Navigating Hyperinflation Crisis: Effective Management Strategies

In the challenging landscape of economics, hyperinflationary crises can present severe threats to businesses, economies, and the livelihoods of individuals. This article explores effective management strategies to navigate hyperinflationary crises, offering insights into proactive approaches and resilience-building measures.

Understanding Hyperinflation: A Looming Threat

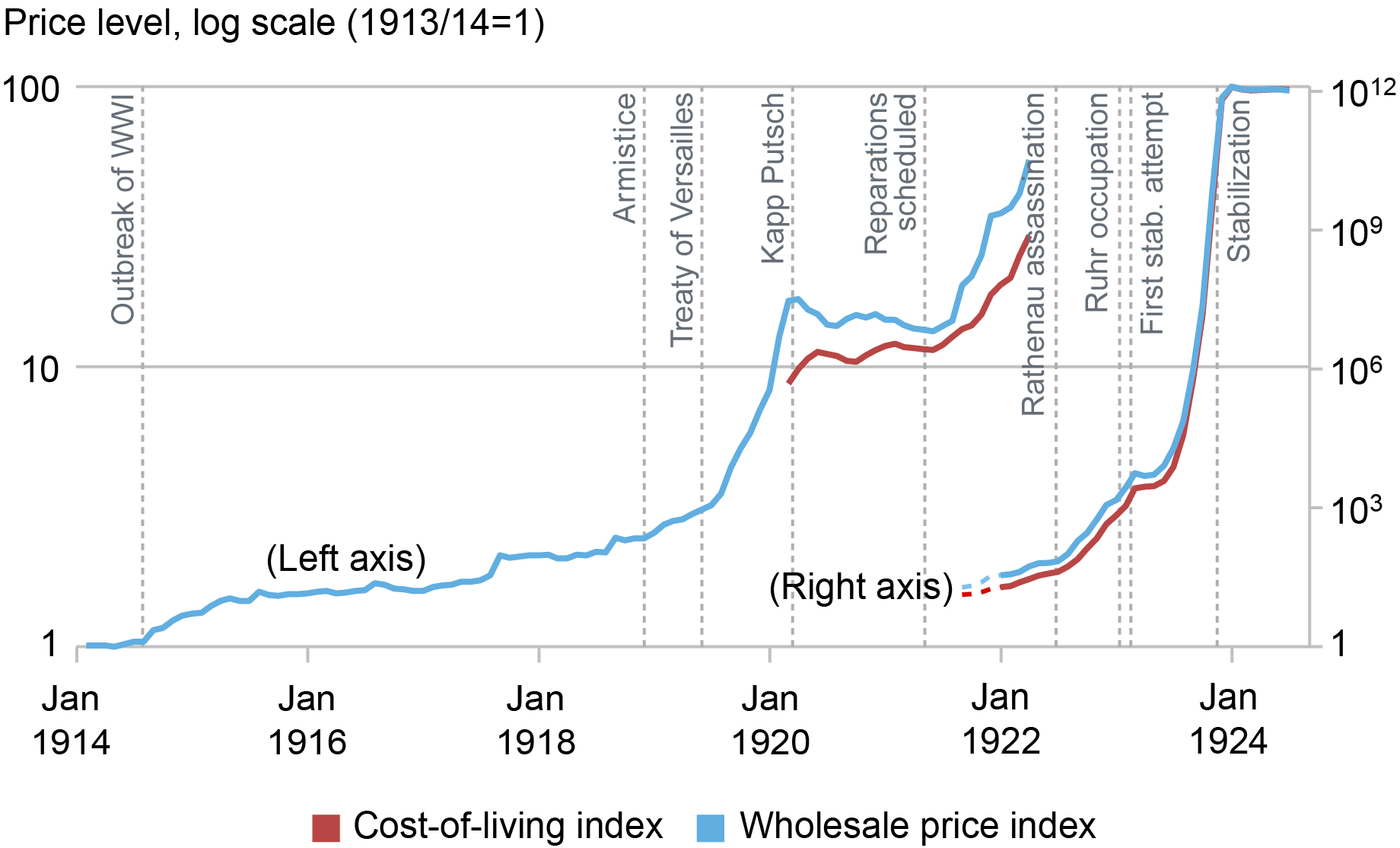

At the core of hyperinflationary crisis management is a profound understanding of hyperinflation itself. Hyperinflation is an extreme and rapid increase in the prices of goods and services, often leading to a loss of confidence in the currency. Identifying the signs and causes of hyperinflation is the first step in crafting effective crisis management strategies.

Immediate Response Measures: Agility is Key

When facing hyperinflation, immediate response measures are crucial. Businesses and individuals must demonstrate agility in adjusting pricing models, revisiting financial strategies, and securing assets that retain value. Rapid adaptation is essential to mitigate the immediate impact of hyperinflation on financial stability.

Currency Risk Mitigation: Diversification Strategies

Crisis management involves mitigating currency risk, a central concern in hyperinflationary environments. Diversification strategies, such as holding assets in stable foreign currencies or investing in tangible assets like precious metals, provide a buffer against the devaluation of the local currency. These measures contribute to maintaining financial resilience during hyperinflation.

Price Stabilization Initiatives: Balancing Supply and Demand

Governments and businesses can play a pivotal role in crisis management by implementing price stabilization initiatives. Balancing supply and demand dynamics, addressing disruptions in the supply chain, and implementing price controls on essential goods can help stabilize prices, providing a degree of economic relief during hyperinflationary crises.

Government Intervention: Policy Measures for Stability

Effective crisis management often requires government intervention. Policymakers may implement strict monetary policies, adjust interest rates, or introduce fiscal measures to restore economic stability. Transparent communication of these policy measures is crucial to maintaining public confidence and fostering collaboration during hyperinflationary crises.

Debt Management Strategies: Navigating Financial Obligations

In a hyperinflationary crisis, managing existing debts becomes a significant challenge. Businesses and individuals must navigate financial obligations by exploring debt restructuring, negotiating with creditors, and considering inflation-resistant financial instruments. Strategic debt management is essential for maintaining financial viability in turbulent economic times.

Social Impact Considerations: Safeguarding Vulnerable Populations

Crisis management should extend beyond economic measures to address the social impact of hyperinflation. Safeguarding vulnerable populations through social programs, access to essential services, and support for basic needs is essential. This holistic approach fosters social stability and resilience amid the challenges posed by hyperinflation.

International Collaboration: Seeking External Support

Hyperinflationary crises often extend beyond national borders. Seeking international collaboration and support can provide additional resources and expertise for crisis management. Engaging with international organizations, neighboring countries, and global financial institutions can contribute to a more coordinated and effective response to hyperinflation.

Long-Term Planning: Building Economic Resilience

While immediate crisis management is essential, long-term planning is equally crucial. Building economic resilience involves structural reforms, diversification of the economy, and fostering an environment conducive to sustainable growth. Long-term planning aims to create a robust economic foundation that can withstand