Decoding the Future: Inflation Forecasting Models

In the dynamic realm of economics, the ability to predict inflation is a critical aspect of informed decision-making for governments, businesses, and investors. This article delves into the intricate world of inflation forecasting models, examining their significance, methodologies, and the role they play in shaping economic strategies.

Importance of Inflation Forecasting

Inflation forecasting serves as a compass for navigating economic landscapes. Anticipating future inflation levels allows policymakers to implement proactive measures, businesses to make informed financial decisions, and investors to adjust their portfolios. Accurate forecasting is crucial for maintaining economic stability and making timely adjustments to monetary and fiscal policies.

Econometric Models: Statistical Insights

Econometric models form the backbone of many inflation forecasting methodologies. These models leverage statistical techniques to analyze historical data, identifying patterns and relationships that contribute to inflation. Factors such as consumer spending, producer prices, interest rates, and unemployment rates are among the variables considered, providing a comprehensive view of economic dynamics.

Time Series Analysis: Unraveling Patterns Over Time

Time series analysis is a fundamental tool in inflation forecasting models. It involves studying historical data points collected over time to identify trends, seasonality, and cyclical patterns. By understanding how inflation has behaved in the past, economists and analysts can develop models that project future trends based on the historical behavior of key economic indicators.

Phillips Curve: Exploring the Trade-Off

The Phillips Curve is a classic economic concept that explores the trade-off between inflation and unemployment. Inflation forecasting models often incorporate this relationship, suggesting that there is an inverse correlation between the two variables. Analyzing the Phillips Curve helps forecasters gauge potential inflationary pressures based on prevailing levels of unemployment.

Monetary Aggregates: Money Supply Dynamics

Inflation forecasting models frequently consider monetary aggregates, such as M1 and M2, which represent different measures of the money supply. Changes in the money supply can impact inflation, and economists use these aggregates to assess the potential inflationary impact of monetary policy decisions.

Leading Indicators: Anticipating Economic Shifts

Leading indicators play a crucial role in inflation forecasting by providing early signals of potential economic shifts. These indicators, which may include stock market performance, housing starts, and consumer sentiment, offer insights into the future direction of the economy. Analysts use leading indicators to assess the likelihood of inflationary or deflationary pressures.

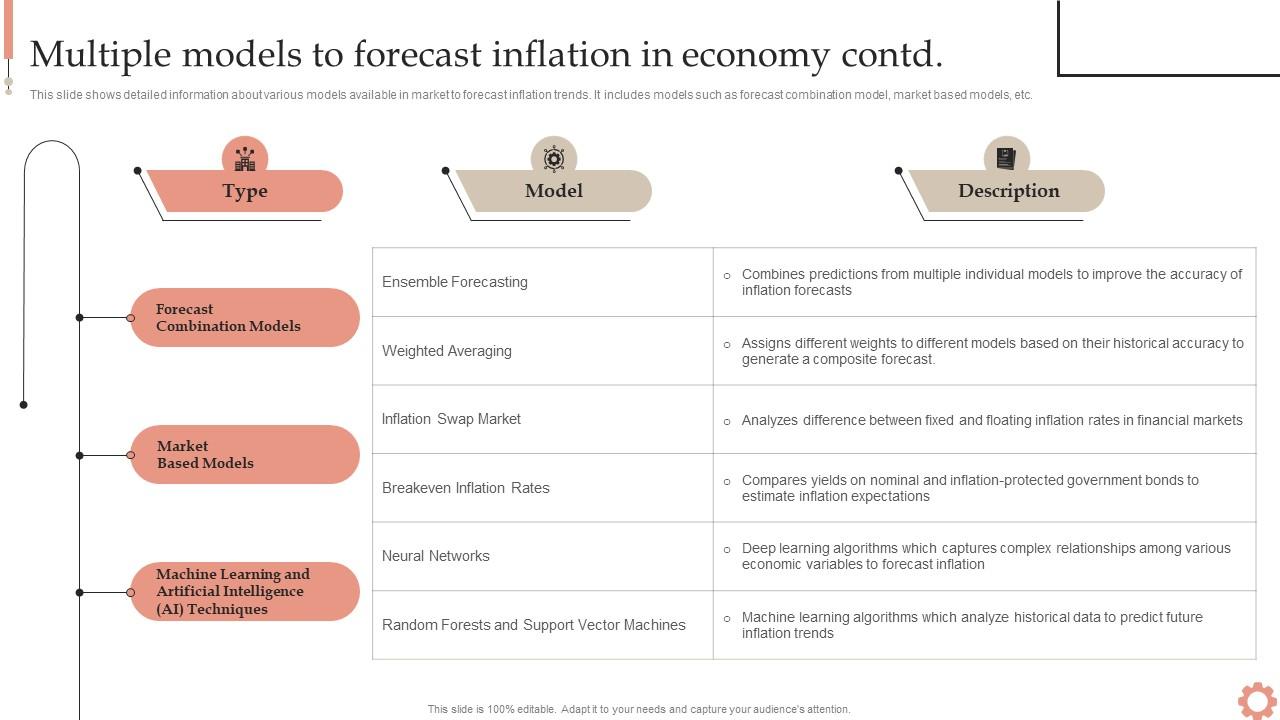

Machine Learning: Harnessing Advanced Techniques

In recent years, machine learning techniques have gained prominence in inflation forecasting. These advanced algorithms analyze vast amounts of data, identify complex patterns, and adapt to changing economic conditions. Machine learning models can incorporate non-linear relationships and provide more accurate forecasts, especially in environments with evolving economic dynamics.

Global Economic Factors: Interconnected World

In an interconnected global economy, inflation forecasting models must consider international factors. Exchange rates, global trade dynamics, and geopolitical events can all influence inflation. Global economic indicators become integral components of models seeking a comprehensive understanding of potential inflationary pressures.

Challenges and Uncertainties: Navigating Complexities

Despite advancements in modeling techniques, forecasting inflation is not without challenges. Economic uncertainties, unexpected events, and external shocks can disrupt even the most sophisticated models. Forecasters must continually refine their models and adapt to evolving economic conditions to enhance the accuracy of their predictions.

Summit Insights: Shaping Economic Strategies

For deeper insights into the world of inflation forecasting models and their impact on economic strategies, consider participating in the Inflation Forecasting Models Summit at rf-summit.com. This summit provides a platform for discussions, shared experiences, and collaborative insights on the evolving landscape of inflation forecasting. Join the conversation and contribute to building more robust and adaptive economic strategies in a rapidly changing world.