Mitigating Inflation: Strategic Measures for Stability

Navigating Economic Challenges: Inflation Mitigation Measures

In the dynamic landscape of economics, inflation can pose significant challenges. This article explores strategic measures for mitigating the impact of inflation, offering insights into proactive approaches that businesses, investors, and policymakers can employ to foster stability and resilience.

Understanding Inflation Dynamics: A Prerequisite for Mitigation

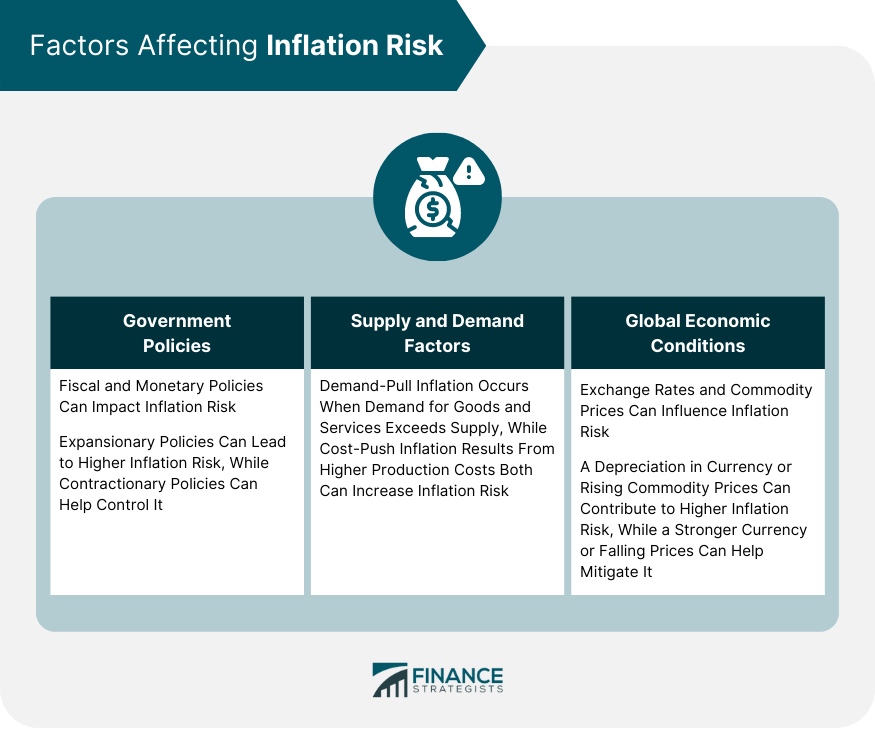

Mitigating inflation begins with a deep understanding of its underlying dynamics. Factors such as demand-supply imbalances, monetary policies, and external shocks contribute to inflation. Before implementing mitigation measures, stakeholders must analyze these dynamics to tailor strategies that address the specific drivers of inflation in a given economic context.

Proactive Pricing Strategies: Adapting to Changing Economic Conditions

One of the primary ways businesses can mitigate the impact of inflation is through proactive pricing strategies. Adjusting product and service prices in response to inflationary pressures allows businesses to maintain profitability and sustain operations. Careful consideration of customer sensitivities and market dynamics is crucial for implementing pricing strategies that strike the right balance.

Diversification of Investments: Building a Resilient Portfolio

For investors, diversification of investments is a key mitigation measure against inflation. Allocating assets across various classes, such as stocks, bonds, and commodities, helps spread risk. In times of inflation, certain asset classes may outperform others, and a diversified portfolio provides a cushion against the potential devaluation of specific investments.

Supply Chain Optimization: Strengthening Resilience

Inflation often impacts the cost of goods and services due to increased production expenses. Businesses can mitigate this impact by optimizing their supply chains. Streamlining operations, negotiating with suppliers, and identifying alternative sourcing options contribute to cost efficiency and resilience in the face of inflationary pressures.

Innovation and Efficiency: Driving Sustainable Business Practices

Mitigating inflation requires businesses to embrace innovation and operational efficiency. Investing in technology, adopting sustainable practices, and optimizing internal processes contribute to cost savings. Efficient operations enhance a company’s ability to navigate inflationary challenges and maintain competitiveness in the market.

Engaging in Hedging Practices: Managing Financial Risks

Financial instruments such as derivatives provide a means for businesses and investors to hedge against inflationary risks. Engaging in hedging practices involves using financial instruments to offset potential losses due to changing economic conditions. While complex, hedging strategies can be valuable tools for managing financial risks associated with inflation.

Collaborative Policymaking: Government and Business Partnership

Mitigating inflation requires collaborative efforts between governments and businesses. Policymakers can implement measures such as adjusting interest rates and fiscal policies to stabilize the economy. Businesses, in turn, can actively engage with policymakers, providing insights into the challenges they face and contributing to the formulation of effective, mutually beneficial policies.

Educating Stakeholders: Fostering Informed Decision-Making

Education plays a crucial role in inflation mitigation. Businesses, investors, and the general public need to be informed about the impact of inflation and the measures in place to mitigate it. Transparent communication, educational campaigns, and financial literacy initiatives contribute to fostering an environment where stakeholders can make informed decisions amid changing economic conditions.

Exploring In-Depth Insights at Inflation Mitigation Measures

For a deeper exploration