Navigating the Global Inflation Landscape: Strategic Insights

Deciphering the Global Inflationary Landscape: Strategic Insights

In the intricate tapestry of global economics, understanding and navigating the nuances of the inflationary environment is essential. This article explores the complexities of the global inflationary environment, providing strategic insights for businesses, investors, and policymakers striving to make informed decisions in this dynamic economic landscape.

Global Economic Interconnectedness: Impact on Inflation

The global inflationary environment is inherently interconnected, with economic events in one region reverberating across the globe. Factors such as international trade dynamics, exchange rates, and geopolitical events contribute to the complex web of the global inflation landscape. Understanding this interconnectedness is crucial for anticipating and navigating inflationary trends.

Global Inflationary Environment – A Link to Strategic Decision-Making

For a deeper exploration of the global inflationary environment, visit Global Inflationary Environment. This resource offers expert analyses, discussions, and insights into the nuances of the global inflation landscape. Accessing such information is paramount for businesses, investors, and policymakers striving for a proactive and informed approach.

Impact of Currency Fluctuations: Navigating Exchange Rate Dynamics

Currency fluctuations play a significant role in shaping the global inflationary environment. Exchange rate dynamics impact international trade, inflation rates, and the overall economic stability of nations. Businesses involved in global trade must closely monitor currency fluctuations to make informed decisions and navigate potential challenges in the global inflationary landscape.

Trade Dynamics and Supply Chains: Inflationary Implications

Global trade dynamics and supply chain intricacies contribute to the inflationary environment. Disruptions in the supply chain, whether due to geopolitical tensions or unforeseen events, can create inflationary pressures. Analyzing these dynamics is essential for businesses to identify potential risks and implement strategies to mitigate the impact on prices and production costs.

Central Banks and Monetary Policies: Global Influencers of Inflation

Central banks and their monetary policies have a profound impact on the global inflationary environment. Interest rate decisions, quantitative easing measures, and currency interventions all play a role in shaping inflation trends. Businesses and investors need to monitor central bank actions globally to anticipate and adapt to the evolving inflation landscape.

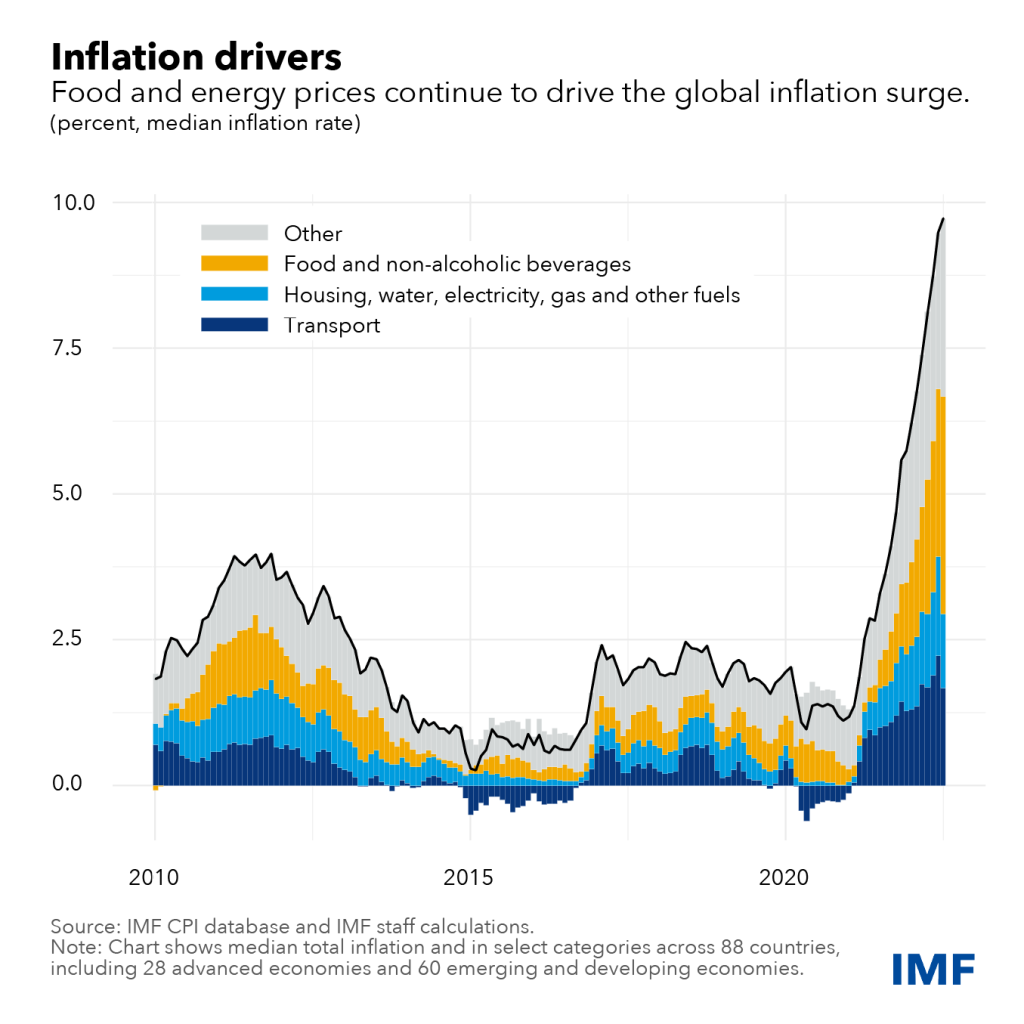

Commodity Prices and Inflation: Unraveling the Connection

Commodity prices are fundamental drivers of inflation globally. Fluctuations in the prices of essential commodities, such as oil and metals, have a cascading effect on production costs and consumer prices. Businesses and investors need to stay attuned to commodity market trends to anticipate potential shifts in the global inflationary environment.

Global Consumer Behavior: Shifting Patterns and Inflation

Understanding global consumer behavior is critical in assessing the inflationary environment. Shifts in consumer spending patterns, preferences, and confidence levels have implications for demand, production, and prices. Businesses and investors with a global footprint must analyze and adapt to these evolving consumer dynamics to navigate the complex global inflation landscape.

Policy Coordination and International Cooperation: Keys to Stability

In addressing the challenges posed by the global inflationary environment, policy coordination and international cooperation play pivotal roles. Nations and central banks need to collaborate to implement effective policies that promote stability, address inflationary pressures, and foster