Navigating Concerns Amid Rising Inflation Trends

The Unsettling Landscape of Rising Inflation Concerns

In recent times, the specter of rising inflation has emerged as a cause for concern in economic circles worldwide. This article aims to delve into the various dimensions of the challenges posed by escalating inflation, examining its origins, implications, and potential strategies for addressing these concerns.

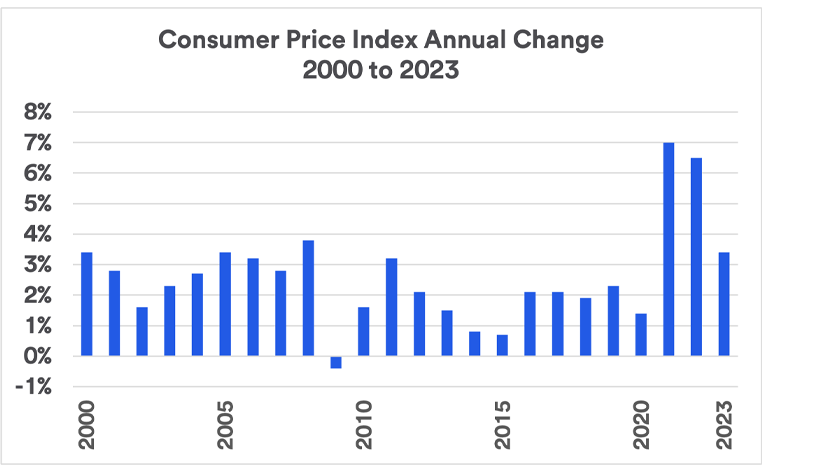

The Root Causes of Inflationary Pressures

Understanding the genesis of rising inflation is crucial for policymakers and economists seeking effective solutions. Factors such as increased demand, supply chain disruptions, and geopolitical events can contribute to inflationary pressures. Examining these root causes provides valuable insights into crafting targeted responses to mitigate the impact.

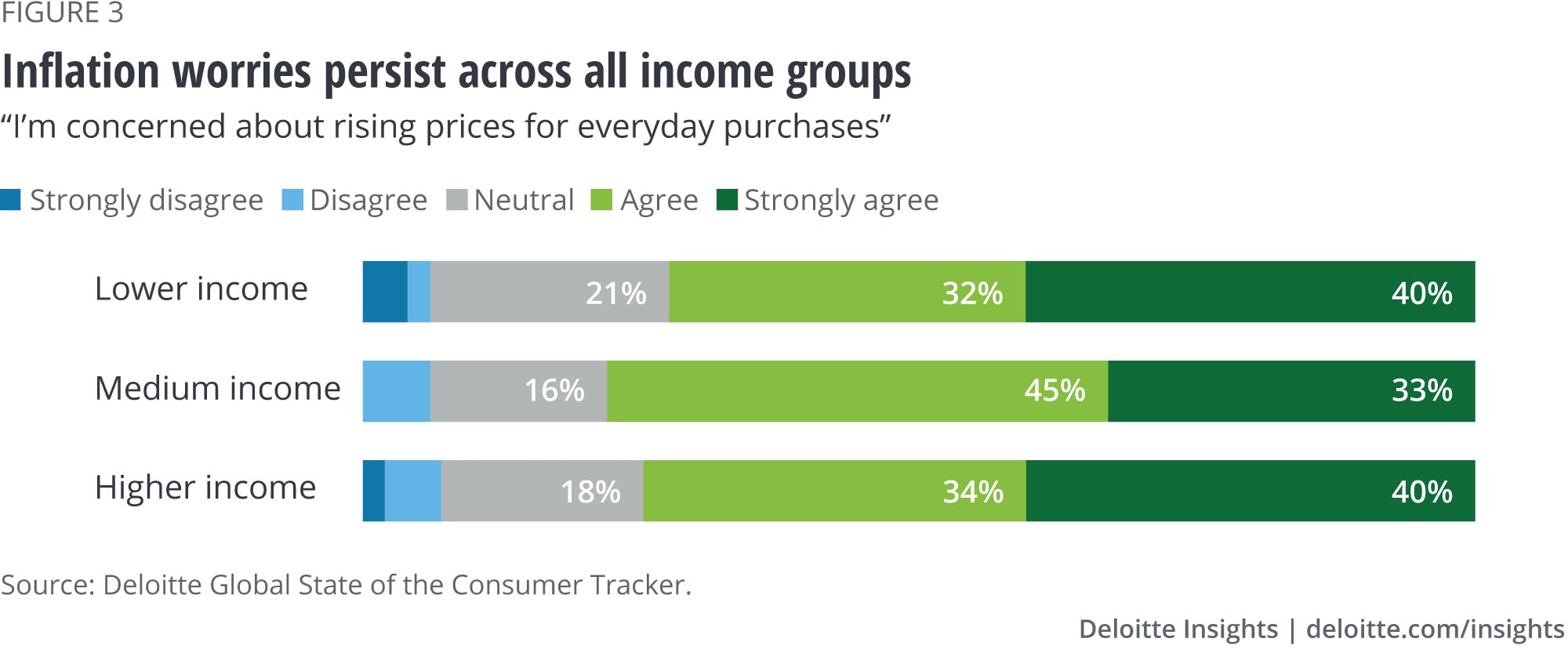

Consumer Impact: Navigating Budget Constraints

One of the most immediate consequences of rising inflation is its impact on consumers. As prices surge, the purchasing power of individuals diminishes, necessitating adjustments in spending habits. This shift can create challenges for households as they navigate budget constraints, potentially altering the landscape of consumer behavior and preferences.

Central Bank Dilemmas: Balancing Act in Monetary Policies

Central banks play a pivotal role in managing inflation through monetary policies. However, addressing rising inflation concerns requires a delicate balancing act. Striking the right equilibrium between stimulating economic growth and preventing runaway inflation becomes a challenging task, demanding nuanced decisions from central banking authorities.

Businesses on the Frontlines: Managing Costs and Prices

For businesses, the surge in inflation brings a set of challenges related to managing increased costs and pricing strategies. Supply chain disruptions, heightened production expenses, and fluctuating commodity prices can squeeze profit margins. Crafting resilient business strategies becomes imperative to navigate the complexities of an inflationary environment.

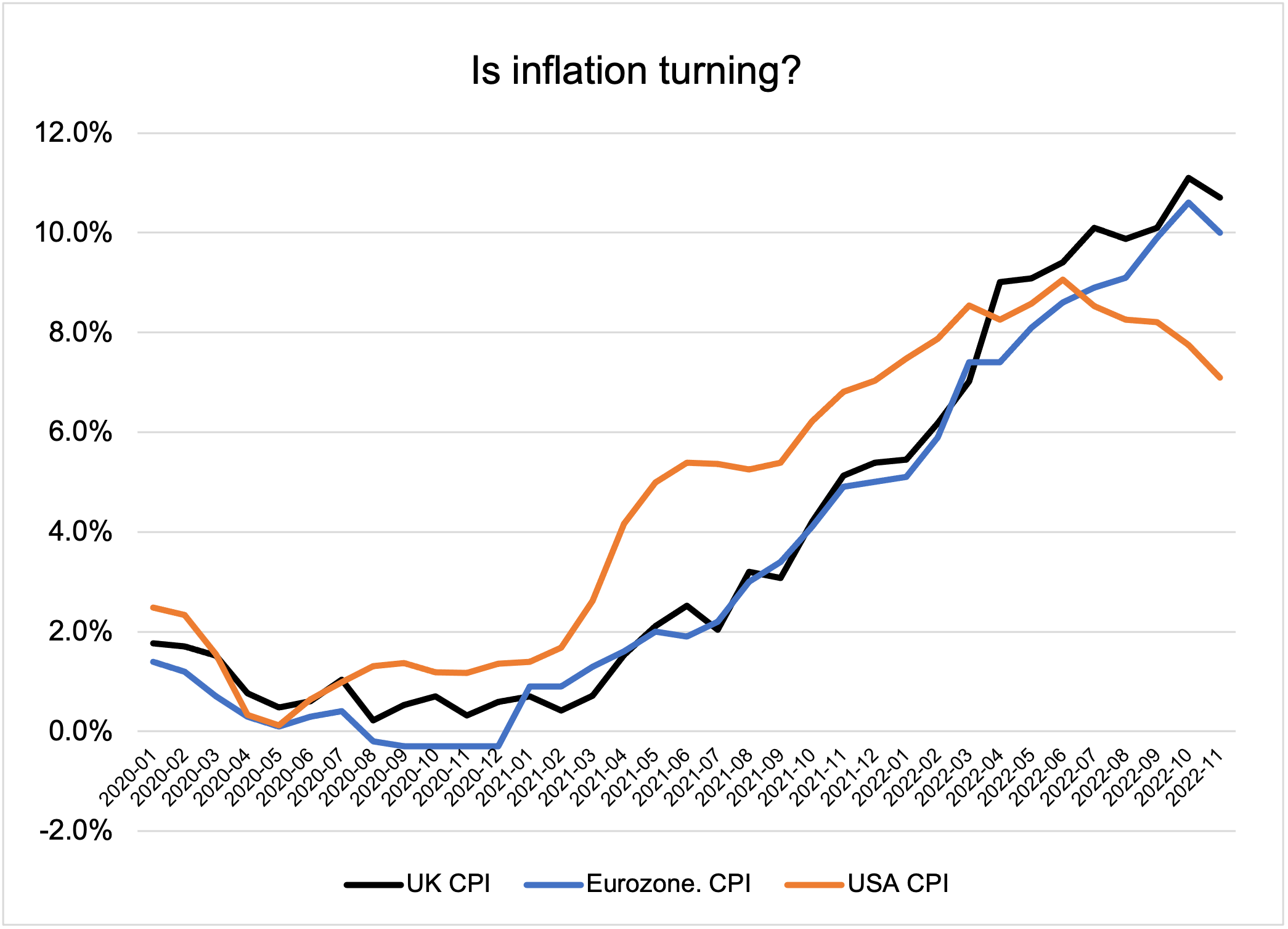

Global Economic Interconnectedness: Ripples Across Borders

In today’s interconnected global economy, the repercussions of rising inflation are not confined within national borders. Economic events in one region can trigger ripple effects across the world. Understanding the dynamics of global economic interconnectedness is essential for formulating comprehensive strategies to address and mitigate rising inflation concerns.

Investment Landscape: Seeking Inflation-Resilient Assets

Investors grapple with the impact of rising inflation on their portfolios. The search for inflation-resilient assets becomes crucial to safeguard against eroding real returns. Diversifying investment portfolios with assets traditionally considered hedges against inflation is a common strategy in the investment landscape.

Real Estate Dynamics: Balancing Act for Homeowners and Investors

The real estate market is intricately tied to inflation trends. While rising inflation may contribute to increased property values, it also brings challenges such as higher mortgage rates. Homeowners and investors alike must navigate this balancing act, considering both the potential opportunities and risks presented by inflationary pressures.

Government Responses: Crafting Effective Policies

Governments play a vital role in addressing rising inflation concerns through fiscal policies and regulatory measures. Crafting effective policies requires a comprehensive understanding of the economic landscape and collaborative efforts to ensure stability. Governments must strike a balance between supporting economic growth and curbing inflationary pressures.

Shaping the Future: Join the Rising Inflation Concerns Summit

To gain deeper insights into the challenges posed by rising inflation and explore strategies for

:max_bytes(150000):strip_icc()/dotdash-worst-hyperinflations-history-Final-4ba22e3b5a0e41668ecb8e30051f7a49.jpg)