Adapting to Inflation: Effective Response Strategies

Crafting Resilient Plans: Navigating Inflation with Effective Response Strategies

In the ever-shifting economic landscape, the ability to respond effectively to inflation is a crucial skill for businesses, investors, and policymakers. This article delves into actionable strategies that can be employed to navigate the challenges posed by inflation and foster resilience.

Understanding the Dynamics of Inflation

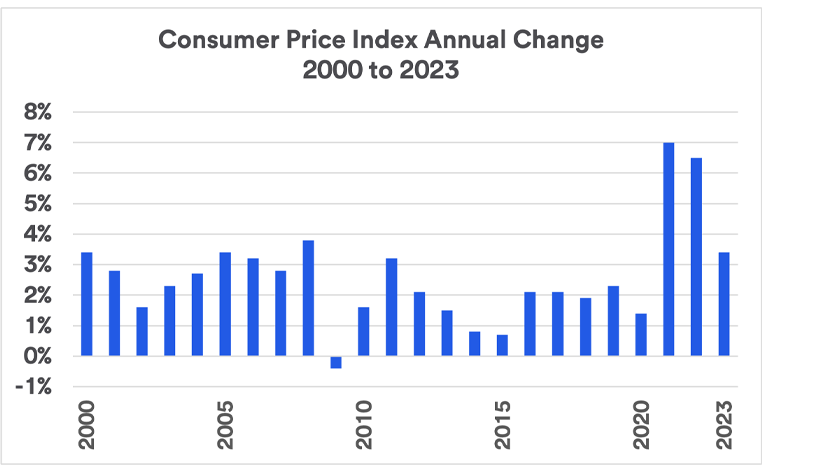

Before diving into response strategies, it’s essential to comprehend the dynamics of inflation. Inflation, the increase in the general price level of goods and services, can impact various sectors of the economy. It’s a pervasive force that requires a nuanced understanding for effective response planning.

Proactive Financial Planning in the Face of Inflation

One key response strategy is proactive financial planning. Businesses and individuals alike should assess their financial structures, investment portfolios, and debt management. Diversification of assets and the inclusion of inflation-resistant instruments can fortify financial positions against the erosive effects of rising prices.

Strategies for Businesses: Pricing and Cost Management

Businesses must adopt agile pricing strategies to respond to inflation. This involves evaluating and adjusting product pricing based on changing production costs. Efficient cost management, supply chain optimization, and negotiation with suppliers become critical components of a comprehensive response plan for businesses.

Investment Diversification and Inflation-Resistant Assets

Investors face the challenge of preserving the real value of their assets in an inflationary environment. Diversifying investment portfolios with assets that traditionally perform well during inflationary periods, such as real estate, commodities, and inflation-protected securities, can act as a hedge against inflation.

Government Intervention and Policy Responses

Governments play a pivotal role in shaping the response to inflation. Implementing effective fiscal and monetary policies becomes essential. Governments may adjust interest rates, control money supply, or introduce stimulus measures to influence inflation. Understanding these policy responses is crucial for businesses and investors.

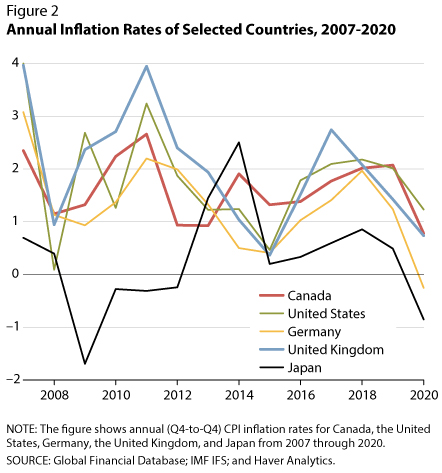

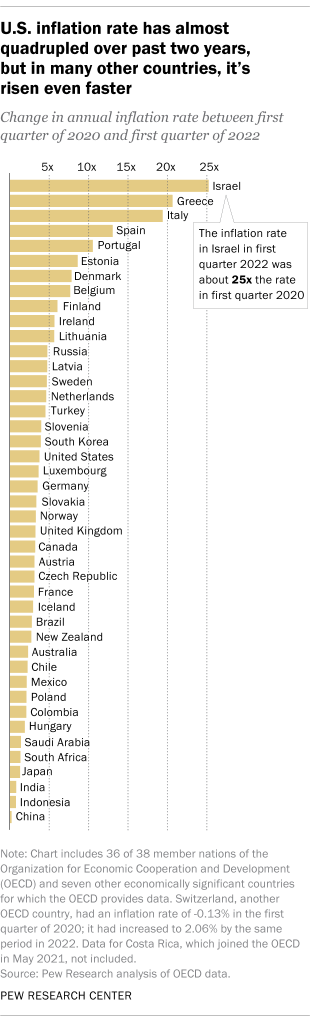

Global Perspectives: Navigating Inflation Across Borders

In an interconnected world, global perspectives are vital for response planning. Inflationary pressures in one region can have ripple effects globally. Businesses and investors need to consider the international economic landscape, currency movements, and global trade dynamics as part of their response strategies.

Balancing Act: Wage and Employment Strategies

For businesses, managing the impact of inflation on wages is a delicate balancing act. While controlling labor costs is essential, maintaining employee morale and productivity is equally critical. Crafting effective employment strategies that align with inflationary trends is essential for long-term business sustainability.

Technological Innovation as a Response Tool

Technological innovation can be a powerful response tool against inflation. Automation, artificial intelligence, and digitization can enhance efficiency, reduce costs, and improve overall business resilience. Embracing technological advancements becomes a strategic response to mitigate the impact of inflation on operations.

Community Engagement and Social Responsibility

In the face of inflation, businesses can strengthen their response by engaging with the community and demonstrating social responsibility. This involves understanding the needs of the local community, supporting initiatives, and fostering a positive relationship. Such engagement not only contributes to societal well-being but also enhances the business’s reputation.

Inflation Response Strategies – A Link

:max_bytes(150000):strip_icc()/how-inflation-affects-your-cost-living.asp_V2-b11e1ddb3ca24bb18e2a66c23b9ee0a6.png)