Assessing Inflationary Pressures: Strategic Insights

Deciphering Economic Indicators: Inflationary Pressure Assessment

In the intricate realm of economics, assessing inflationary pressures is a critical task for businesses, investors, and policymakers. This article delves into the significance of inflationary pressure assessment, providing strategic insights and guidance for navigating the complexities of economic landscapes.

Understanding Inflationary Pressures: A Holistic Overview

Before delving into the specifics, it’s crucial to understand the concept of inflationary pressures. These pressures refer to the factors and indicators that contribute to the overall rise in prices within an economy. Assessing these pressures involves analyzing a multitude of economic indicators to gauge the potential impact on inflation.

Inflationary Pressure Assessment – A Link to Strategic Decision-Making

For a more in-depth exploration of inflationary pressure assessment, visit Inflationary Pressure Assessment. This resource offers expert analyses, discussions, and insights into the nuances of assessing inflationary pressures. Accessing such information is crucial for businesses, investors, and policymakers striving for a proactive and informed approach.

Key Economic Indicators: Tools for Assessing Inflationary Pressures

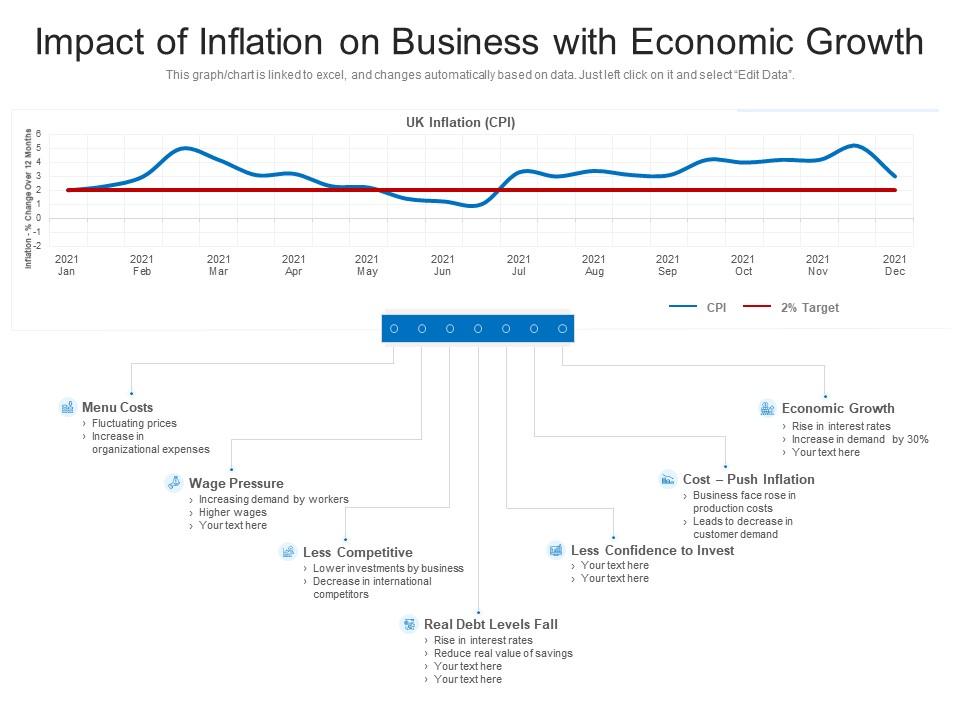

Assessing inflationary pressures relies on a set of key economic indicators. These include Consumer Price Index (CPI), Producer Price Index (PPI), wage data, and others. Analyzing these indicators provides a comprehensive view of the economic landscape, helping stakeholders anticipate potential inflationary trends.

Central Bank Policies: Influence on Inflationary Pressure Assessment

Central banks play a pivotal role in shaping inflationary pressures through monetary policies. Assessing central bank policies, including interest rate decisions and quantitative easing measures, provides valuable insights into the potential trajectory of inflation. This analysis guides strategic decision-making for businesses and investors.

Global Economic Factors: Impact on Inflationary Pressures

Inflationary pressures are not confined to national borders; they are influenced by global economic factors. Exchange rates, international trade dynamics, and geopolitical events can significantly impact inflation. Assessing these global factors is crucial for stakeholders with international exposure, guiding decisions in a globally interconnected economy.

Consumer Behavior Analysis: Unveiling Inflationary Signals

Consumer behavior is a key indicator in assessing inflationary pressures. Understanding how consumers respond to price changes, shifts in spending patterns, and overall confidence levels provides valuable signals. Businesses and investors leveraging consumer behavior analysis are better equipped to adapt to changing inflationary landscapes.

Supply Chain Dynamics: Identifying Potential Inflationary Risks

Assessing inflationary pressures involves scrutinizing supply chain dynamics. Disruptions in the supply chain can lead to increased production costs and potential inflationary risks. Businesses conducting thorough assessments of their supply chains can identify vulnerabilities and implement strategies to mitigate inflation-related challenges.

Investment Strategy Adaptation: Navigating Inflationary Challenges

Investors need to adapt their strategies based on the assessment of inflationary pressures. As inflation erodes the real value of money, understanding potential impacts on various asset classes helps investors optimize portfolios. Diversification and strategic asset allocation become crucial in navigating inflation-induced uncertainties.

Policy Responses: Governments and Inflationary Pressure Assessment

Governments formulate policy responses based on assessments of inflationary pressures. Fiscal measures, regulatory changes, and public spending decisions are influenced by the perceived risks of inflation. Stakeholders must closely monitor government responses to anticipate potential shifts