Inflationary Economic Trends: Navigating Financial Challenges

Inflationary Economic Trends: Navigating Financial Challenges

Understanding the Landscape

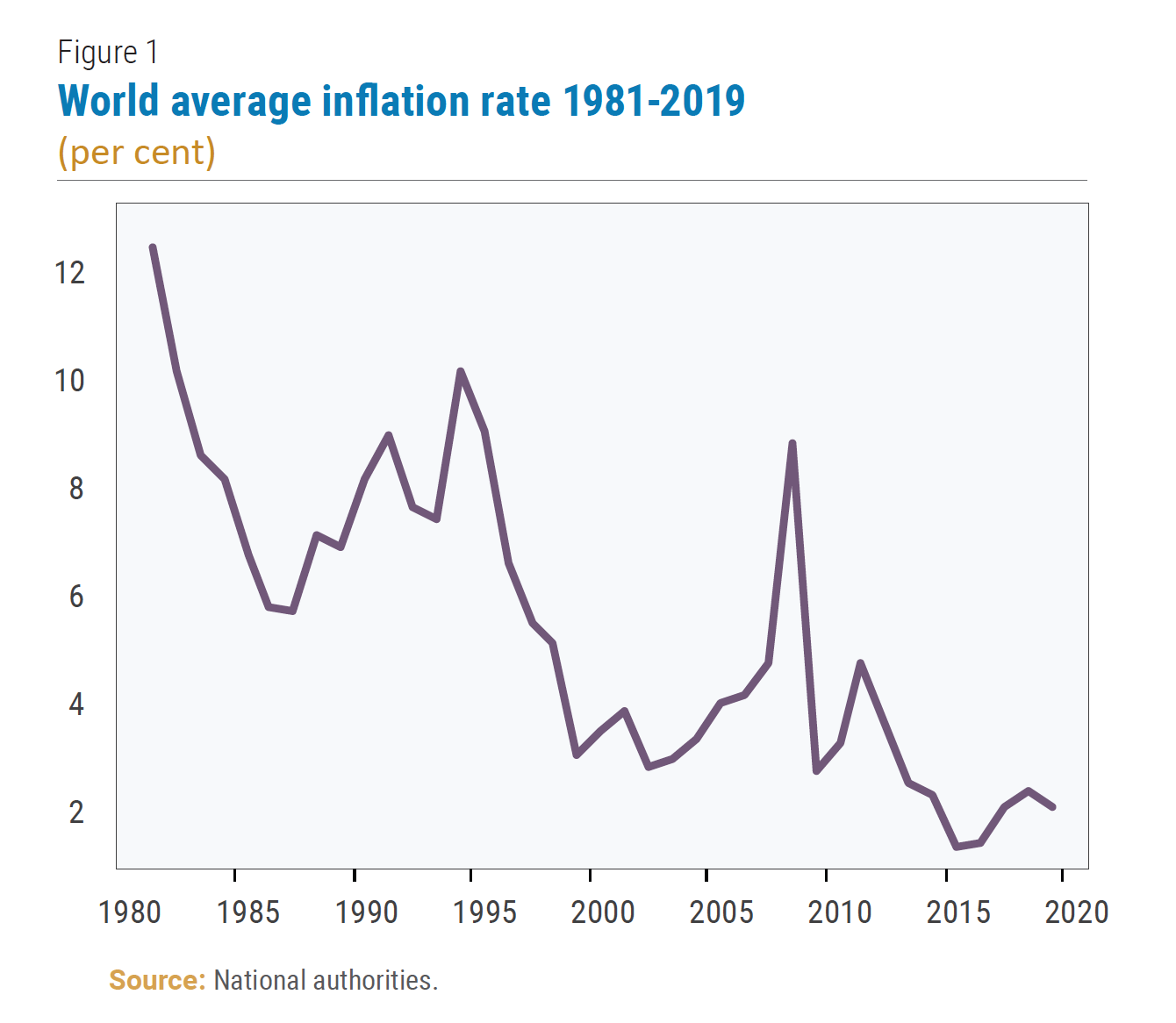

In today’s dynamic economic environment, staying informed about inflationary trends is crucial for individuals and businesses alike. Inflation can significantly impact purchasing power, investment returns, and overall financial well-being. As we delve into the intricacies of inflationary economic trends, it’s essential to first grasp the broader landscape.

Factors Driving Inflation

Various factors contribute to inflation, and comprehending these drivers is key to making informed financial decisions. From changes in demand and supply dynamics to shifts in global commodity prices, understanding the intricate web of factors influencing inflation can empower individuals to navigate economic uncertainties more effectively.

Implications for Consumers and Businesses

The repercussions of inflation extend beyond theoretical discussions. Consumers feel the pinch as the prices of goods and services rise, affecting their daily lives and spending habits. Similarly, businesses must adapt to rising operational costs and strategize to maintain profitability. Navigating these implications requires a proactive approach and a keen understanding of market dynamics.

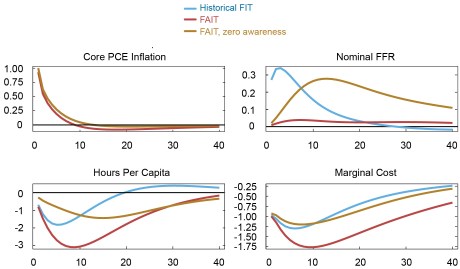

Government Responses and Monetary Policies

Governments often implement measures to address inflation and stabilize the economy. These responses may include fiscal policies, such as adjusting taxation and public spending, and monetary policies, where central banks regulate interest rates. Analyzing these responses provides insights into the broader economic strategy and its potential impact on inflationary trends.

Adopting a Strategic Financial Approach

Given the uncertainties surrounding inflation, individuals and businesses should adopt a strategic financial approach. This involves diversifying investments, considering inflation-protected securities, and staying vigilant about market trends. A well-informed financial strategy can serve as a buffer against the challenges posed by inflation.

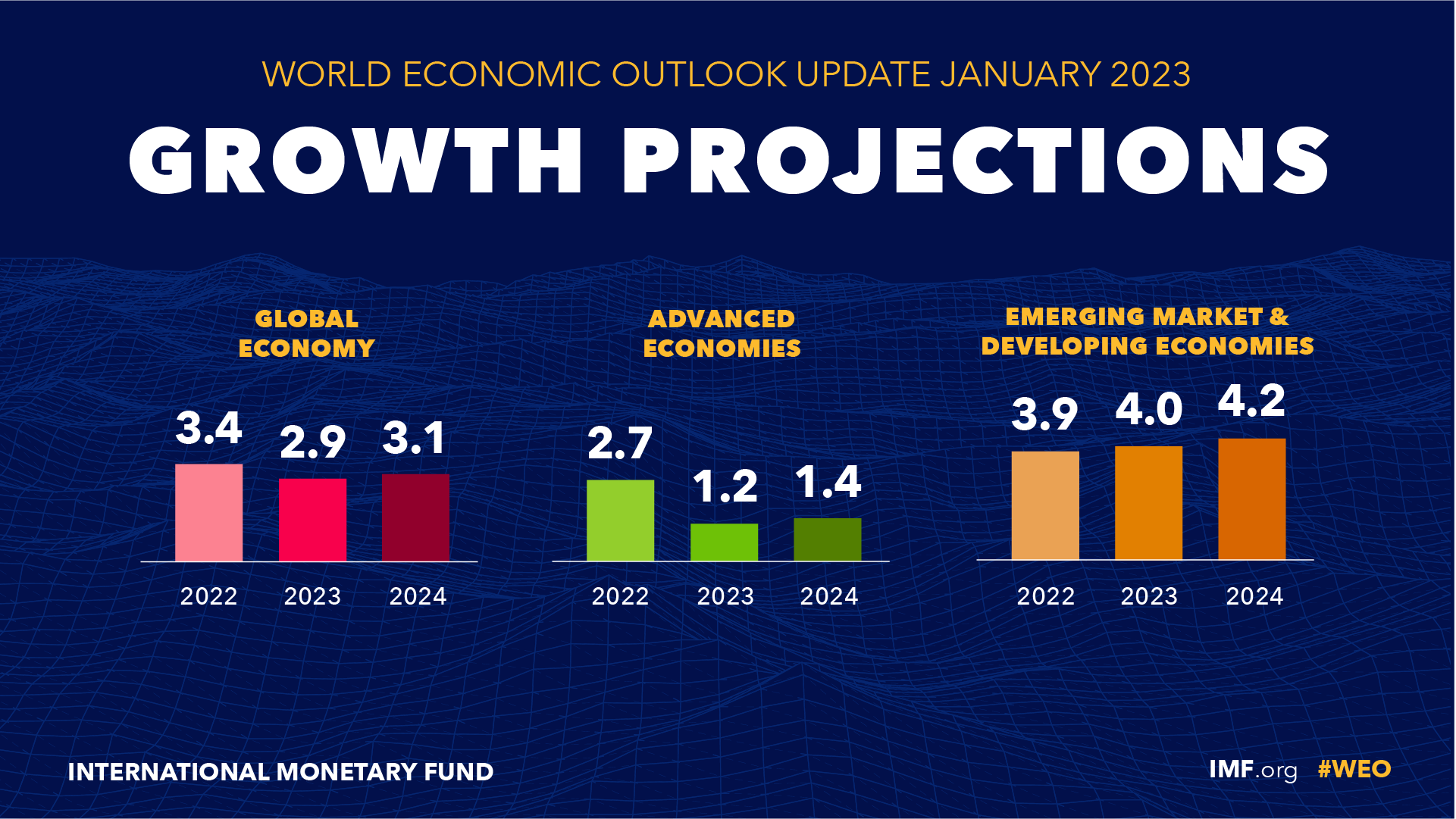

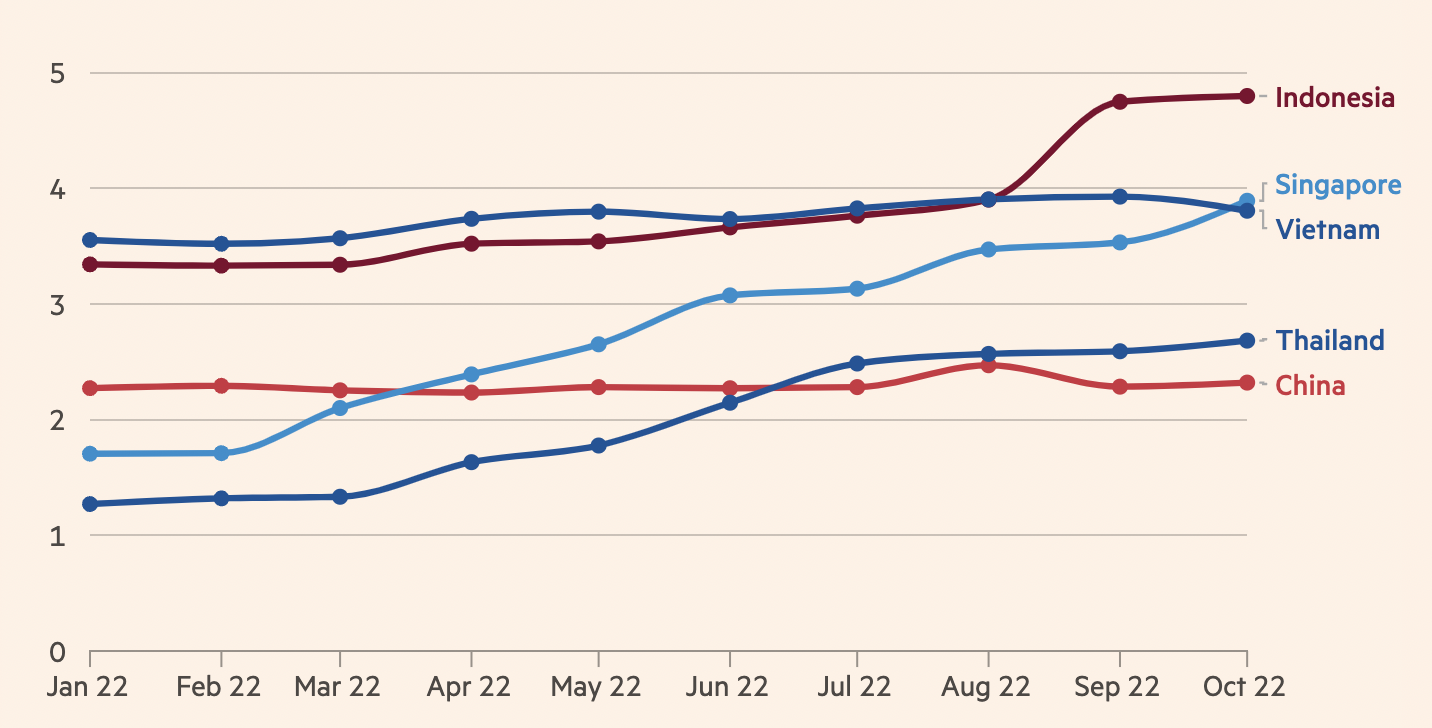

Global Economic Trends and Inflation Linkages

In today’s interconnected world, global economic trends play a significant role in shaping inflationary dynamics. Understanding how events on the global stage influence local economies provides valuable insights for investors and policymakers alike. It underscores the importance of a holistic approach when assessing inflationary economic trends.

Technology and Innovation Amidst Inflation

Innovation and technological advancements can be powerful tools in mitigating the impact of inflation. Businesses that leverage technology to enhance efficiency and reduce costs may find themselves better positioned to navigate inflationary challenges. Exploring innovative solutions becomes imperative in an environment where adaptability is key.

Investment Strategies in an Inflationary Environment

Investors often seek refuge in specific asset classes during periods of inflation. From real estate and precious metals to certain types of stocks, understanding how different investments perform in inflationary environments is essential. Crafting a well-balanced investment portfolio can help mitigate the risks associated with inflation.

Educational Initiatives for Financial Literacy

Enhancing financial literacy is a proactive step in preparing individuals and businesses for inflationary economic trends. Educational initiatives, whether provided by governments, financial institutions, or independent organizations, play a crucial role in empowering people to make informed financial decisions and navigate economic uncertainties effectively.

Conclusion: Navigating the Future

As we navigate the complexities of inflationary economic trends, staying informed and proactive is paramount. In this ever-evolving landscape, individuals and businesses must adapt, strategize, and leverage