. They rarely pay dividends and buyers buy them within the hope of capital appreciation. We offer you, the individual evaluation report of the Penny Stocks and in addition to yours.

In my opinion the Doubling Stocks publication helps me solve all of the above questions. Good dividend paying stocks are usually stocks of companies that can endure rough financial times and won’t fluctuate wildly. Almost each household is dependent on a number of of it is medical merchandise You’ll be able to both purchase the stock immediately from prizer or undergo a reduction investing website corresponding to Scottrade or Sharebuilder. They rarely pay dividends and buyers buy them within the hope of capital appreciation. We offer you, the individual evaluation report of the Penny Stocks and in addition to yours.

Choosing particular person stocks or ETFs from different companies can have advantages over mutual funds for some buyers. A common rule of thumb is to put money into stocks with an above-common fee of progress and affordable valuations. I am happy to know this and can ensure that I don’t make the mistake of investing in penny stocks. ITrade is a superb inventory market recreation that simulates the market properly and lets you start out with $a hundred,000 to put money into your favorite firms. In different words, have an exit strategy before you buy the safety and execute that technique unemotionally. Dividend stocks dividend yield: The dividend yield is an organization’s subsequent 12-month dividend(s) divided by the corporate’s present share price. Keep in mind for those who put money into what you recognize thoroughly then it should most likely provide you with good return. I might like to see how someone can become profitable in penny stocks on a regular basis.

At the moment, investment in stocks and shares will not be restricted to the effectively to do; even the common center-class is moving into it in droves. Relying on its funding objective and policies, a inventory fund may concentrate on a particular type of inventory, similar to blue chips, massive-cap value stocks, or mid-cap growth stocks.

You may invest your money in absolutely anything that interests you, together with CFD trading, agricultural commodities like corn and soybeans, precious metals like gold and silver, binary choices buying and selling , bonds, foreign currencies trading, Spread betting, and a huge number of different types of investments.

Stocks that pay monthly dividends are often trusts, closed end mutual funds, and other funding autos that really personal a portfolio of earnings producing assets, and distribute money generated by these property every month to their traders. …

…

One simple strategy to make a little bit cash with your digicam in a low stress manner is thru inventory images. In June, 1969- Notification issued to the impact that each one contracts for the sale and buy of securities other than ‘spot supply contracts’ or contracts settled by stock change are void. Pretty… it was interesting to see the unique Google Homepage in comparison to today’s.

One simple strategy to make a little bit cash with your digicam in a low stress manner is thru inventory images. In June, 1969- Notification issued to the impact that each one contracts for the sale and buy of securities other than ‘spot supply contracts’ or contracts settled by stock change are void. Pretty… it was interesting to see the unique Google Homepage in comparison to today’s. …

…

Your likelihood of dying is intimately tied to your current health status… and as such, your current health status is intimately linked to your life insurance rates! Unintentional injuries and acts of violence comprise less than 10% of deaths all over the world, and a far lower percentage in Australia. Cardiovascular disease, ischemic heart disease, cancers and respiratory problems are currently the big killers all over the world, and the risk factors for developing all of them are well documented and asked in life insurance rate questionnaires in order to determine your premiums.

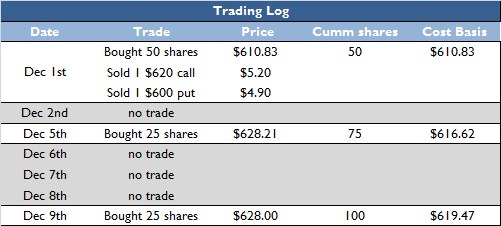

Your likelihood of dying is intimately tied to your current health status… and as such, your current health status is intimately linked to your life insurance rates! Unintentional injuries and acts of violence comprise less than 10% of deaths all over the world, and a far lower percentage in Australia. Cardiovascular disease, ischemic heart disease, cancers and respiratory problems are currently the big killers all over the world, and the risk factors for developing all of them are well documented and asked in life insurance rate questionnaires in order to determine your premiums. SAN FRANCISCO — Google has turned into a stock marketplace laggard as the shift to mobile devices has lowered the Net search leader’s digital ad prices and the company’s high-priced investments in far-out technology has trimmed its profit margins. Some brokerages, such as Piper Jaffray, JMP Securities and Canaccord Genuity, raised their value targets, with Piper Jaffray saying that the new technique will boost ad income in the longer term. Excessive euphoria in the stock market place need to act as a clear signal for the average investor not to put more income into securities or funds. When the stock market — when traders and investors, really — turn out to be this euphoric, the scenario, as has occurred again and once again, will reach a tipping point. Splitting just indicates the value is cut in half and there are then twice as a lot of shares offered. But following the split, Google share worth will halve, creating it much more affordable. Rephrased, that is a chart that reports 1 minute intervals, and shows 2 hours of the stock movement. You have the option to get your covered calls back, but the cost to purchase them back increases with the share price.

SAN FRANCISCO — Google has turned into a stock marketplace laggard as the shift to mobile devices has lowered the Net search leader’s digital ad prices and the company’s high-priced investments in far-out technology has trimmed its profit margins. Some brokerages, such as Piper Jaffray, JMP Securities and Canaccord Genuity, raised their value targets, with Piper Jaffray saying that the new technique will boost ad income in the longer term. Excessive euphoria in the stock market place need to act as a clear signal for the average investor not to put more income into securities or funds. When the stock market — when traders and investors, really — turn out to be this euphoric, the scenario, as has occurred again and once again, will reach a tipping point. Splitting just indicates the value is cut in half and there are then twice as a lot of shares offered. But following the split, Google share worth will halve, creating it much more affordable. Rephrased, that is a chart that reports 1 minute intervals, and shows 2 hours of the stock movement. You have the option to get your covered calls back, but the cost to purchase them back increases with the share price. Getting the auto insurance price quotes online is the easiest, quickest and also the most convenient option for the consumers today. When meeting an agent personally, you have to be prepared for all sorts of questions and a single wrong answer can influence the quote badly. But, you can fill out the questionnaire online as per your convenience which will give your more time to decide what’s best. You can get the quotes by following a few easy steps. The best part is that you do not have to be an internet pro to take advantage of this better method. Even a small kid can fill out the necessary details and procure the insurance quotes in minutes.

Getting the auto insurance price quotes online is the easiest, quickest and also the most convenient option for the consumers today. When meeting an agent personally, you have to be prepared for all sorts of questions and a single wrong answer can influence the quote badly. But, you can fill out the questionnaire online as per your convenience which will give your more time to decide what’s best. You can get the quotes by following a few easy steps. The best part is that you do not have to be an internet pro to take advantage of this better method. Even a small kid can fill out the necessary details and procure the insurance quotes in minutes. The IBT Pulse Newsletter keeps you linked to the largest stories unfolding in the international financial system. Currently, the preliminary funding of $1,020 could be price $15,426.36, which is 12 shares multiplied by $658.27 per share plus 12 shares multiplied by $627.26. The return on funding (ROI) from these shares bought at Google’s IPO would be 1,415.39%.

The IBT Pulse Newsletter keeps you linked to the largest stories unfolding in the international financial system. Currently, the preliminary funding of $1,020 could be price $15,426.36, which is 12 shares multiplied by $658.27 per share plus 12 shares multiplied by $627.26. The return on funding (ROI) from these shares bought at Google’s IPO would be 1,415.39%.

According to research, the most common reason for wanting to switch is “price”, and it makes perfect sense, especially in tough economic times. That would explain the reason most insurance companies promise savings by switching. In fact, out of 2000 people interviewed, the majority said they would switch if they can save at least $20 per month.

According to research, the most common reason for wanting to switch is “price”, and it makes perfect sense, especially in tough economic times. That would explain the reason most insurance companies promise savings by switching. In fact, out of 2000 people interviewed, the majority said they would switch if they can save at least $20 per month. This put up will describes how you can retieve actual time inventory values in your application through the use of completely different companies like Google , yahoo and many others. Google is lacking one thing right here it received what it called a no win game in browser battle with Microsoft, too dangerous for Google. Google Finance was designed to supply details about U.S. and international exchanges, firms and funds. I keep in mind when AltaVista was the search engine of selection by many, Yahoo by others, Dogpile was inviting as a result of it combined all of them and Google was simply approaching the scene.

This put up will describes how you can retieve actual time inventory values in your application through the use of completely different companies like Google , yahoo and many others. Google is lacking one thing right here it received what it called a no win game in browser battle with Microsoft, too dangerous for Google. Google Finance was designed to supply details about U.S. and international exchanges, firms and funds. I keep in mind when AltaVista was the search engine of selection by many, Yahoo by others, Dogpile was inviting as a result of it combined all of them and Google was simply approaching the scene. …

… Stock merchants are faced with the overwhelming activity of choosing from hundreds of stocks, from markets around the globe, when determining the easiest way to invest. If you wish to develop into an active investor, you’ll want to understand how all these factors influence the market. Their orders often find yourself with an expert at a inventory alternate, who executes the order of buying or promoting. Notice this recreation may be performed with paper money from a novelty store or a Monopoly recreation, but I personally like Skittles better! Market manipulation is in full progress and the stimulus package deal most likely gave the manipulators more clout. We play A whole lot of games at our home and I have been making an attempt to work on this with among the youngsters on the plus minus of the whole thing so possibly the sport will help them understand.

Stock merchants are faced with the overwhelming activity of choosing from hundreds of stocks, from markets around the globe, when determining the easiest way to invest. If you wish to develop into an active investor, you’ll want to understand how all these factors influence the market. Their orders often find yourself with an expert at a inventory alternate, who executes the order of buying or promoting. Notice this recreation may be performed with paper money from a novelty store or a Monopoly recreation, but I personally like Skittles better! Market manipulation is in full progress and the stimulus package deal most likely gave the manipulators more clout. We play A whole lot of games at our home and I have been making an attempt to work on this with among the youngsters on the plus minus of the whole thing so possibly the sport will help them understand.

Genting SP in any case that excellent news lately decided that sellers will take management and command over buyers. True, you could purchase absolutely anything in a bull market and be up, however the highest proportion features in my book have been in bad markets. Fashionable forward, or futures agreements started in Chicago in the 1840s, with the looks of the railroads. If there’s a stock market crash, you anticipate change, you anticipate the turning point. In fact, there would be days, through which all of our inventory costs would drop drastically and we’d lose a lot of money.

Genting SP in any case that excellent news lately decided that sellers will take management and command over buyers. True, you could purchase absolutely anything in a bull market and be up, however the highest proportion features in my book have been in bad markets. Fashionable forward, or futures agreements started in Chicago in the 1840s, with the looks of the railroads. If there’s a stock market crash, you anticipate change, you anticipate the turning point. In fact, there would be days, through which all of our inventory costs would drop drastically and we’d lose a lot of money.

In this hub we’ll look at and draw basic profit and loss diagrams of choice strategies. At eleven:00, the inventory stalls for a bit and rides alongside the 50 day MA. I’m not taking the commerce but, because the indicators aren’t all lined up, and I am not an enormous danger taker. If you had invested $1,020 at its preliminary public offering (IPO) worth of $eighty five, you’d have been able to purchase 12 shares. We did not add shares of Class C and will thus understate the worth of your portfolio.

In this hub we’ll look at and draw basic profit and loss diagrams of choice strategies. At eleven:00, the inventory stalls for a bit and rides alongside the 50 day MA. I’m not taking the commerce but, because the indicators aren’t all lined up, and I am not an enormous danger taker. If you had invested $1,020 at its preliminary public offering (IPO) worth of $eighty five, you’d have been able to purchase 12 shares. We did not add shares of Class C and will thus understate the worth of your portfolio.

…

… A high risk pool is a special program designed to help a very small percentage of the American population that does not have medical insurance provided to them through normal means. The majority of Americans, roughly sixty percent in fact, are covered for health insurance through their employer, also known as group health insurance. Another twenty-seven percent are covered by medical care programs sponsored by the government, such as Medicare, CHIP (children’s health care programs), military health care programs, and so on. This leaves only roughly thirteen to fourteen percent of the population that is not covered through these means, and for this small percentage, health insurance must be purchased through private health insurance companies.

A high risk pool is a special program designed to help a very small percentage of the American population that does not have medical insurance provided to them through normal means. The majority of Americans, roughly sixty percent in fact, are covered for health insurance through their employer, also known as group health insurance. Another twenty-seven percent are covered by medical care programs sponsored by the government, such as Medicare, CHIP (children’s health care programs), military health care programs, and so on. This leaves only roughly thirteen to fourteen percent of the population that is not covered through these means, and for this small percentage, health insurance must be purchased through private health insurance companies. Google morphed from a simple, Stanford College search engine analysis project in 1996, to its present standing of being the largest American firm (not part of the Dow Jones Industrial Average) as of October, 2007. In addition to the present scandal and probes into whether or not its Irish tax dealings represent unlawful state aid, Google is also within the midst of an EU antitrust investigation into potential abuse of its search monopoly. The Advanced Search choice permits you to seek for a selected phrase, date, file format or other specific info relevant to your search inquiry. Google has declined to comment on the news, and has reiterated that it complies with the letter of tax legal guidelines in all nations it conducts business in. Right here is one other version for download of a clean printable world map via Wikimedia Commons.

Google morphed from a simple, Stanford College search engine analysis project in 1996, to its present standing of being the largest American firm (not part of the Dow Jones Industrial Average) as of October, 2007. In addition to the present scandal and probes into whether or not its Irish tax dealings represent unlawful state aid, Google is also within the midst of an EU antitrust investigation into potential abuse of its search monopoly. The Advanced Search choice permits you to seek for a selected phrase, date, file format or other specific info relevant to your search inquiry. Google has declined to comment on the news, and has reiterated that it complies with the letter of tax legal guidelines in all nations it conducts business in. Right here is one other version for download of a clean printable world map via Wikimedia Commons.

…

… We current the evidence that the GOOGLE inventory, one of the crucial vital shares within the 21st century, may have been illegally controlled by massive Wall Road companies. But many traders have grow to be annoyed with Page’s unwavering perception that Google needs to be spending billions on far-flung initiatives ranging from driverless vehicles to diabetes-controlling contact lenses that will take years to repay and have little to do with the company’s principal enterprise of search and digital advertising.

We current the evidence that the GOOGLE inventory, one of the crucial vital shares within the 21st century, may have been illegally controlled by massive Wall Road companies. But many traders have grow to be annoyed with Page’s unwavering perception that Google needs to be spending billions on far-flung initiatives ranging from driverless vehicles to diabetes-controlling contact lenses that will take years to repay and have little to do with the company’s principal enterprise of search and digital advertising.

Blogging is considered by many to be an art form and one that needs to be carefully cultivated. While this viewpoint has an element of truth to it, don’t be discouraged. Anyone can learn to blog in an effective, informative and entertaining manner. Take a look at some valuable tips in this article to get you on your way to being a master blogger.

Blogging is considered by many to be an art form and one that needs to be carefully cultivated. While this viewpoint has an element of truth to it, don’t be discouraged. Anyone can learn to blog in an effective, informative and entertaining manner. Take a look at some valuable tips in this article to get you on your way to being a master blogger. Grandparenting is actually an important part or stage of a person’s life because this is the time when you will be able to witness the changes, improvements and developments that takes place as your grandchild grows up. You learn to appreciate and get amazed on how a child’s mind develops. It is also the time when you will be able see things just like the way a child sees them. You can play and bond with your grandchild and teach him some things that he can eventually use in the future. His parents may be able to provide everything that he needs but there are some things or information that only a grandparent can share. It is because of the wisdom and experience you gained.

Grandparenting is actually an important part or stage of a person’s life because this is the time when you will be able to witness the changes, improvements and developments that takes place as your grandchild grows up. You learn to appreciate and get amazed on how a child’s mind develops. It is also the time when you will be able see things just like the way a child sees them. You can play and bond with your grandchild and teach him some things that he can eventually use in the future. His parents may be able to provide everything that he needs but there are some things or information that only a grandparent can share. It is because of the wisdom and experience you gained.

With the intention to make your on-line banking experience much more secure we have now launched a brand new safety feature that enables us to detect uncommon activity on your account. Especially, emblem design of Alexandra, Fortress Financial, Lifebloom and Lake Constanz seems superior with simple however catchy look. Right now we had better hope finance by no means leaves Guernsey until something higher comes alongside. The brand new brand is visually wealthy, intellectually fascinating, and allows Future Finance to catch peoples consideration while speaking about something serious. A designer has to review colossal number of designs earlier than he finalizes the concept for his brand.

With the intention to make your on-line banking experience much more secure we have now launched a brand new safety feature that enables us to detect uncommon activity on your account. Especially, emblem design of Alexandra, Fortress Financial, Lifebloom and Lake Constanz seems superior with simple however catchy look. Right now we had better hope finance by no means leaves Guernsey until something higher comes alongside. The brand new brand is visually wealthy, intellectually fascinating, and allows Future Finance to catch peoples consideration while speaking about something serious. A designer has to review colossal number of designs earlier than he finalizes the concept for his brand.

Final week, Google France head Jean-Marc Tassetto (fifty three) resigned to go work in an e-learning startup, in keeping with a Google assertion. For example, if you happen to love to watch on-line videos, you could find the most recent and hottest Google and You Tube movies underneath the Video Hyperlink. As with all different Google search pages, Google CA search can be considered in languages other than English. If you wish to stroll down that avenue and take a look you just need to activate Google Pegman by clicking on him and he brings you for an incredible stroll anywhere you need to go. The corporate publishes a transparency report on RTBF elimination requests, but the report solely offers the percentage of URLs faraway from its search outcomes, just a few pattern requests, and a listing of probably the most-affected websites. You probably have not browse the road view of this breath-taking Amazon rainforest, then you definitely may achieve this by going at Google map and then sort the next on the search bar. Blank world map pad consists of 25 pages your kids can tear off, color, and label.

Final week, Google France head Jean-Marc Tassetto (fifty three) resigned to go work in an e-learning startup, in keeping with a Google assertion. For example, if you happen to love to watch on-line videos, you could find the most recent and hottest Google and You Tube movies underneath the Video Hyperlink. As with all different Google search pages, Google CA search can be considered in languages other than English. If you wish to stroll down that avenue and take a look you just need to activate Google Pegman by clicking on him and he brings you for an incredible stroll anywhere you need to go. The corporate publishes a transparency report on RTBF elimination requests, but the report solely offers the percentage of URLs faraway from its search outcomes, just a few pattern requests, and a listing of probably the most-affected websites. You probably have not browse the road view of this breath-taking Amazon rainforest, then you definitely may achieve this by going at Google map and then sort the next on the search bar. Blank world map pad consists of 25 pages your kids can tear off, color, and label.

…

…:max_bytes(150000):strip_icc()/consumerpriceindex_final-2bbbfc247d8e48c5b73b8b9a3d151a16.png)

They can strike at any moment. They come on fast and seem to last forever. Anyone that has ever had a migraine knows how bad the pain can be for those who get them. A migraine is much more than just your regular headache. It is a type of headache that is usually associated with sensitivity to light and noise, nausea, and vomiting. There are a lot of things that can trigger migraines and sometimes not a lot that can be done to treat them. Though men can get them, we typically see them happen in women. This article will take a look at the link between women and migraines. By understanding a little bit about them you may be able to protect yourself.

They can strike at any moment. They come on fast and seem to last forever. Anyone that has ever had a migraine knows how bad the pain can be for those who get them. A migraine is much more than just your regular headache. It is a type of headache that is usually associated with sensitivity to light and noise, nausea, and vomiting. There are a lot of things that can trigger migraines and sometimes not a lot that can be done to treat them. Though men can get them, we typically see them happen in women. This article will take a look at the link between women and migraines. By understanding a little bit about them you may be able to protect yourself.