Inflationary Pressure Evaluation: Analyzing Economic Trends

In today’s dynamic economic landscape, understanding and assessing inflationary pressures is crucial for policymakers, businesses, and individuals alike. Inflation, the sustained increase in the general price level of goods and services over time, can have far-reaching implications for economies. This article delves into the intricacies of inflationary pressure assessment, exploring key factors and their impact.

Measuring Inflationary Pressures

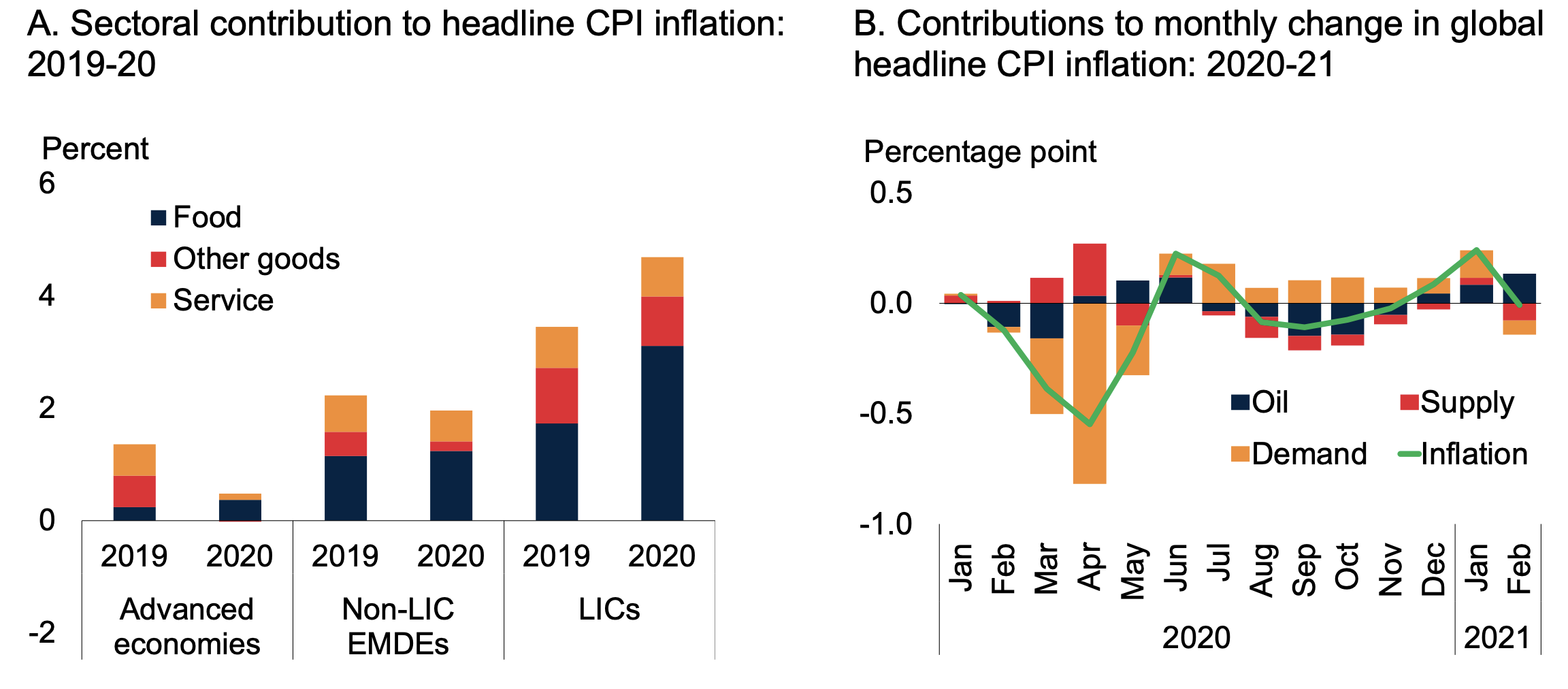

To comprehend inflationary pressures, it’s essential to employ effective measurement tools. Economists often rely on indices such as the Consumer Price Index (CPI) and the Producer Price Index (PPI). These indicators track changes in the prices of goods and services at the consumer and producer levels, offering valuable insights into inflation trends.

Factors Influencing Inflation

Various factors contribute to inflationary pressures, and understanding them is pivotal. Demand-pull inflation occurs when consumer demand outpaces the supply of goods and services, leading to price increases. Cost-push inflation, on the other hand, arises from increased production costs, such as higher wages or raw material prices. Unraveling the interplay of these factors is crucial for a comprehensive assessment.

Global Economic Trends and Inflation

In today’s interconnected world, global economic trends play a significant role in shaping inflationary pressures. Fluctuations in international markets, geopolitical events, and trade dynamics can have a cascading impact on inflation rates. Analyzing these global factors provides a broader perspective on the forces influencing domestic economies.

Central Bank Policies and Inflation Management

Central banks play a pivotal role in managing inflation through monetary policy. By adjusting interest rates and controlling the money supply, central banks aim to stabilize prices and foster economic growth. Examining the effectiveness of these policies is essential for assessing the overall resilience of an economy in the face of inflationary pressures.

Impact on Businesses and Consumers

Inflationary pressures have direct implications for businesses and consumers. Rising prices can erode consumer purchasing power and affect the profitability of businesses. Small and medium-sized enterprises (SMEs) may face particular challenges in navigating these economic conditions. Understanding the nuanced impact on different stakeholders is crucial for informed decision-making.

Navigating Inflationary Challenges

As economies navigate inflationary challenges, businesses and individuals must adopt proactive strategies. This may involve adjusting pricing strategies, exploring cost-cutting measures, or diversifying investment portfolios. Assessing the specific impact of inflation on different sectors allows for targeted responses.

Inflationary Pressure Assessment in Real-Time

Staying informed about inflationary pressures in real-time is paramount for effective decision-making. Online platforms such as rf-summit.com provide up-to-date information, analyses, and insights into inflation trends. Utilizing these resources allows stakeholders to make informed decisions based on the latest economic data.

In conclusion, a nuanced understanding of inflationary pressures is essential for navigating the complexities of today’s economic environment. By delving into measurement tools, influencing factors, and global trends, stakeholders can develop informed strategies to mitigate risks and capitalize on opportunities. Stay connected with reliable sources such as rf-summit.com to stay ahead of the curve in the ever-evolving landscape of inflationary pressures.