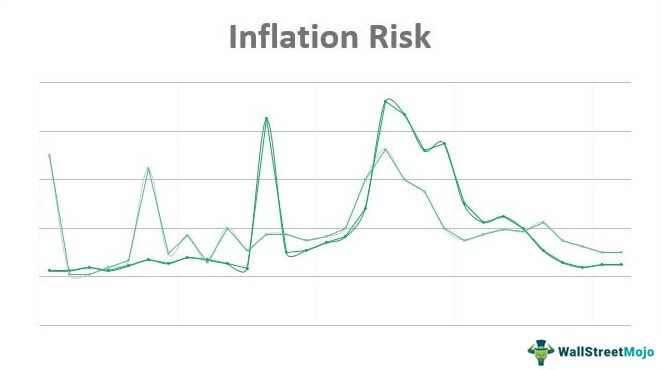

Navigating Economic Uncertainties: The Art of Inflation Risk Management

In the dynamic landscape of finance, mastering inflation risk management is a strategic imperative for businesses, investors, and policymakers. This article explores the nuances of inflation risk, its impact on various sectors, and the proactive measures employed to safeguard against its potentially adverse effects.

Understanding the Dynamics of Inflation Risk

Inflation risk refers to the potential for unexpected changes in inflation rates, disrupting economic stability and impacting the real value of assets. The first step in effective inflation risk management is a comprehensive understanding of the dynamics that contribute to inflation fluctuations, both on a macroeconomic and industry-specific level.

Impact of Inflation Risk on Businesses

Inflation risk poses unique challenges for businesses, influencing production costs, pricing strategies, and overall profitability. Understanding how inflation risk can affect different industries and sectors is crucial for businesses to develop resilient strategies that mitigate potential negative impacts on their operations.

Investor Perspectives: Navigating Inflation-Linked Investments

For investors, inflation risk can erode the purchasing power of financial assets. Inflation-linked investments, such as Treasury Inflation-Protected Securities (TIPS) or commodities, become valuable tools in a portfolio to hedge against the impact of rising prices. Diversification and strategic asset allocation are key elements of investor responses to inflation risk.

Central Bank Policies and Inflation Risk Mitigation

Central banks play a pivotal role in mitigating inflation risk through monetary policies. Adjusting interest rates, influencing money supply, and employing other tools, central banks aim to maintain price stability and mitigate the risk of excessive inflation. Monitoring central bank actions becomes essential for businesses and investors in assessing inflation risk.

Real Assets as Inflation Hedges

Real assets, including real estate and commodities, are often considered effective hedges against inflation risk. These tangible assets tend to retain or increase in value during inflationary periods, providing a safeguard for investors. Strategic allocation to real assets becomes a crucial element of a diversified portfolio for inflation risk management.

The Importance of Contractual Protections

In various business contracts, especially long-term agreements, inflation risk can pose challenges. Implementing contractual protections, such as inflation adjustment clauses or price escalation mechanisms, helps businesses manage the impact of inflation on their contractual obligations, fostering stability and predictability.

Risk Management Strategies for Small Businesses

Small businesses, often more susceptible to economic uncertainties, benefit from adopting robust risk management strategies. This includes careful financial planning, monitoring inflation indicators, and diversifying suppliers. Implementing proactive measures positions small businesses to navigate inflation risk and maintain resilience.

International Trade Dynamics and Inflation Risk

Global businesses engaged in international trade face additional complexities related to inflation risk. Currency fluctuations, trade agreements, and geopolitical events can amplify the impact of inflation risk on cross-border transactions. Understanding these dynamics is critical for multinational corporations to develop effective risk management strategies.

Technology as a Tool in Inflation Risk Management

Advancements in technology provide powerful tools for businesses and investors to manage inflation risk. Data analytics, predictive modeling, and risk management software enable organizations to assess and respond to inflation risk more effectively. Embracing technology becomes a strategic advantage in navigating the complexities of the modern economic landscape.

In-Depth Exploration of Inflation Risk Management

For a comprehensive exploration of inflation risk management strategies and expert insights, explore Inflation Risk Management. This resource offers valuable information to help businesses, investors, and policymakers stay informed and implement effective measures to safeguard against the challenges posed by inflation risk.

Fortifying Strategies for a Stable Future

In conclusion, mastering inflation risk management is an ongoing process that demands vigilance, adaptability, and strategic planning. Businesses, investors, and policymakers must work collaboratively, leveraging insights, and implementing proactive measures to fortify strategies against the uncertainties of inflation risk. With a comprehensive approach, organizations can navigate economic uncertainties and build a foundation for stability and growth.