Navigating Economic Challenges: Inflation Risk Management

In the dynamic realm of finance, effective inflation risk management is a cornerstone for businesses, investors, and policymakers alike. This article delves into the complexities of inflation risk, exploring its impact, the strategies employed for mitigation, and the pivotal role it plays in shaping economic decisions.

Understanding Inflation Risk: A Prerequisite for Management

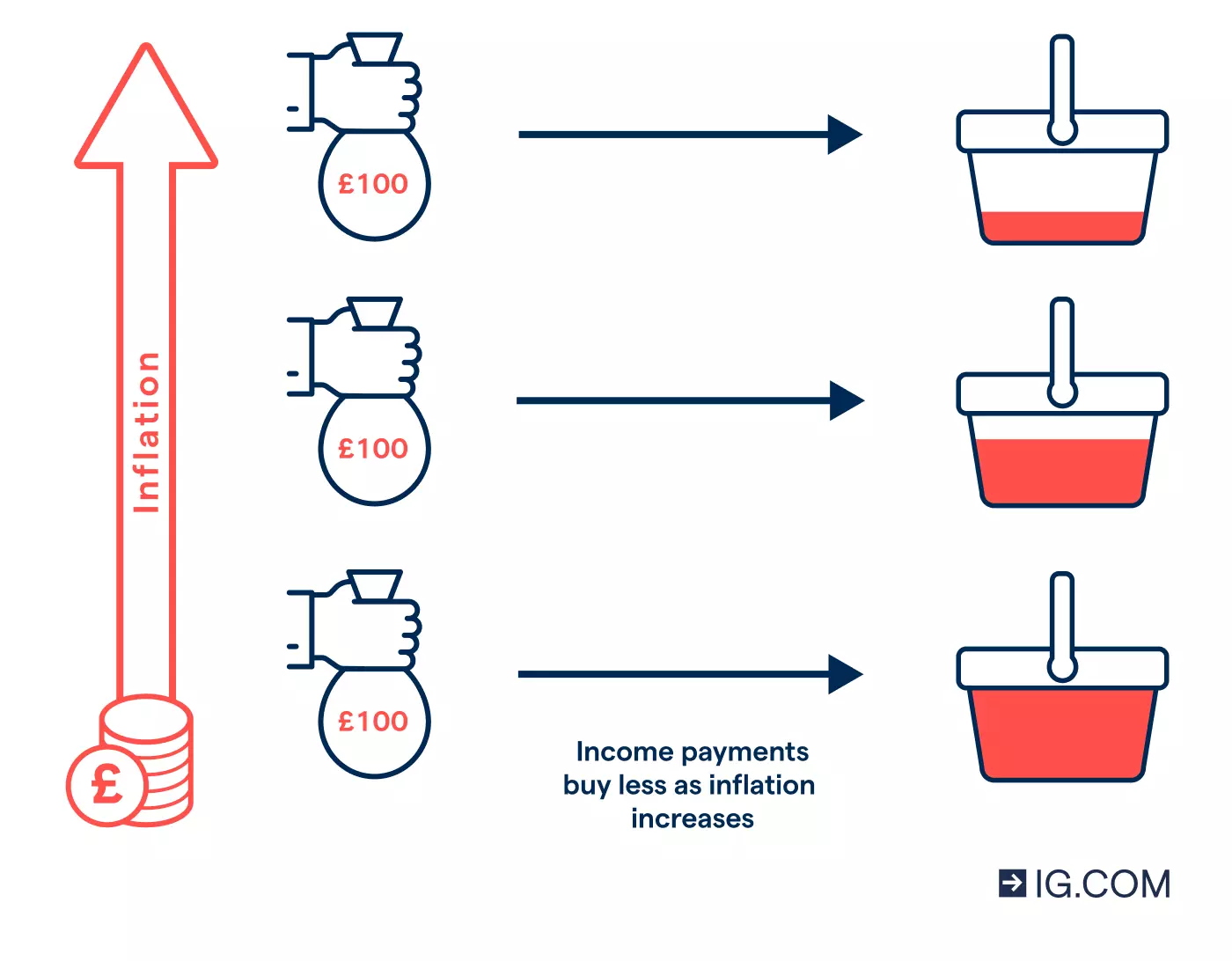

Before embarking on effective inflation risk management, a comprehensive understanding of what constitutes inflation risk is crucial. Inflation risk refers to the potential loss of purchasing power due to rising prices. Businesses and investors must analyze the factors contributing to inflation risk, including monetary policies, global economic trends, and supply chain dynamics, to make informed decisions.

Impact on Financial Portfolios: A Balancing Act

Inflation risk has a direct impact on financial portfolios. As prices rise, the real value of returns diminishes, affecting the purchasing power of investments. Effective inflation risk management involves striking a balance between risk and return. Investors must consider inflation-protected securities, diversification, and dynamic asset allocation strategies to mitigate the erosive effects of inflation on portfolios.

Business Resilience Strategies: Adapting to Inflation Dynamics

For businesses, inflation risk management is about ensuring resilience in the face of changing economic dynamics. Pricing strategies, supply chain optimization, and flexible cost structures are integral components of effective risk management. Businesses that proactively adapt to inflationary pressures are better positioned to navigate economic challenges and sustain growth.

Role of Central Banks: Inflation Risk and Monetary Policies

Central banks play a crucial role in managing inflation risk through monetary policies. Interest rate adjustments, open market operations, and communication strategies are tools employed to control inflation. Understanding the dynamics of central bank policies is essential for businesses and investors to align their strategies with broader economic trends.

Globalization Challenges: Inflation Risk in Interconnected Economies

In a globalized world, inflation risk is interconnected across economies. Global events, supply chain disruptions, and currency fluctuations can contribute to inflationary pressures. Businesses and investors engaged in international markets must factor in these globalization challenges when formulating inflation risk management strategies.

Inflation Derivatives and Risk Hedging Instruments

Financial markets offer instruments such as inflation derivatives to hedge against inflation risk. These derivatives allow businesses and investors to transfer or mitigate the impact of inflation risk through strategic financial contracts. Understanding the use of inflation derivatives is integral to a comprehensive inflation risk management strategy.

Consumer Impact: Inflation Risk and Purchasing Power

Inflation risk directly affects consumers by eroding their purchasing power. As prices rise, the cost of living increases, impacting household budgets. Inflation risk management strategies should consider the implications for consumer behavior and incorporate measures to address the challenges faced by individuals and households.

Long-Term Investment Planning: Inflation Risk Mitigation

Inflation risk management extends into long-term investment planning. Retirement funds, pension portfolios, and endowments must incorporate strategies to safeguard against the long-term erosive effects of inflation. Diversification into inflation-resistant assets and ongoing monitoring of economic indicators are essential components of effective long-term inflation risk management.

Strategic Planning for Economic Stability

Ultimately, inflation risk management is about strategic planning for economic stability. Businesses, investors, and policymakers must collaborate to develop and implement effective strategies that balance the need for growth with the imperative of managing inflation risk. In doing so, they contribute to a more resilient and sustainable economic landscape.

Exploring In-Depth Insights at Inflation Risk Management

For a deeper exploration of insights and strategies related to inflation risk management, visit Inflation Risk Management. In a world where economic uncertainties abound, mastering the art of inflation risk management is pivotal for informed decision-making and sustained growth.