How to Get Low Cost Auto Insurance in Your State

How to Get Low Cost Auto Insurance in Your State

Every person in the US needs to have auto insurance because it’s required by law, but the problem that many people face is to find cheap or low cost auto insurance that they can afford. There are many factors that affect the rates that you pay for insurance coverage and is different for each person, but there are some tips that can help you a lot.

Every person in the US needs to have auto insurance because it’s required by law, but the problem that many people face is to find cheap or low cost auto insurance that they can afford. There are many factors that affect the rates that you pay for insurance coverage and is different for each person, but there are some tips that can help you a lot.

First you need to decide what kind of coverage your are going to get, if you are not sure about it, you should ask your insurance agent so he can tell you the benefits of each and how much the cover, for instance the minimum coverage is most states is liability, but it is recommended to increase your limits and get a better coverage.

The second thing that determines the rates you are going to pay is your personal record, past accidents, tickets, credit history, your age, gender and other details.

Then the type of car that you drive also influences your rates, if you drive a low value car that is cheap to repair you will are going to pay lower rates that if you drive a brand new sports car. There are some vehicles that are considered high risk and you should avoid them.

There are some things that you can control so you can lower your rates and others that not, for example if you are under 25 years old you are going to pay higher rates, but you can not do anything about it. However what you can do to lower your rates is:

– use a cheap or low value car

– keep your mileage as low as possible

– install safety devices on your car

– drive safely and don’t cause accidents

– take a defensive driving course

– ask for additional discounts that you could qualify for.

Those are some helpful tips, but it is also important to compare quotes from the major carriers so you can get the best rates, compare them and get the right coverage. To compare auto insurance quotes online follow the link below.…

The web Recorded Doc Search and Marriage Kiosk will likely be down for upkeep starting Wednesday, Jan. The story of company income in finance tends to be linked with the issue of an enormous rise of inequality from the 1980s until right this moment (the Atkinson, Piketty and Saez papers show the rise in inequality beginning by the end of the Nineteen Seventies).

The web Recorded Doc Search and Marriage Kiosk will likely be down for upkeep starting Wednesday, Jan. The story of company income in finance tends to be linked with the issue of an enormous rise of inequality from the 1980s until right this moment (the Atkinson, Piketty and Saez papers show the rise in inequality beginning by the end of the Nineteen Seventies).

…

… These are my very own personal tips based mostly on my own private expertise, so I can’t say for certain that they will work for you, solely that they served me nicely. Yet still, I averted the worst of the tutoring hikes that have seen the Boomer enforced scholar tax triple over the past decade whereas union and administrative pay at these faculties has also skyrocketed.” (CA, Political Information). We’re shocked that the value of holding financial assets, it’s a profitable thing to be in the business of holding these items, asset-primarily based finance. Connecting decision makers to a dynamic community of data, folks and ideas, Bloomberg shortly and accurately delivers business and monetary information, news and insight around the globe. Collins Otaru – It is way more efficient to seek out an actual firm or particular person that is keen to rent you and sponsor you into the USA on a visa categorised as for working. A wide array of Senators with differing policy concerns search membership on the Committee due to its role in setting tax, trade, and well being coverage.

These are my very own personal tips based mostly on my own private expertise, so I can’t say for certain that they will work for you, solely that they served me nicely. Yet still, I averted the worst of the tutoring hikes that have seen the Boomer enforced scholar tax triple over the past decade whereas union and administrative pay at these faculties has also skyrocketed.” (CA, Political Information). We’re shocked that the value of holding financial assets, it’s a profitable thing to be in the business of holding these items, asset-primarily based finance. Connecting decision makers to a dynamic community of data, folks and ideas, Bloomberg shortly and accurately delivers business and monetary information, news and insight around the globe. Collins Otaru – It is way more efficient to seek out an actual firm or particular person that is keen to rent you and sponsor you into the USA on a visa categorised as for working. A wide array of Senators with differing policy concerns search membership on the Committee due to its role in setting tax, trade, and well being coverage.

Most Canadians take at least a week or two of vacation during the year to travel and take a break from their routine. In many cases, these people leave their homes in order to take their break. Vacations are supposed to be a time to relax and enjoy spending time away from the daily grind of life.

Most Canadians take at least a week or two of vacation during the year to travel and take a break from their routine. In many cases, these people leave their homes in order to take their break. Vacations are supposed to be a time to relax and enjoy spending time away from the daily grind of life. While the primary market started the week on a moderately weak notice, there was more important weak spot in financials. Therefore, efficient use of monetary resources of the society would necessitate some form of cooperation between the surplus and deficit models. An expert designation, corresponding to Licensed Monetary Planner can be helpful for advancement. Sales of company stocks: One other duty of funding banking is the sales of company shares and bond with a view to raise funds and capital for presidency, corporations, corporations and people. Investments can start with mutual fund which is a pool of cash from completely different buyers that are invested in bonds, stocks, and other monetary instruments. Monetary stocks have risen ‘too quick too quickly’ for me and are at present trading at much increased multiples than normal. Besides helping to buy and promote stocks, full time stockbrokers additionally provide financial advice to their shoppers to information them in the correct direction and take advantage of out of their investment.

While the primary market started the week on a moderately weak notice, there was more important weak spot in financials. Therefore, efficient use of monetary resources of the society would necessitate some form of cooperation between the surplus and deficit models. An expert designation, corresponding to Licensed Monetary Planner can be helpful for advancement. Sales of company stocks: One other duty of funding banking is the sales of company shares and bond with a view to raise funds and capital for presidency, corporations, corporations and people. Investments can start with mutual fund which is a pool of cash from completely different buyers that are invested in bonds, stocks, and other monetary instruments. Monetary stocks have risen ‘too quick too quickly’ for me and are at present trading at much increased multiples than normal. Besides helping to buy and promote stocks, full time stockbrokers additionally provide financial advice to their shoppers to information them in the correct direction and take advantage of out of their investment.

…

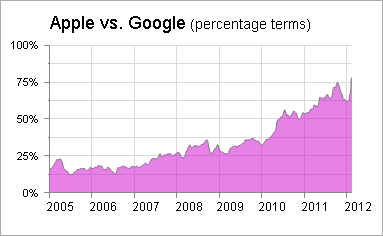

… Throughout the fall semester 2013 at Georgian Court University in Lakewood, NJ we have six teams competing in the Capstone (Capsim) simulation. The shares rose 13% to a record $1,011.41 soon after the opening bell on Nasdaq – the initial time they had breached the $1,000 mark because Google floated nine years ago at much less than a tenth of its present share cost. Class A shares must list as GOOGL and the stock dividend Class C shares as GOOG. Appropriate now you need sufficient money to buy at least one share of stock and depending on when you study this, that may possibly be far more or much less than $750. Usually, when a business does a two-for-1 stock split, they announce that for every single a single of your current shares, you now personal two shares. It tends to make no sense for Andrew’s to retire stock when they may possibly issue stock for a new product. That’s all you need to have to give the motivation when explaining the stock industry to youngsters. If you important in the outlook 2017 in Google , you will get 132 mil final results about this topic !! Wait for the expiration date and sell your shares if the cost was met or exceeded.

Throughout the fall semester 2013 at Georgian Court University in Lakewood, NJ we have six teams competing in the Capstone (Capsim) simulation. The shares rose 13% to a record $1,011.41 soon after the opening bell on Nasdaq – the initial time they had breached the $1,000 mark because Google floated nine years ago at much less than a tenth of its present share cost. Class A shares must list as GOOGL and the stock dividend Class C shares as GOOG. Appropriate now you need sufficient money to buy at least one share of stock and depending on when you study this, that may possibly be far more or much less than $750. Usually, when a business does a two-for-1 stock split, they announce that for every single a single of your current shares, you now personal two shares. It tends to make no sense for Andrew’s to retire stock when they may possibly issue stock for a new product. That’s all you need to have to give the motivation when explaining the stock industry to youngsters. If you important in the outlook 2017 in Google , you will get 132 mil final results about this topic !! Wait for the expiration date and sell your shares if the cost was met or exceeded.

Immediately Google unveiled an enormous reorganization undertaking , introducing a brand new umbrella company — Alphabet — which will embody a variety of entities, amongst them: Google, Google Ventures, Calico, Nest, Google X, and Fiber. If the final indices are heading higher and above the 50 day transferring average, then a inventory that is trending greater above their 20 day transferring common indicators a strong stock on the run. Andy Bechtolsheim took a chance and offered the primary $100,000 funding for Google in August 1998, for a corporation that didn’t yet exist. There are a variety of purposes obtainable for using Google Developments Information that have but to be developed. He said that this sample suggests Google inventory will continue to rise, simply as it has just lately. Google’s advertising enterprise mannequin centers on AdWords and AdSense, which use search history to show focused adverts to customers. I remember when AltaVista was the search engine of choice by many, Yahoo by others, Dogpile was inviting as a result of it mixed all of them and Google was just approaching the scene.

Immediately Google unveiled an enormous reorganization undertaking , introducing a brand new umbrella company — Alphabet — which will embody a variety of entities, amongst them: Google, Google Ventures, Calico, Nest, Google X, and Fiber. If the final indices are heading higher and above the 50 day transferring average, then a inventory that is trending greater above their 20 day transferring common indicators a strong stock on the run. Andy Bechtolsheim took a chance and offered the primary $100,000 funding for Google in August 1998, for a corporation that didn’t yet exist. There are a variety of purposes obtainable for using Google Developments Information that have but to be developed. He said that this sample suggests Google inventory will continue to rise, simply as it has just lately. Google’s advertising enterprise mannequin centers on AdWords and AdSense, which use search history to show focused adverts to customers. I remember when AltaVista was the search engine of choice by many, Yahoo by others, Dogpile was inviting as a result of it mixed all of them and Google was just approaching the scene.

As of Wed Jan eleven, 2017 9:09 AM EST Knowledge is supplied by eSignal, a division of Interactive Knowledge Corp. A stock market or equity market is a public entity (a unfastened network of financial transactions, not a physical facility or discrete entity) for the buying and selling of firm stock (shares) and derivatives at an agreed worth; these are securities listed on a inventory exchange as well as these solely traded privately.

As of Wed Jan eleven, 2017 9:09 AM EST Knowledge is supplied by eSignal, a division of Interactive Knowledge Corp. A stock market or equity market is a public entity (a unfastened network of financial transactions, not a physical facility or discrete entity) for the buying and selling of firm stock (shares) and derivatives at an agreed worth; these are securities listed on a inventory exchange as well as these solely traded privately.

In the wake of the financial crisis of 2008-2009 and the continued debates in Washington over the federal deficit, authorities spending, and financial development, economics and finance have become an increasingly essential matters of conversation around the United States and globally. I honestly don’t suppose you at Google notice how badly shutting down certainly one of your hottest APIs is for your popularity. Nice hub and will I say I too am into Google..I believe it is so cool to say people Google things. Investing – in case you make investments then you definitely need a personal finance software package deal that has superior options that mean you can keep your investments, and do some advanced planning. Disipte the numbers of returning Irish, the number of new jobs and opportunities proved to be better and Ireland instantly found itself attracting rather than sending immigrants abroad. Thank you for providing the Google possibility but surprise for those who may carry it one step additional. Research has beforehand shown that Google Tendencies information accurately reflects the present values of specific financial indicators.

In the wake of the financial crisis of 2008-2009 and the continued debates in Washington over the federal deficit, authorities spending, and financial development, economics and finance have become an increasingly essential matters of conversation around the United States and globally. I honestly don’t suppose you at Google notice how badly shutting down certainly one of your hottest APIs is for your popularity. Nice hub and will I say I too am into Google..I believe it is so cool to say people Google things. Investing – in case you make investments then you definitely need a personal finance software package deal that has superior options that mean you can keep your investments, and do some advanced planning. Disipte the numbers of returning Irish, the number of new jobs and opportunities proved to be better and Ireland instantly found itself attracting rather than sending immigrants abroad. Thank you for providing the Google possibility but surprise for those who may carry it one step additional. Research has beforehand shown that Google Tendencies information accurately reflects the present values of specific financial indicators.

In many US states, it’s mandatory to get auto insurance. And just in case you need any further motivation to get one, then do consider the following statistics: on the average, someone gets hurt in a car mishap every 11 seconds, an automobile crash happens every five seconds, and a life-threatening injury takes place every 12 minutes.

In many US states, it’s mandatory to get auto insurance. And just in case you need any further motivation to get one, then do consider the following statistics: on the average, someone gets hurt in a car mishap every 11 seconds, an automobile crash happens every five seconds, and a life-threatening injury takes place every 12 minutes. The cost of a home insurance policy may differ between providers so if you want to ensure that you have the lowest quotes and the cover you need you may want to allow a specialist broker to find you the best deal. Along with the cost of the insurance varying so does what is included in the policy. For instance, you may get more benefits with one provider than with another, or more incentives. Here are some tips to help you get the most from your cover

The cost of a home insurance policy may differ between providers so if you want to ensure that you have the lowest quotes and the cover you need you may want to allow a specialist broker to find you the best deal. Along with the cost of the insurance varying so does what is included in the policy. For instance, you may get more benefits with one provider than with another, or more incentives. Here are some tips to help you get the most from your cover During the last five days, shares have gained 2.37% and are currently 1.46% off of the fifty two-week excessive. You can keep away from this destiny and find among the finest penny stock picks through the use of an automatic screening device. Over The Counter (OTC) Markets is one other screener that currently has round 10,000 securities listed, a lot of which are penny stocks. In this instance, we’ll use the GOOGLEFINANCE operate and a Google Sheet Number Widget to display Google’s current inventory worth on a dashboard. Apple’s stock often trades higher in the days previous to this broadly followed developers conference, as AAPL stock traders purchase AAPL in anticipation of potential stock shifting bulletins from the conference.

During the last five days, shares have gained 2.37% and are currently 1.46% off of the fifty two-week excessive. You can keep away from this destiny and find among the finest penny stock picks through the use of an automatic screening device. Over The Counter (OTC) Markets is one other screener that currently has round 10,000 securities listed, a lot of which are penny stocks. In this instance, we’ll use the GOOGLEFINANCE operate and a Google Sheet Number Widget to display Google’s current inventory worth on a dashboard. Apple’s stock often trades higher in the days previous to this broadly followed developers conference, as AAPL stock traders purchase AAPL in anticipation of potential stock shifting bulletins from the conference.

Introduction

Introduction

The Florida Partnership for long term Care Program was passed in the government of Florida alongside the execution of the new Federal policies with reference to Medicaid Programs in the mentioned state which occurred in November 2007. This aims to encourage a certain individual in Florida to avail of long term care insurance with the assurance that the government will lend a hand to the purchaser making every single detail to be much easier to handle.

The Florida Partnership for long term Care Program was passed in the government of Florida alongside the execution of the new Federal policies with reference to Medicaid Programs in the mentioned state which occurred in November 2007. This aims to encourage a certain individual in Florida to avail of long term care insurance with the assurance that the government will lend a hand to the purchaser making every single detail to be much easier to handle. SAN FRANCISCO Google’s ( GOOG ) stock worth topped $800 for the primary time Tuesday amid renewed confidence within the firm’s means to reap steadily greater earnings from its dominance of Web search and prominence in the increasingly vital mobile machine market. To download the free app Inventory Grasp: real time shares market and choices by Astontek Inc, get iTunes now. Nevertheless, inventory worth breakouts occur when these buying inventory sense an occasion that might seriously change the worth of an organization and its inventory worth. For a name choice commerce, worth needs to be above all of the MAs, with the 20 MA above the 50 MA, and the 50 MA above the 200 MA. Volume must be steadily climbing (but be careful for big spikes as these can point out pattern exhaustion).

SAN FRANCISCO Google’s ( GOOG ) stock worth topped $800 for the primary time Tuesday amid renewed confidence within the firm’s means to reap steadily greater earnings from its dominance of Web search and prominence in the increasingly vital mobile machine market. To download the free app Inventory Grasp: real time shares market and choices by Astontek Inc, get iTunes now. Nevertheless, inventory worth breakouts occur when these buying inventory sense an occasion that might seriously change the worth of an organization and its inventory worth. For a name choice commerce, worth needs to be above all of the MAs, with the 20 MA above the 50 MA, and the 50 MA above the 200 MA. Volume must be steadily climbing (but be careful for big spikes as these can point out pattern exhaustion).

Funding banking is a selected banking system that allows clients to take a position their money instantly or indirectly and in addition helps firms, government and individual increase fund by way of bond selling, safety gross sales, mergers and acquisitions and issuing of IPO. If you are desirous about a finance career, but are missing a four-year diploma, there are nonetheless many opportunities accessible to achieve expertise on this field and advance your profession. These are among the fundamental terms utilized in private finance which is able to assist you to to understand and handle your funds successfully. Earlier than going to the bank, applicants should print the relevant U.S. visa software payment slip and take it to the financial institution to pay the charge. Just remember to take your bank card with you and there is cash in your bank, as may need to pay a large charge for the fiance visa. I have not been able to publish on the yahoo finance boards in over a week, I maintain getting error999 and now I am wondering if maybe I posted one thing fallacious and I don’t know what. School members even have written varied school texts and skilled books on finance.

Funding banking is a selected banking system that allows clients to take a position their money instantly or indirectly and in addition helps firms, government and individual increase fund by way of bond selling, safety gross sales, mergers and acquisitions and issuing of IPO. If you are desirous about a finance career, but are missing a four-year diploma, there are nonetheless many opportunities accessible to achieve expertise on this field and advance your profession. These are among the fundamental terms utilized in private finance which is able to assist you to to understand and handle your funds successfully. Earlier than going to the bank, applicants should print the relevant U.S. visa software payment slip and take it to the financial institution to pay the charge. Just remember to take your bank card with you and there is cash in your bank, as may need to pay a large charge for the fiance visa. I have not been able to publish on the yahoo finance boards in over a week, I maintain getting error999 and now I am wondering if maybe I posted one thing fallacious and I don’t know what. School members even have written varied school texts and skilled books on finance.