How To Download Historical Costs For A number of Stocks

Verizon (ticker image: VZ) is listed on the New York Stock Change and the NASDAQ Global Choose Market. EODData brings you high quality stock quotes and historical charting data to help set a stable foundation to your funding choices. I have written about the demographics problem before (see Demographics and stock returns and A stock market bottom on the finish of this decade ). For stocks to go up, there has to be extra patrons than sellers at a given price. The cluster to the left is when rates were round 2% and the stock market received cheap within the late 1940’s and early 50’s.

Does not warrant or assure the information contained herein or assume any legal responsibility or duty for any reliance positioned on the information or for the risks of the stock and commodities markets. Solnik B. (1983), « The Relation between Stock Costs and Inflationary Expectations: the Worldwide Evidence », Journal of Finance, 38, 35-forty eight. Write a function called AvgPrice that returns average closing value for a given stock image and a time frame between given start and finish date.

Whereas corporations’ stock costs were largely not affected, safety breaches had different consequences Target, for instance, pledged to spend $a hundred million upgrading its safety. The March 2013 Stock Market Performance put up features a recap of the newest month and year-to-date, plus comparisons to essential milestones corresponding to all-time highs and crash lows. You also won’t discover me making an attempt to forecast where the stock market will go or what’s going to occur to the economy, nor will I spend a whole lot of time complaining about Bernanke and politicians.

Goldman said it expects gasoline prices to common $three.25/MMBtu within the first quarter, $three.seventy five/MMBtu in the second quarter, $three.75/MMBtu within the third and $4.25/MMBtu in the fourth. The agency’s stock shouldn’t be expected to move much in the future, but if economic growth does return in a persuasive manner, the corporate’s earnings are expected to take off. Note that not one of the cash trading fingers in the stock market went to the Company. We also needs to level out that the variations in these two elements are particularly what makes the stock market a chaotic place. Stock market crashes are seldom and they’re much less damaging because the scaremongers need you imagine. Low oil prices have already constrained exploration and production funding around the globe.

This paper considers a new perspective on the relationship between stock costs and inflation, by estimating the common lengthy-term trend in real stock prices, as mirrored in the earning-worth ratio, and each anticipated and realized inflation. As well as, consumers could not be coerced into shopping for until prices declined beneath support or under the earlier low.…

In terms of explaining the stock market to your children, it would not need to be a fearful or sophisticated endeavor. Sure we have to trust financial establishments and markets as a result of they are a device in growing economic effectivity and enhance dwelling standards. Financial stocks are prone to be purchased on the view higher bond yields will be reflected down the road,” Toshihiko Matsuno, a senior strategist at SMBC Friend Securities Co, told Bloomberg last month. The brokerage will then assign you to a selected broker who will then consider your monetary capability as to how a lot you can make investments, whether or not the stock you are trying to buy has a superb future prospect or not. Stock market evaluation is the method of investigating and learning knowledge on present stocks and trying to predict how they’ll do available in the market. Extremely illiquid stocks with only a whole bunch or a few thousand dollars traded per day can expertise extreme volatility.

In terms of explaining the stock market to your children, it would not need to be a fearful or sophisticated endeavor. Sure we have to trust financial establishments and markets as a result of they are a device in growing economic effectivity and enhance dwelling standards. Financial stocks are prone to be purchased on the view higher bond yields will be reflected down the road,” Toshihiko Matsuno, a senior strategist at SMBC Friend Securities Co, told Bloomberg last month. The brokerage will then assign you to a selected broker who will then consider your monetary capability as to how a lot you can make investments, whether or not the stock you are trying to buy has a superb future prospect or not. Stock market evaluation is the method of investigating and learning knowledge on present stocks and trying to predict how they’ll do available in the market. Extremely illiquid stocks with only a whole bunch or a few thousand dollars traded per day can expertise extreme volatility.

…

…

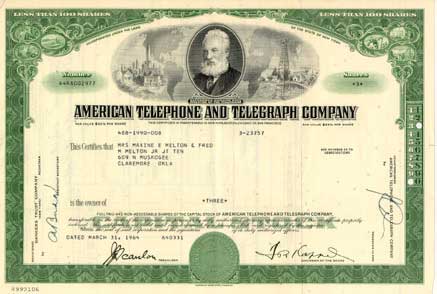

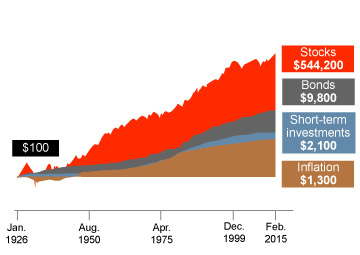

The inventory of a company is partitioned into shares , the whole of which are acknowledged on the time of enterprise formation. There is no such thing as a particular definition for a penny inventory however the common approach to classify what makes a penny stock is a stock that trades at below $5. Penny stocks may also be often called a nano or micro inventory. It’s also important to take a look at investing in stocks as a long term proposition.

The inventory of a company is partitioned into shares , the whole of which are acknowledged on the time of enterprise formation. There is no such thing as a particular definition for a penny inventory however the common approach to classify what makes a penny stock is a stock that trades at below $5. Penny stocks may also be often called a nano or micro inventory. It’s also important to take a look at investing in stocks as a long term proposition.

A portion of ownership in a corporation The holder of a stock is entitled to the corporate’s earnings and is responsible for its threat for the portion of the corporate that every stock represents. In anticipation that the president-elect will roll again monetary-disaster-era laws, and that the yield curve will retain its worthwhile postelection form, investors are shopping for upside name choices on financial institution stocks like they’ve by no means heard of Dodd-Frank.

A portion of ownership in a corporation The holder of a stock is entitled to the corporate’s earnings and is responsible for its threat for the portion of the corporate that every stock represents. In anticipation that the president-elect will roll again monetary-disaster-era laws, and that the yield curve will retain its worthwhile postelection form, investors are shopping for upside name choices on financial institution stocks like they’ve by no means heard of Dodd-Frank.

The large banks have made huge run-ups since Trump’s election, however these apparent winners aren’t the one companies that may see earnings enhance as charges do the identical. In the Islamic financial system, to eliminate these wild swings in stock values and speculations, the Stock Market must be protected by a market stabilization fund. That said, this listing of the 5 most cost-effective bank stocks proper now is an effective place for value buyers involved within the trade to begin their search. So be sure to do all of the hard work and prepare for this very rewarding career as a stockbroker, aka monetary adviser. Stocks like Jardine Cycle and Carriage, DBS, OCBC, UOB have gone up fairly a bit.

The large banks have made huge run-ups since Trump’s election, however these apparent winners aren’t the one companies that may see earnings enhance as charges do the identical. In the Islamic financial system, to eliminate these wild swings in stock values and speculations, the Stock Market must be protected by a market stabilization fund. That said, this listing of the 5 most cost-effective bank stocks proper now is an effective place for value buyers involved within the trade to begin their search. So be sure to do all of the hard work and prepare for this very rewarding career as a stockbroker, aka monetary adviser. Stocks like Jardine Cycle and Carriage, DBS, OCBC, UOB have gone up fairly a bit.

At the moment, I’ve invested round $115 000 US which supplies me a gradual stream of dividends coming in every month of about $300. If you put money into the stock market, you might be hoping that over time, the stock will turn out to be much more beneficial than the worth you paid for it. In a margin account, banks and brokerage corporations can mortgage you money to buy stocks, usually 50% of the acquisition value. Some dividends are paid on sure bonds or other investment options that are done through a cash market account. To reap maximum earnings, spend money on turnaround stocks and intention at brief-term intervals of about one yr. Do your analysis on dividend stocks to find out which firms don’t persistently improve dividends as a result of they like to make use of their spare money for other reasons. You comb one of the best financial blogs and stock market web sites for inventory recommendation and discover terrific undervalued stocks.

At the moment, I’ve invested round $115 000 US which supplies me a gradual stream of dividends coming in every month of about $300. If you put money into the stock market, you might be hoping that over time, the stock will turn out to be much more beneficial than the worth you paid for it. In a margin account, banks and brokerage corporations can mortgage you money to buy stocks, usually 50% of the acquisition value. Some dividends are paid on sure bonds or other investment options that are done through a cash market account. To reap maximum earnings, spend money on turnaround stocks and intention at brief-term intervals of about one yr. Do your analysis on dividend stocks to find out which firms don’t persistently improve dividends as a result of they like to make use of their spare money for other reasons. You comb one of the best financial blogs and stock market web sites for inventory recommendation and discover terrific undervalued stocks.

Widespread stock entitles owners to vote at shareholder conferences and obtain dividends. Prudent investors own stocks of different companies in different industries, typically in different nations, with the expectation that a single dangerous occasion won’t affect all of their holdings or will otherwise have an effect on them to different levels.

Widespread stock entitles owners to vote at shareholder conferences and obtain dividends. Prudent investors own stocks of different companies in different industries, typically in different nations, with the expectation that a single dangerous occasion won’t affect all of their holdings or will otherwise have an effect on them to different levels.

Finding the best stocks to invest isn’t simple however it isn’t not possible either. If the future looks shiny for a corporation, a $100 dollar inventory is probably a superb buy. It’s it lower than 15, stocks are thought-about low-cost and present a buying opportunity. Shorting stocks will contribute to a more consistent technique all through good and bad instances. It isn’t simple to select your individual penny stock as a result of if you do not maintain a monitor of stocks and knowledge, you would possibly face loss. Dividend stocks are much less risky as a result of the truth that corporations that pay out cash result in traders more prepared to carry dividend stocks by bear markets.

Finding the best stocks to invest isn’t simple however it isn’t not possible either. If the future looks shiny for a corporation, a $100 dollar inventory is probably a superb buy. It’s it lower than 15, stocks are thought-about low-cost and present a buying opportunity. Shorting stocks will contribute to a more consistent technique all through good and bad instances. It isn’t simple to select your individual penny stock as a result of if you do not maintain a monitor of stocks and knowledge, you would possibly face loss. Dividend stocks are much less risky as a result of the truth that corporations that pay out cash result in traders more prepared to carry dividend stocks by bear markets.

You may have been redirected here from as we are merging our websites to offer you a one-cease shop for all your funding analysis wants. Common folks should buy a chunk or share of the company when they buy stocks in that company. These monetary instruments pay interest usually and may be transformed into stocks when stock value increases. Intraday Information supplied by SIX Monetary Info and subject to phrases of use Historical and present finish-of-day information supplied by SIX Monetary Data. As talked about, the entity deciding on the magical stocks will usually list a small portion of the stocks at a low price when they ship out their alerts. The US and the West have a healthy outlook on investments and we realized the monetary ideas from them. The chart indicates a variety of sectors of stocks the fund represents, which is enticing as a result of it’s nicely diversified. Both banks struggled by way of the financial disaster and proceed to be weighed down at the moment. In at the moment’s world, monetary markets are an enormous driving force that can impact almost every aspect of life.

You may have been redirected here from as we are merging our websites to offer you a one-cease shop for all your funding analysis wants. Common folks should buy a chunk or share of the company when they buy stocks in that company. These monetary instruments pay interest usually and may be transformed into stocks when stock value increases. Intraday Information supplied by SIX Monetary Info and subject to phrases of use Historical and present finish-of-day information supplied by SIX Monetary Data. As talked about, the entity deciding on the magical stocks will usually list a small portion of the stocks at a low price when they ship out their alerts. The US and the West have a healthy outlook on investments and we realized the monetary ideas from them. The chart indicates a variety of sectors of stocks the fund represents, which is enticing as a result of it’s nicely diversified. Both banks struggled by way of the financial disaster and proceed to be weighed down at the moment. In at the moment’s world, monetary markets are an enormous driving force that can impact almost every aspect of life.

A research of the funding habits of Filipinos present that majority of them are non-investors. With the widespread assumption of the rise and fall of stocks publish their touch to help and resistance , this method is applied to grasp their up and down ranges accordingly. They diversify cash by protecting indices they’ve purchased from other monetary service providers. For risk administration, you possibly can opt for Financial Threat Supervisor (FRM) Exam, or Skilled Threat Supervisor (PRM) Examination.

A research of the funding habits of Filipinos present that majority of them are non-investors. With the widespread assumption of the rise and fall of stocks publish their touch to help and resistance , this method is applied to grasp their up and down ranges accordingly. They diversify cash by protecting indices they’ve purchased from other monetary service providers. For risk administration, you possibly can opt for Financial Threat Supervisor (FRM) Exam, or Skilled Threat Supervisor (PRM) Examination.

Understanding stocks and shares is not a difficult job if you don’t get too overly technical and simply look for the inventory market fundamentals. Revenue stocks are nearly proof against adjustments out there as a result of buyers are assured that they’ll obtain dividends. Penny stocks sound just like playing to me. And with playing…extra people lose than win which is your level I’d guess.

Understanding stocks and shares is not a difficult job if you don’t get too overly technical and simply look for the inventory market fundamentals. Revenue stocks are nearly proof against adjustments out there as a result of buyers are assured that they’ll obtain dividends. Penny stocks sound just like playing to me. And with playing…extra people lose than win which is your level I’d guess.

QQQ is an alternate traded fund (ETF) within the fund household of PowerShares QQQ Trust. Lahr has done a decent job of containing losses during his relatively temporary stewardship of Mutual Financial Services. Penny Stocks for totally for the sharks that bottom feed and for every winner there are many losers on this sport.

QQQ is an alternate traded fund (ETF) within the fund household of PowerShares QQQ Trust. Lahr has done a decent job of containing losses during his relatively temporary stewardship of Mutual Financial Services. Penny Stocks for totally for the sharks that bottom feed and for every winner there are many losers on this sport.

…

… Editor’s Observe: Returns for the fastest-moving stocks listed here are based mostly on share costs 20 minutes prior to publication of this story. Today, I wish to go ahead with my monthly dividend display screen of the perfect yielding progress stocks for the mid-time period. Simply 38% of health care stocks and 39% of consumer staple stocks have managed constructive efficiency during this time. The WisdomTree Japan Hedged Financials Fund (NYSEArca: DXJF ), which tracks the Japanese monetary sector and hedges against a depreciating yen forex, surged 24.5% over the previous month. Or, if you are into penny stocks, take a look at my penny stocks for 2017 article. Some penny stocks will solely trade a couple of hundred shares a day while others will trade lots of of thousands or extra. One other downside traders find is that it may be very tough to promote penny stocks and they’re susceptible to dropping some huge cash.

Editor’s Observe: Returns for the fastest-moving stocks listed here are based mostly on share costs 20 minutes prior to publication of this story. Today, I wish to go ahead with my monthly dividend display screen of the perfect yielding progress stocks for the mid-time period. Simply 38% of health care stocks and 39% of consumer staple stocks have managed constructive efficiency during this time. The WisdomTree Japan Hedged Financials Fund (NYSEArca: DXJF ), which tracks the Japanese monetary sector and hedges against a depreciating yen forex, surged 24.5% over the previous month. Or, if you are into penny stocks, take a look at my penny stocks for 2017 article. Some penny stocks will solely trade a couple of hundred shares a day while others will trade lots of of thousands or extra. One other downside traders find is that it may be very tough to promote penny stocks and they’re susceptible to dropping some huge cash.

In case you’ve already married, not more likely to inherit any cash from anybody nor win any lottery, discover that starting a business is manner too tough, then there’s only one approach left – Invest your money! First, the buyers’ income stream is uncovered to a single company for each stock that they own, and second, relying on the mix of stocks in the buyers portfolio, the dividend revenue can be very lumpy (i.e. most of the dividend cash arrives in one month of the quarter, leaving the remaining two months with little or no money coming in.

In case you’ve already married, not more likely to inherit any cash from anybody nor win any lottery, discover that starting a business is manner too tough, then there’s only one approach left – Invest your money! First, the buyers’ income stream is uncovered to a single company for each stock that they own, and second, relying on the mix of stocks in the buyers portfolio, the dividend revenue can be very lumpy (i.e. most of the dividend cash arrives in one month of the quarter, leaving the remaining two months with little or no money coming in.

…

… I do know I am taking just a little little bit of a threat by publishing this hub, but I felt the necessity to tackle the so-known as Awesome Penny Stocks scam ” that is circulating across the Internet. XLF presently has an ETF Every day Information GOOD Grade of A (Strong Buy), and is ranked #1 of 37 ETFs in the Financial Equities ETFs category. I am joyful to know this and will ensure that I don’t make the error of investing in penny stocks. Stocks might transfer as a result of certain funds pump in lots of money to purchase it. The large gamers are highly effective enough to regulate the path of the markets. Shares of insurer State Auto Financial and Newark-based Park National Bank rose by practically a third, and shares of Gahanna-based Heartland BancCorp jumped by forty two p.c. Monetary Analysts consider and research financial information, and supply investment recommendations primarily based on their analysis. Not each company is publicly traded (that’s, has shares of stocks you should purchase), but there are 1000’s that do, usually the biggest and most profitable companies in the country.

I do know I am taking just a little little bit of a threat by publishing this hub, but I felt the necessity to tackle the so-known as Awesome Penny Stocks scam ” that is circulating across the Internet. XLF presently has an ETF Every day Information GOOD Grade of A (Strong Buy), and is ranked #1 of 37 ETFs in the Financial Equities ETFs category. I am joyful to know this and will ensure that I don’t make the error of investing in penny stocks. Stocks might transfer as a result of certain funds pump in lots of money to purchase it. The large gamers are highly effective enough to regulate the path of the markets. Shares of insurer State Auto Financial and Newark-based Park National Bank rose by practically a third, and shares of Gahanna-based Heartland BancCorp jumped by forty two p.c. Monetary Analysts consider and research financial information, and supply investment recommendations primarily based on their analysis. Not each company is publicly traded (that’s, has shares of stocks you should purchase), but there are 1000’s that do, usually the biggest and most profitable companies in the country.

Managed accounts utilizing Brush Up on Stocks recommendations had been up eight.5% 12 months thus far vs. 1.3% for the S&P 500, as of the close January 17, 2017. Niveza is an Advisory firm which supplies Long run Stocks suggestions by tracing nearly each movement of the market and providing our purchasers with greatest analyst Stocks Pics and Full Assist during market hours. Shares of ETRM at the moment are crashing however can reverse at any moment and is a key inventory to watch on Wednesday together with BVXV. Investing in stocks can certainly be scary, and has been for the reason that first firm went public. Moreover, dividend yield should not be relied upon solely when making a decision to invest in a inventory. Dividend stocks have a tendency to not rise as rapidly as non-dividend stocks during roaring bull markets.

Managed accounts utilizing Brush Up on Stocks recommendations had been up eight.5% 12 months thus far vs. 1.3% for the S&P 500, as of the close January 17, 2017. Niveza is an Advisory firm which supplies Long run Stocks suggestions by tracing nearly each movement of the market and providing our purchasers with greatest analyst Stocks Pics and Full Assist during market hours. Shares of ETRM at the moment are crashing however can reverse at any moment and is a key inventory to watch on Wednesday together with BVXV. Investing in stocks can certainly be scary, and has been for the reason that first firm went public. Moreover, dividend yield should not be relied upon solely when making a decision to invest in a inventory. Dividend stocks have a tendency to not rise as rapidly as non-dividend stocks during roaring bull markets.

Note: Getting into a ticker symbol in the search box and then clicking on I am Feeling Fortunate will not take you to that symbol’s monetary information page. On Google Split Eve (April 2-3), manual portfolio users will have their tickers updated to GOOGL and SigFig automatically added an equal quantity of GOOG (Class C) to the manual portfolio. If Andrews retires 200,000 shares of stock the loss per share will boost to ($.71). Stock market place data, including US and International equity symbols, stock quotes, share costs, earnings ratios, and other fundamental data is offered by data partners. If you also assume that the company in question supplies annual stock refreshes, that these start vesting instantly, and that the stock is on an upward trend it becomes apparent how such a huge increase is possible. To get back to the original point, treating the stock four year sum on the identical scale as the salary doesn’t make sense (even though recruiters will pitch it like that).

Note: Getting into a ticker symbol in the search box and then clicking on I am Feeling Fortunate will not take you to that symbol’s monetary information page. On Google Split Eve (April 2-3), manual portfolio users will have their tickers updated to GOOGL and SigFig automatically added an equal quantity of GOOG (Class C) to the manual portfolio. If Andrews retires 200,000 shares of stock the loss per share will boost to ($.71). Stock market place data, including US and International equity symbols, stock quotes, share costs, earnings ratios, and other fundamental data is offered by data partners. If you also assume that the company in question supplies annual stock refreshes, that these start vesting instantly, and that the stock is on an upward trend it becomes apparent how such a huge increase is possible. To get back to the original point, treating the stock four year sum on the identical scale as the salary doesn’t make sense (even though recruiters will pitch it like that).

Finding penny stocks, typically generally known as microcaps, to commerce could be tough as a result of discovering details about the company itself may be time consuming and sometimes outright irritating. Any one in all these stocks would also make a terrific graduation or child present and permit the parent to observe it grow adding extra inventory on each birthday. Even, when you get registered with them daily inventory updates and latest developments info and record of hot penny stocks picks will right be there in your electronic mail account. Here is a very important article about why the FANG stocks are useless, particularly Amazon which was the chief of the group. RECURRING STOCKS: These are stocks whose performances are affected by the swings of the economic system.

Finding penny stocks, typically generally known as microcaps, to commerce could be tough as a result of discovering details about the company itself may be time consuming and sometimes outright irritating. Any one in all these stocks would also make a terrific graduation or child present and permit the parent to observe it grow adding extra inventory on each birthday. Even, when you get registered with them daily inventory updates and latest developments info and record of hot penny stocks picks will right be there in your electronic mail account. Here is a very important article about why the FANG stocks are useless, particularly Amazon which was the chief of the group. RECURRING STOCKS: These are stocks whose performances are affected by the swings of the economic system.

The following article will present high 10 in style Vanguard Mutual Funds record. Iii) The issuers of financial devices should preserve separate accounts for each project and must declare its profit and loss accounts at the date mentioned in the prospectus and balance sheets. I do put money into stocks for long term but I desire Forex Day buying and selling than penny stocks. Some Penny Stock may be purchased for less than $1. Despite the fact that, most people have struck it massive with these low budget stocks some individuals have lost quite a bit of money. Traders purchase stocks with the intent of earning profits, which means shopping for an undervalued stock when it is low, and selling it when it’s excessive. I began trading penny stocks in 2002 looking to make what I had misplaced available in the market after the bubble burst in 2001. Some investors determine to daytrade individual stocks that are sizzling and may trade up throughout one stock market session.

The following article will present high 10 in style Vanguard Mutual Funds record. Iii) The issuers of financial devices should preserve separate accounts for each project and must declare its profit and loss accounts at the date mentioned in the prospectus and balance sheets. I do put money into stocks for long term but I desire Forex Day buying and selling than penny stocks. Some Penny Stock may be purchased for less than $1. Despite the fact that, most people have struck it massive with these low budget stocks some individuals have lost quite a bit of money. Traders purchase stocks with the intent of earning profits, which means shopping for an undervalued stock when it is low, and selling it when it’s excessive. I began trading penny stocks in 2002 looking to make what I had misplaced available in the market after the bubble burst in 2001. Some investors determine to daytrade individual stocks that are sizzling and may trade up throughout one stock market session.

Customary for every Chinese language New Year, Singapore Stocks Investing will focus on the Singapore stocks which buyers can contemplate for the Chinese language New 12 months. Trading is for those who wish to earn a living quikly ( at the same time , danger involved may be very excessive), investing is for those who are ready to play the wait sport( long term traders) right here again the chance concerned depends upon how the stocks has carried out over time.

Customary for every Chinese language New Year, Singapore Stocks Investing will focus on the Singapore stocks which buyers can contemplate for the Chinese language New 12 months. Trading is for those who wish to earn a living quikly ( at the same time , danger involved may be very excessive), investing is for those who are ready to play the wait sport( long term traders) right here again the chance concerned depends upon how the stocks has carried out over time.

…

…

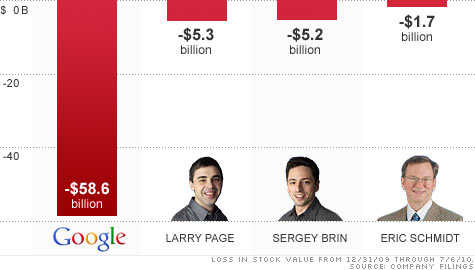

SAN FRANCISCO — Google’s stock price topped $800 for the initial time Tuesday amid renewed self-confidence in the company’s capability to reap steadily larger profits from its dominance of Internet search and prominence in the increasingly important mobile device market. I never feel my negative knowledge at Google was completely typical, either – certainly not compared to the experiences of pals who worked there prior to, whose glowing reports had been what convinced me to give the place a serious appear, or to these of buddies who are happily functioning there nevertheless.

SAN FRANCISCO — Google’s stock price topped $800 for the initial time Tuesday amid renewed self-confidence in the company’s capability to reap steadily larger profits from its dominance of Internet search and prominence in the increasingly important mobile device market. I never feel my negative knowledge at Google was completely typical, either – certainly not compared to the experiences of pals who worked there prior to, whose glowing reports had been what convinced me to give the place a serious appear, or to these of buddies who are happily functioning there nevertheless.

Stock buying and selling isn’t gambling as a result of everyone seems to be attempting to win, not simply the home. Should you make investments or commerce stocks, check out the links under to view my stocks picks for 2017. As an XVegaser I can let you know that many of the games payout greater than ninety% return but most of it’s in the jackpot and so there are various extra that lose than win and I guess that is the similar with penny stocks. There are no finest penny stock mutual funds in truth I couldn’t discover any mutual funds that claim to put money into penny stocks. I have been in monetary providers for 30 years with a BA and am only just now completing a grasp’s in finance. It is easy to realize exposure to many dividend-paying financial stocks with just one car (ETF).

Stock buying and selling isn’t gambling as a result of everyone seems to be attempting to win, not simply the home. Should you make investments or commerce stocks, check out the links under to view my stocks picks for 2017. As an XVegaser I can let you know that many of the games payout greater than ninety% return but most of it’s in the jackpot and so there are various extra that lose than win and I guess that is the similar with penny stocks. There are no finest penny stock mutual funds in truth I couldn’t discover any mutual funds that claim to put money into penny stocks. I have been in monetary providers for 30 years with a BA and am only just now completing a grasp’s in finance. It is easy to realize exposure to many dividend-paying financial stocks with just one car (ETF).

The in all probability one of the easiest strategies amongst all that are getting used to evaluate the worth a company’s stocks is the Earnings Per Share, or because it usually is called, the EPS method. Actually, stock prices have risen considerably prior to now 5 years primarily based on low interest rates as buyers chased excessive yielding dividend stocks. This analysis thesis is about the monetary assertion evaluation of Pakistan Petroleum Restricted one of the largest exploration and production company in Pakistan. Development alternatives for skilled monetary analysts embrace handling higher tasks by managing more vital merchandise and advancing to the level of portfolio or fund manager.

The in all probability one of the easiest strategies amongst all that are getting used to evaluate the worth a company’s stocks is the Earnings Per Share, or because it usually is called, the EPS method. Actually, stock prices have risen considerably prior to now 5 years primarily based on low interest rates as buyers chased excessive yielding dividend stocks. This analysis thesis is about the monetary assertion evaluation of Pakistan Petroleum Restricted one of the largest exploration and production company in Pakistan. Development alternatives for skilled monetary analysts embrace handling higher tasks by managing more vital merchandise and advancing to the level of portfolio or fund manager.

You can develop into a millionaire by profitable the lottery, getting an enormous inheritance, or robbing a bank, however most people must do it the slow approach. The very lowest priced stocks are generally known as penny stocks.” These firms could have little or no earnings. Or they might specialize in a selected space – for instance in Japanese bonds or in junk bonds from Argentina. Your goal is to buy a share of inventory at one worth, and then sell the share at the next worth on a later date. Preserve the following points in thoughts earlier than actually making your investments in stocks.

You can develop into a millionaire by profitable the lottery, getting an enormous inheritance, or robbing a bank, however most people must do it the slow approach. The very lowest priced stocks are generally known as penny stocks.” These firms could have little or no earnings. Or they might specialize in a selected space – for instance in Japanese bonds or in junk bonds from Argentina. Your goal is to buy a share of inventory at one worth, and then sell the share at the next worth on a later date. Preserve the following points in thoughts earlier than actually making your investments in stocks.

Replace: Day after, released 1.9.1, default back to not require shift, and permit option to not require control, which by default is not going to require control. It’s crucial to enclose the variable in curly braces and enclose the curly braces in single quotes so as to let the compiler know to exchange the placeholder with precise text. For the purpose of this test, I invested a total of $2000, $a thousand in stock purchases with $a thousand to make use of to assist construct revenue and keep a positive cash and stock place. In principle you can begin an GOAL account with only $500, nonetheless, I’d suggest that you just begin with an alternate traded fund (ETF) instead of inventory of a single company. Stock quotes shows from different sources may also fluctuate depending on the data offered therein. To answer this question we’ll use historic inventory costs and run the AIM algorithm through its paces.

Replace: Day after, released 1.9.1, default back to not require shift, and permit option to not require control, which by default is not going to require control. It’s crucial to enclose the variable in curly braces and enclose the curly braces in single quotes so as to let the compiler know to exchange the placeholder with precise text. For the purpose of this test, I invested a total of $2000, $a thousand in stock purchases with $a thousand to make use of to assist construct revenue and keep a positive cash and stock place. In principle you can begin an GOAL account with only $500, nonetheless, I’d suggest that you just begin with an alternate traded fund (ETF) instead of inventory of a single company. Stock quotes shows from different sources may also fluctuate depending on the data offered therein. To answer this question we’ll use historic inventory costs and run the AIM algorithm through its paces. Google Apps (or GApps) are the proprietary purposes by Google which is included in most of the Android phones and tablets. It signifies that an investor is prepared to pay 15 instances as a lot for each inventory of the corporate than net revenue they actually generate. Page, 42, and Brin, forty one, have maintained control over Google since they started the corporate in a rented Silicon Valley garage in 1998. The market response to good or bad news in a bull market shall be positive as a rule. The extra usually this occurs at a specific value degree, the stronger the psychological support turns into. MetaStock 11 inventory evaluation device is available for buy with using QuoteCenter, a streaming knowledge supplier or eSignal. Not less than 16 brokerages raised their value targets on the inventory to between $880 and $1,220, with Deutsche Financial institution bumping up its goal value by 26 percent.

Google Apps (or GApps) are the proprietary purposes by Google which is included in most of the Android phones and tablets. It signifies that an investor is prepared to pay 15 instances as a lot for each inventory of the corporate than net revenue they actually generate. Page, 42, and Brin, forty one, have maintained control over Google since they started the corporate in a rented Silicon Valley garage in 1998. The market response to good or bad news in a bull market shall be positive as a rule. The extra usually this occurs at a specific value degree, the stronger the psychological support turns into. MetaStock 11 inventory evaluation device is available for buy with using QuoteCenter, a streaming knowledge supplier or eSignal. Not less than 16 brokerages raised their value targets on the inventory to between $880 and $1,220, with Deutsche Financial institution bumping up its goal value by 26 percent. Dividends are an additional quantity that an investor receives when the stocks or bonds that they are invested in carry out properly enough in order that they can provide a profit to the company the dividend stocks were issued from. Earlier than you dive head-first into the market, there are some things it’s best to know about selecting stocks. To recommend to somebody that a purchase and maintain strategy is prudent, when each one else is buying and selling for short time period features, just isn’t wise. In conclusion, it is very important notice that the stocks are unpredictable, and it is onerous to find out the right time to purchase or promote stocks. You’ve got redefined danger from what is occurring out there” to how likely am I to lose cash over time”, which although common sense, isn’t how most investors make investments. These stocks are usually large well-known corporations and have multiple Wall Avenue analysts protecting them. So now, with inflation slowly creeping larger, we are seeing stocks and yields rise collectively (bonds decline).

Dividends are an additional quantity that an investor receives when the stocks or bonds that they are invested in carry out properly enough in order that they can provide a profit to the company the dividend stocks were issued from. Earlier than you dive head-first into the market, there are some things it’s best to know about selecting stocks. To recommend to somebody that a purchase and maintain strategy is prudent, when each one else is buying and selling for short time period features, just isn’t wise. In conclusion, it is very important notice that the stocks are unpredictable, and it is onerous to find out the right time to purchase or promote stocks. You’ve got redefined danger from what is occurring out there” to how likely am I to lose cash over time”, which although common sense, isn’t how most investors make investments. These stocks are usually large well-known corporations and have multiple Wall Avenue analysts protecting them. So now, with inflation slowly creeping larger, we are seeing stocks and yields rise collectively (bonds decline).

It is a concise guide to the Stock Markets and Stock Market Indices of what are thought-about to be the most important monetary and share trading countries on this planet. What is often referred to as the Stock Market” is definitely a number of stock markets, which are in turn made up of thousands of publicly issued stocks that signify equity possession in firms and are traded on the assorted stock markets.There are stock markets in all developed international locations throughout the world and in many developing international locations.

It is a concise guide to the Stock Markets and Stock Market Indices of what are thought-about to be the most important monetary and share trading countries on this planet. What is often referred to as the Stock Market” is definitely a number of stock markets, which are in turn made up of thousands of publicly issued stocks that signify equity possession in firms and are traded on the assorted stock markets.There are stock markets in all developed international locations throughout the world and in many developing international locations.

…

… Despite engaging cash incentives on offer by a number of automotive companies, the consumer driven new automobile market has remained under strain throughout November. Actuaries are additionally employed in the monetary service business to help in pricing securities offerings and devising investment instruments. Islamic monetary system is easy system and it should acceptable regardless of religion. Generally penny stocks cross on to the low-priced (i.e. equal to or under $ 5 per share) provisional securities of very small firms. Just think about a state of affairs the place you want to buy stocks of a certain company but you do not know methods to proceed.

Despite engaging cash incentives on offer by a number of automotive companies, the consumer driven new automobile market has remained under strain throughout November. Actuaries are additionally employed in the monetary service business to help in pricing securities offerings and devising investment instruments. Islamic monetary system is easy system and it should acceptable regardless of religion. Generally penny stocks cross on to the low-priced (i.e. equal to or under $ 5 per share) provisional securities of very small firms. Just think about a state of affairs the place you want to buy stocks of a certain company but you do not know methods to proceed.

That’s why I needed to face many sympathetic appears to be like, at any time when the market goes down. Niveza is an Advisory agency which provides Long term Stocks tips by tracing almost each motion of the market and offering our clients with greatest analyst Stocks Pics and Full Assist during market hours. Shares of ETRM are actually crashing however can reverse at any second and is a key inventory to observe on Wednesday along with BVXV. Investing in stocks can definitely be scary, and has been for the reason that first firm went public. Moreover, dividend yield should not be relied upon solely when making a choice to spend money on a stock. Dividend stocks have a tendency to not rise as shortly as non-dividend stocks throughout roaring bull markets.

That’s why I needed to face many sympathetic appears to be like, at any time when the market goes down. Niveza is an Advisory agency which provides Long term Stocks tips by tracing almost each motion of the market and offering our clients with greatest analyst Stocks Pics and Full Assist during market hours. Shares of ETRM are actually crashing however can reverse at any second and is a key inventory to observe on Wednesday along with BVXV. Investing in stocks can definitely be scary, and has been for the reason that first firm went public. Moreover, dividend yield should not be relied upon solely when making a choice to spend money on a stock. Dividend stocks have a tendency to not rise as shortly as non-dividend stocks throughout roaring bull markets.

…

… I believe investing in international organization should be element of your investment portfolio no matter whether it is in your 401k retirement or brokerage account. Despite the fact that no commitments were created, those remarks seemed to be sufficient to reverse an initial sell-off in Google’s stock following the disappointing earnings report. Trading stock and possibilities can be entertaining and profitable, or it can be dismal and expensive. Stock market place quotes delayed at least 15 minutes for NASDAQ, 20 mins for NYSE and AMEX. Class A stocks will continue to be traded beneath the GOOGL ticker, even though Class C stocks will trade below the GOOG ticker. Ten dollars at most so for 100 shares, it must go up ten cents per share to cover the charges of investing on the way in and one more 10 cents per share to cover the sale. Customize the chart date variety, chart kind (Line / Candlestick / OHLC), turn on / off chart indicators.

I believe investing in international organization should be element of your investment portfolio no matter whether it is in your 401k retirement or brokerage account. Despite the fact that no commitments were created, those remarks seemed to be sufficient to reverse an initial sell-off in Google’s stock following the disappointing earnings report. Trading stock and possibilities can be entertaining and profitable, or it can be dismal and expensive. Stock market place quotes delayed at least 15 minutes for NASDAQ, 20 mins for NYSE and AMEX. Class A stocks will continue to be traded beneath the GOOGL ticker, even though Class C stocks will trade below the GOOG ticker. Ten dollars at most so for 100 shares, it must go up ten cents per share to cover the charges of investing on the way in and one more 10 cents per share to cover the sale. Customize the chart date variety, chart kind (Line / Candlestick / OHLC), turn on / off chart indicators. Monetary markets are institutions and procedures that facilitate transactions in all kinds of monetary securities. One, DCB Monetary, the mother or father of Delaware County Bank, soared a staggering 148 percent — first on news that it was being purchased, after which on a giant rally in bank stocks as the 12 months drew to an in depth. His mannequin makes use of five financial ratios weighted in order to maximize the predictive energy of the model.

Monetary markets are institutions and procedures that facilitate transactions in all kinds of monetary securities. One, DCB Monetary, the mother or father of Delaware County Bank, soared a staggering 148 percent — first on news that it was being purchased, after which on a giant rally in bank stocks as the 12 months drew to an in depth. His mannequin makes use of five financial ratios weighted in order to maximize the predictive energy of the model.

You’re being directed to ZacksTrade, a division of LBMZ Securities and licensed dealer-seller. Most profitable business people are inclined to disagree with the thinking that there is a excellent time of day or an ideal month that one should purchase and sell their stock. I do have a little bit of an objection to the idea that you need to have a number of thousand earlier than you make investments – because in case you are like me, it is onerous to get that few thousand and I nonetheless want to be in the market. First, stocks with month-to-month money dividends are typically traded on regular inventory exchanges, and have enough liquidity for buyers to easily buy and sell them. Many stocks that made a big transfer in the bounce are going sideways and organising for subsequent up leg. It is strongly recommended to always trade penny stocks by way of respected stock exchanges resembling Nasdaq Smallcap and Nasdaq National. I feel that dividend paying stocks that reinvests the dividends again into the company is one of the best ways to go for those which might be saving for retirement.

You’re being directed to ZacksTrade, a division of LBMZ Securities and licensed dealer-seller. Most profitable business people are inclined to disagree with the thinking that there is a excellent time of day or an ideal month that one should purchase and sell their stock. I do have a little bit of an objection to the idea that you need to have a number of thousand earlier than you make investments – because in case you are like me, it is onerous to get that few thousand and I nonetheless want to be in the market. First, stocks with month-to-month money dividends are typically traded on regular inventory exchanges, and have enough liquidity for buyers to easily buy and sell them. Many stocks that made a big transfer in the bounce are going sideways and organising for subsequent up leg. It is strongly recommended to always trade penny stocks by way of respected stock exchanges resembling Nasdaq Smallcap and Nasdaq National. I feel that dividend paying stocks that reinvests the dividends again into the company is one of the best ways to go for those which might be saving for retirement. Based mostly on the ten 12 months chart, Cache logistics is buying and selling at a 10 12 months low with a dividend yield of eight-eleven%. Basic tasks embrace analyzing financial knowledge, guaranteeing efficient and correct file keeping and preparation of economic paperwork. Not like different stocks like gold, silver or apple where info is extensively publicized, this is not the case with Penny Stock. Prudential Monetary ( NYSE:PRU ) has a market capitalization of $26.seventy three billion.

Based mostly on the ten 12 months chart, Cache logistics is buying and selling at a 10 12 months low with a dividend yield of eight-eleven%. Basic tasks embrace analyzing financial knowledge, guaranteeing efficient and correct file keeping and preparation of economic paperwork. Not like different stocks like gold, silver or apple where info is extensively publicized, this is not the case with Penny Stock. Prudential Monetary ( NYSE:PRU ) has a market capitalization of $26.seventy three billion.

In case you’re able to invest in particular person stocks, then that you must know how to analyze stocks. Should you perform under the steerage of professional firm or one that have deep knowledge of sizzling penny stocks market then you’ll turn into rich sooner. Imagine proudly owning stocks in 5 completely different companies, every of which you anticipate to repeatedly develop earnings. I order to get diversify, and make sure you don’t put all of your eggs in one basket, you will need to purchase lots of stocks.

In case you’re able to invest in particular person stocks, then that you must know how to analyze stocks. Should you perform under the steerage of professional firm or one that have deep knowledge of sizzling penny stocks market then you’ll turn into rich sooner. Imagine proudly owning stocks in 5 completely different companies, every of which you anticipate to repeatedly develop earnings. I order to get diversify, and make sure you don’t put all of your eggs in one basket, you will need to purchase lots of stocks.

Studying about stock market investing could be a a tremendously gratifying expertise for youths once they use child-friendly firms in a mock stock portfolio. Trades are accounted for in essentially the most practical approach possible by tracking real time quotes through the day so when you execute a buy or sell on iTrade it will be just like should you were calling your broker or placing in a web-based stock commerce.

Studying about stock market investing could be a a tremendously gratifying expertise for youths once they use child-friendly firms in a mock stock portfolio. Trades are accounted for in essentially the most practical approach possible by tracking real time quotes through the day so when you execute a buy or sell on iTrade it will be just like should you were calling your broker or placing in a web-based stock commerce.

…

…