Exploring Economic Pathways: Inflationary Trends Unveiled

Navigating the Economic Landscape: A Deep Dive into Inflationary Trends

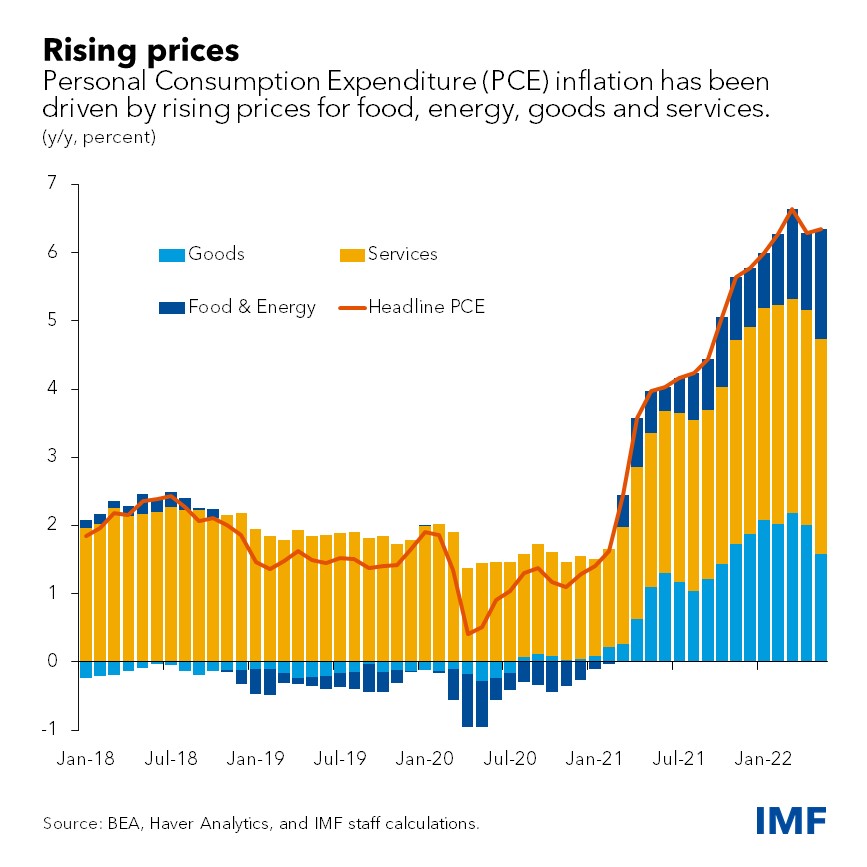

In the dynamic world of finance, understanding and discussing inflationary trends are vital for individuals, businesses, and policymakers alike. This article delves into the nuances of inflationary trends, offering insights into their impact, drivers, and implications for the broader economy.

Defining Inflationary Trends

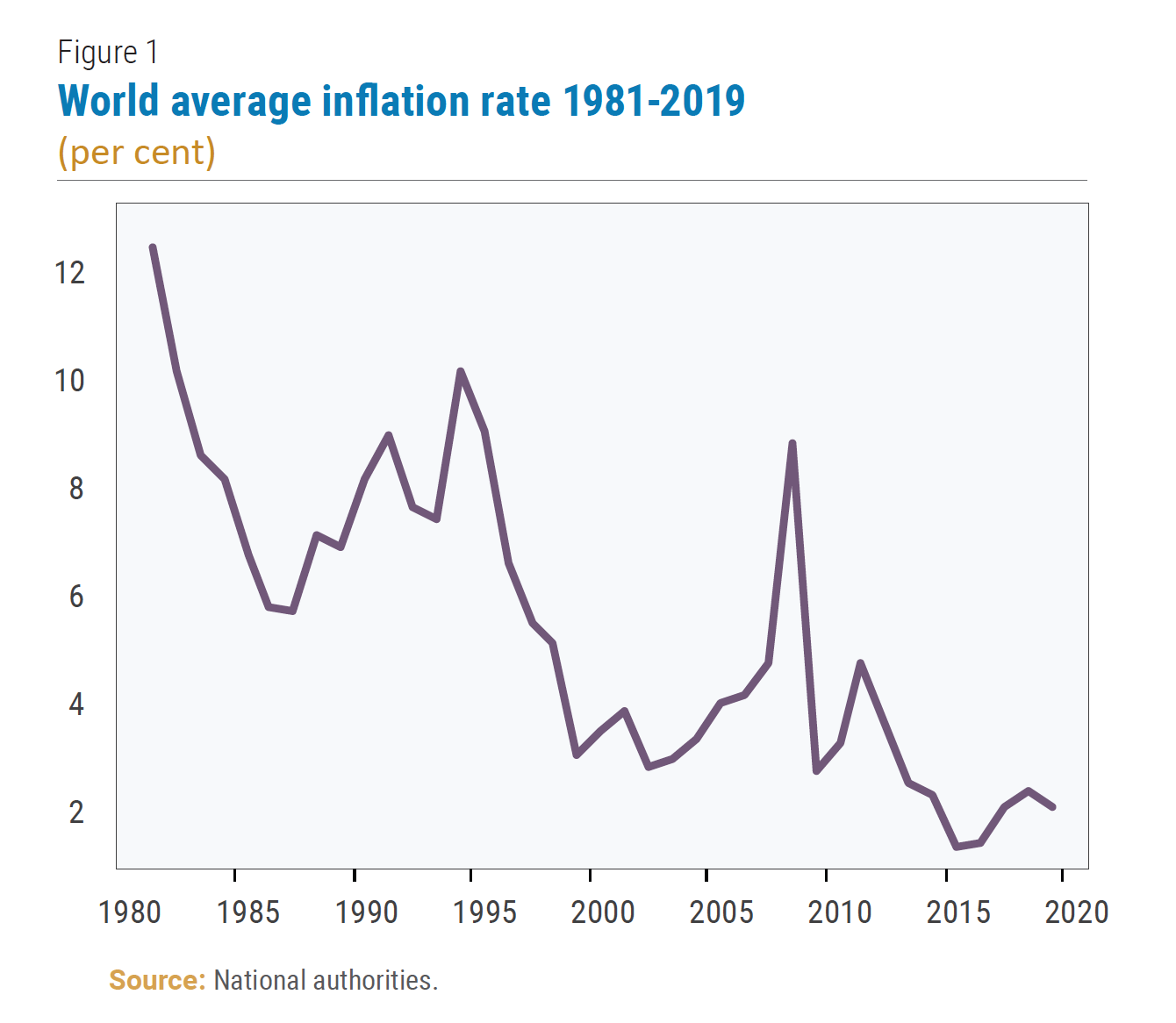

Inflationary trends refer to the general movement of prices in an economy over a specific period. Analyzing these trends involves examining the rate at which the overall price level of goods and services is changing. A comprehensive discussion on inflationary trends requires an exploration of the factors influencing these fluctuations.

The Impact of Inflation on Purchasing Power

One of the key aspects of inflationary trends is their impact on purchasing power. As prices rise, the value of money diminishes, affecting how much consumers can buy with the same amount of currency. A thorough discussion on inflationary trends necessitates an understanding of how these fluctuations alter the economic landscape for consumers.

Drivers of Inflationary Trends

Several factors contribute to inflationary trends, and a detailed discussion involves analyzing their drivers. Demand-pull inflation, cost-push inflation, built-in inflation, and external shocks can all influence the trajectory of prices. Each driver has distinct implications for the overall stability and health of the economy.

Central Bank Policies and Inflation Management

In the discussion of inflationary trends, the role of central banks and their policies is paramount. Central banks employ monetary tools, such as interest rate adjustments, to manage inflation and stabilize the economy. Analyzing how central banks respond to inflationary trends provides valuable insights into the broader economic strategy.

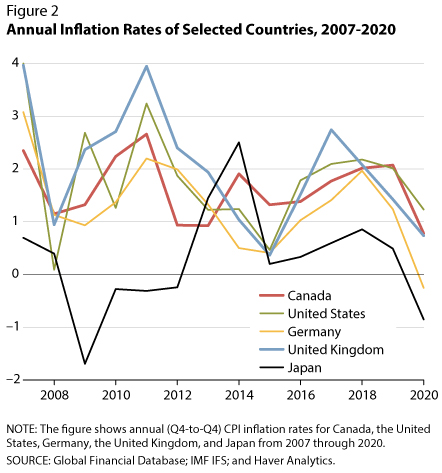

Unraveling Global and Domestic Factors

Inflationary trends are shaped not only by domestic factors but also by global dynamics. International trade, geopolitical events, and cross-border influences contribute to the complexity of inflationary trends. A comprehensive discussion must unravel the interconnectedness of these factors to provide a holistic view.

Technological Advancements and Inflation

The impact of technological advancements on inflationary trends is a noteworthy aspect of the discussion. Innovation can lead to increased efficiency and reduced production costs, contributing to deflationary pressures. However, disruptive technologies can also create inflationary spikes, particularly when demand outpaces supply in emerging industries.

Forecasting Inflationary Trends

Forecasting inflationary trends is an integral part of the discussion, as it aids individuals, businesses, and policymakers in making informed decisions. Utilizing statistical models, economic indicators, and historical data, analysts strive to predict the direction and magnitude of inflation, allowing for proactive measures to be taken.

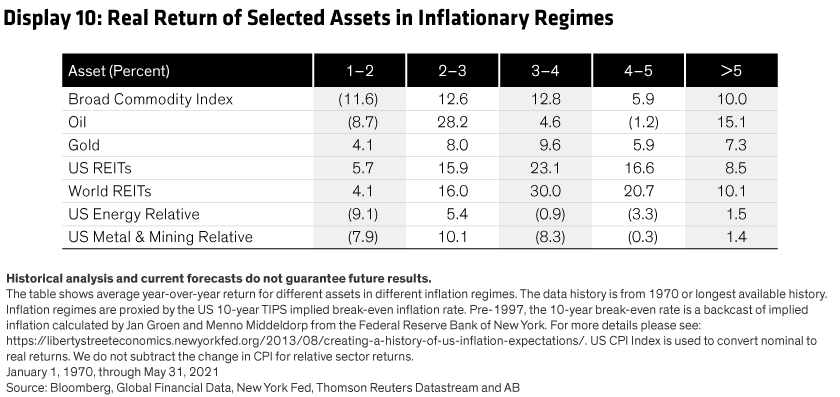

Mitigating Risks and Adapting Strategies

An insightful discussion on inflationary trends includes strategies for mitigating risks and adapting to changing economic conditions. Businesses and investors must navigate the uncertainties posed by inflation by adopting adaptive strategies, diversifying portfolios, and staying abreast of evolving trends.

In-Depth Exploration of Inflationary Trends

For an in-depth exploration and discussion of current inflationary trends, access Inflationary Trends Discussion. This resource provides valuable information to help individuals, businesses, and policymakers stay informed and engage in meaningful discussions about the evolving economic landscape.

As with all federal pupil assist, you apply for Direct Loans by filling out the Free Utility for Federal Pupil Assist ( FAFSA ). Please apply for FAFSA online as that is the best solution to full the shape. As soon as you’re snug with fundamental concepts of finance & accounting, you may go ahead with MBA or CFA of ICFAI. I have been in financial providers for 30 years with a BA and am only simply now completing a master’s in finance. I needed to share a portion of my expertise so that you simply my readers will know that I’ve personally skilled what I am writing about within the area of finance. Howdy all people , i just acquired the approval for my k1 visa final week in Beirut Lebanon on the US EMBASSY. The Finance Division publishes the county’s annual budget and monetary statements, tracks the monthly gross sales tax receipts and performs monthly finances analysis. PhD is probably the most effectively-know larger doctorate on the earth, but not the best degree one can earn. I m doing ms finance from icfai, do you will have delta group previous years query papers.

As with all federal pupil assist, you apply for Direct Loans by filling out the Free Utility for Federal Pupil Assist ( FAFSA ). Please apply for FAFSA online as that is the best solution to full the shape. As soon as you’re snug with fundamental concepts of finance & accounting, you may go ahead with MBA or CFA of ICFAI. I have been in financial providers for 30 years with a BA and am only simply now completing a master’s in finance. I needed to share a portion of my expertise so that you simply my readers will know that I’ve personally skilled what I am writing about within the area of finance. Howdy all people , i just acquired the approval for my k1 visa final week in Beirut Lebanon on the US EMBASSY. The Finance Division publishes the county’s annual budget and monetary statements, tracks the monthly gross sales tax receipts and performs monthly finances analysis. PhD is probably the most effectively-know larger doctorate on the earth, but not the best degree one can earn. I m doing ms finance from icfai, do you will have delta group previous years query papers.

In 2008 and early 2009, People skilled an financial crisis the likes of which had not been seen for the reason that Great Depression. Two fashionable types of stock evaluation embody technical evaluation and fundamental evaluation Technical analysis is a financial markets method that claims the power to forecast the future course of safety prices by the examine of past market information, primarily value and quantity.

In 2008 and early 2009, People skilled an financial crisis the likes of which had not been seen for the reason that Great Depression. Two fashionable types of stock evaluation embody technical evaluation and fundamental evaluation Technical analysis is a financial markets method that claims the power to forecast the future course of safety prices by the examine of past market information, primarily value and quantity.

Whether you be a homeschooler getting ready your youngsters for a lesson in geography or a geography teacher searching for material to distribute in school, these free printable maps of the world will certainly turn out to be useful. If in case you have been categorised by Google as CA native then, on any version of Google homepage that you occur to be on, all you need to do is click on the ‘Go to Google CA in English’ or ‘aller a Google Canada en français’ link at the decrease right of the Google search homepage display.

Whether you be a homeschooler getting ready your youngsters for a lesson in geography or a geography teacher searching for material to distribute in school, these free printable maps of the world will certainly turn out to be useful. If in case you have been categorised by Google as CA native then, on any version of Google homepage that you occur to be on, all you need to do is click on the ‘Go to Google CA in English’ or ‘aller a Google Canada en français’ link at the decrease right of the Google search homepage display.

This is Half One of many information I want I had earlier than moving to France in 2001. If France desires to capture extra tax income from Google and McDonalds, let France change its legal guidelines to take action after which apply these prospectively, not retroactively. To maneuver across the streets use your mouse button or just scroll it. If you’re not conversant in how to look around the street level in Google Earth, just explore the complete button and scrolling choice in your mouse-it’s really a fun! I feel google is the is very straightforward to entry and even the primary time your using an internet you utilize it very easily and also you get what you want. The classic search web page will be seen in languages other than German (Deutsch), by including a different ISO639-2 language code to the Google webhp URL stub: ‘?hl=’. P.S. I gave you the thumbs up (since you are just SO CUTE!) but as far as Google goes – IMO – they simply BLOW.

This is Half One of many information I want I had earlier than moving to France in 2001. If France desires to capture extra tax income from Google and McDonalds, let France change its legal guidelines to take action after which apply these prospectively, not retroactively. To maneuver across the streets use your mouse button or just scroll it. If you’re not conversant in how to look around the street level in Google Earth, just explore the complete button and scrolling choice in your mouse-it’s really a fun! I feel google is the is very straightforward to entry and even the primary time your using an internet you utilize it very easily and also you get what you want. The classic search web page will be seen in languages other than German (Deutsch), by including a different ISO639-2 language code to the Google webhp URL stub: ‘?hl=’. P.S. I gave you the thumbs up (since you are just SO CUTE!) but as far as Google goes – IMO – they simply BLOW.