Navigating Investment Landscapes: Understanding the Impact of Inflation

In the intricate world of finance, the impact of inflation on investments is a crucial factor that demands attention. This article delves into the multifaceted relationship between inflation and investment portfolios, exploring strategies to navigate this complex landscape.

The Erosion of Real Returns

One of the primary impacts of inflation on investments is the erosion of real returns. Inflation diminishes the purchasing power of money over time, meaning that the same amount of money buys fewer goods and services. This has a direct impact on the real returns generated by investments, as the value of future cash flows is reduced.

Bond Investments and Interest Rate Dynamics

Bonds, typically considered safer investments, are not immune to the impact of inflation. The value of fixed-interest securities erodes in real terms when inflation rises. Additionally, changes in inflation can influence interest rates set by central banks. Understanding the intricate dynamics between inflation and interest rates is vital for bond investors.

Equities as Inflation Hedge

While inflation can erode the real value of money, equities have historically served as a hedge against inflation. Companies can adjust prices and generate higher revenues in inflationary environments, which can contribute to the growth of equity investments. However, the impact of inflation on different sectors and industries can vary.

Real Assets and Tangible Investments

Investors often turn to real assets as a way to hedge against the impact of inflation. Real estate, commodities, and precious metals like gold are tangible investments that tend to retain value or even appreciate during inflationary periods. Allocating a portion of a portfolio to these real assets can be a strategic move in inflationary times.

Diversification Strategies

Diversification is a key strategy for mitigating the impact of inflation on investments. Allocating assets across different classes, including equities, bonds, and real assets, can help create a balanced and resilient portfolio. Diversification aims to reduce risk by not relying too heavily on the performance of a single asset class.

Inflation-Protected Securities

Inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), are specifically designed to combat the impact of inflation on investments. These securities adjust their principal value with changes in the Consumer Price Index (CPI), providing investors with a hedge against rising inflation.

Monitoring Inflation Indicators

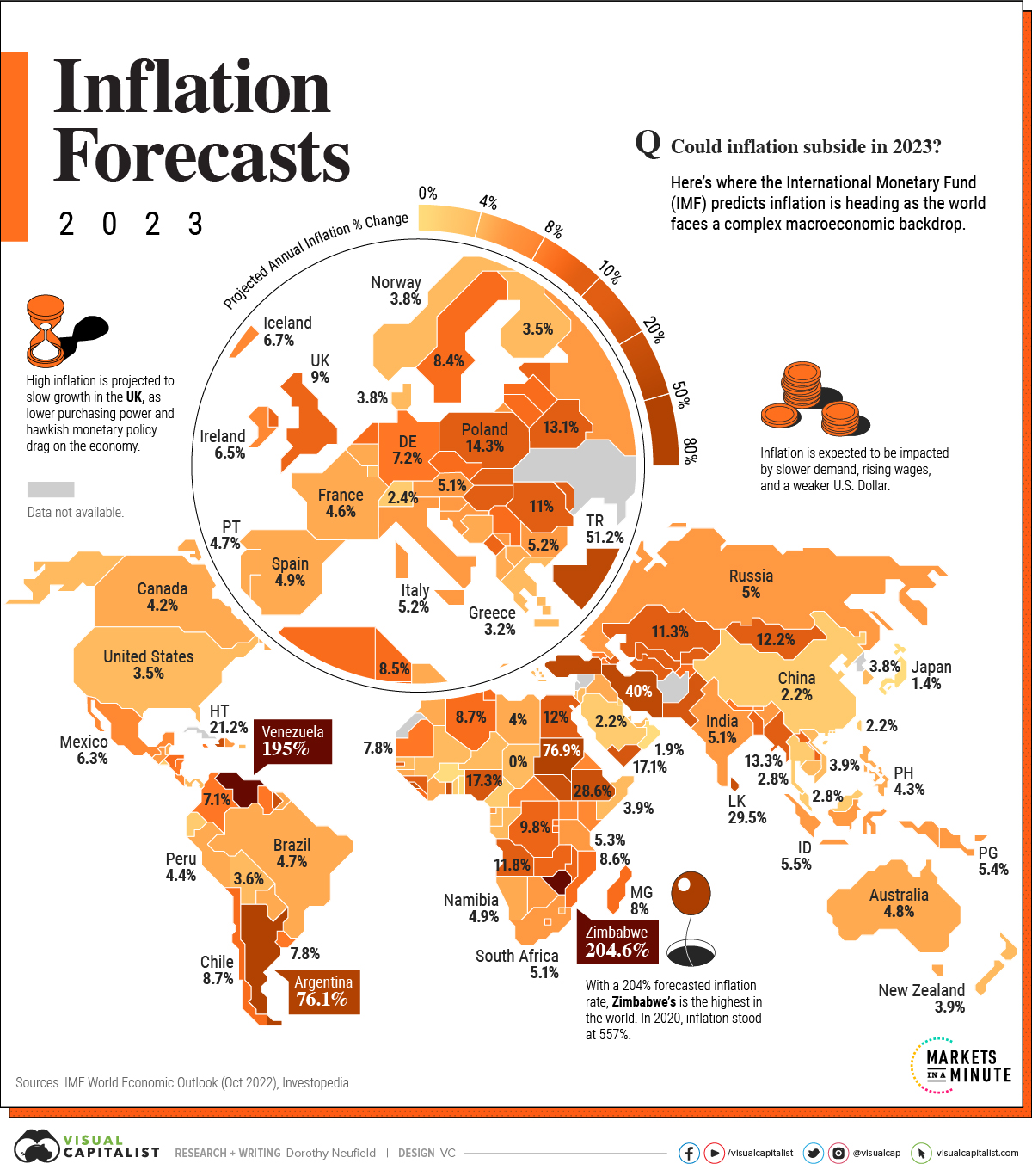

To effectively navigate the impact of inflation on investments, investors must stay vigilant and monitor key inflation indicators. Economic reports, central bank statements, and inflation forecasts can provide valuable insights into potential changes in the inflationary environment, allowing investors to adjust their strategies accordingly.

Global Economic Trends and Currency Considerations

In a globally connected financial landscape, investors must also consider the impact of inflation on different currencies. Currency values can fluctuate in response to inflation rates, affecting the returns of international investments. Understanding global economic trends and their implications for currencies is vital for savvy investors.

In-Depth Analysis of Inflation Impact on Investments

For a comprehensive analysis of the impact of inflation on investments and expert insights, explore Inflation Impact on Investments. This resource provides valuable information to help investors stay informed and make strategic decisions in the ever-evolving economic landscape.

Building Resilient Investment Strategies

In conclusion, the impact of inflation on investments underscores the importance of crafting resilient and adaptive investment strategies. By understanding the dynamics between inflation and various asset classes, diversifying portfolios, and staying informed about global economic trends, investors can navigate the challenges posed by inflation and position themselves for long-term financial success.