Inflationary Risk Assessment: Navigating Financial Landscapes

Navigating the Complexity of Inflationary Risk Evaluation

In the realm of finance, understanding and assessing inflationary risks is paramount for investors and businesses alike. As economic landscapes evolve, the ability to evaluate and navigate inflationary risks becomes a crucial skill in managing financial portfolios and making informed decisions.

The Nature of Inflationary Risks

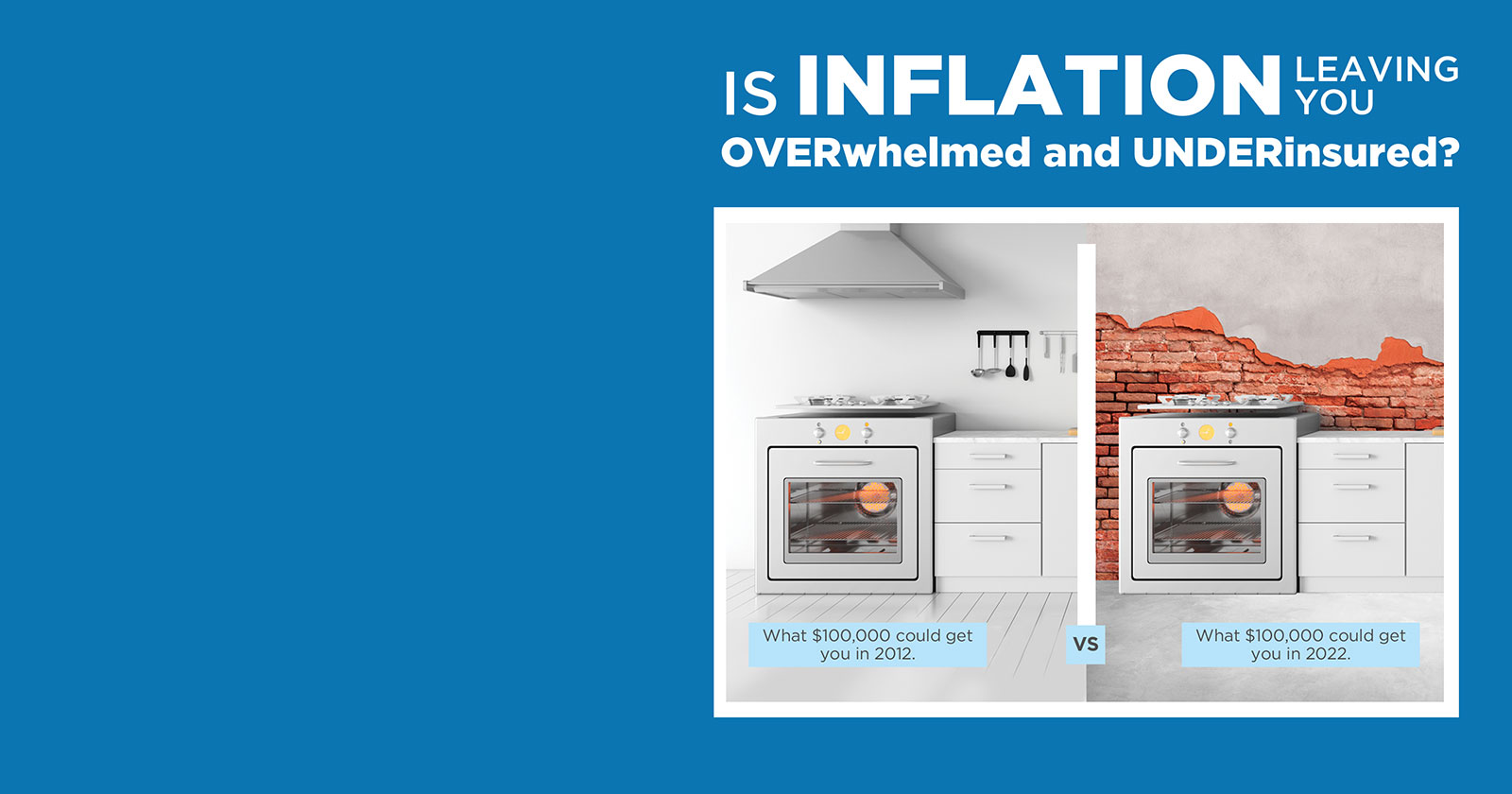

Inflationary risks stem from the potential increase in the general price level of goods and services over time. This phenomenon can erode purchasing power, disrupt financial planning, and impact investment returns. To effectively navigate these risks, it’s essential to delve into the nature and dynamics of inflation, recognizing it as a multifaceted challenge.

Economic Indicators and Early Warning Signs

Successful risk evaluation begins with monitoring economic indicators and recognizing early warning signs. Key indicators such as consumer price indices, producer price indices, and employment figures can offer insights into the direction and magnitude of inflationary pressures. Staying vigilant and interpreting these signals can be instrumental in proactive risk management.

Impact on Investment Portfolios

Inflationary risks can significantly influence the performance of investment portfolios. Evaluating the susceptibility of various assets to inflation is crucial. Equities, bonds, and real assets may respond differently to inflationary pressures. Diversification strategies and understanding the historical behavior of asset classes can aid in constructing resilient portfolios that withstand inflationary challenges.

Interest Rates and Monetary Policy Dynamics

Assessing inflationary risks involves a keen understanding of interest rates and monetary policy dynamics. Central banks often use interest rate adjustments to control inflation. Evaluating the potential impact of interest rate changes on borrowing costs, investment returns, and overall economic conditions is central to gauging inflationary risk.

Sectoral Analysis: Identifying Vulnerabilities and Opportunities

Different economic sectors respond uniquely to inflationary pressures. Some sectors may face challenges due to rising input costs, while others may benefit from increased consumer spending. Conducting a thorough sectoral analysis helps identify vulnerabilities and opportunities within a diverse economic landscape.

Global Perspectives and Currency Risks

In an interconnected global economy, inflationary risks extend beyond national borders. Evaluating global economic trends and understanding currency risks is essential. Currency devaluation or appreciation can impact international trade, investments, and the overall risk profile of portfolios. A comprehensive risk evaluation considers the broader global context.

Risk Mitigation Strategies

Once inflationary risks are identified, effective risk mitigation strategies can be implemented. These may include adjusting asset allocations, incorporating inflation-protected securities, and exploring alternative investments. Risk mitigation is an ongoing process that requires adaptability and a proactive approach in response to evolving economic conditions.

Role of Financial Planning in Inflationary Risk Management

Financial planning plays a pivotal role in managing inflationary risks. Developing a comprehensive financial plan that considers inflation expectations, lifestyle goals, and risk tolerance is essential. Regular reviews and adjustments ensure that the financial plan remains aligned with an individual’s or organization’s long-term objectives.

Exploring In-Depth Insights at Inflationary Risk Evaluation

For a deeper exploration of strategies and insights related to inflationary risk evaluation, visit Inflationary Risk Evaluation. Staying informed and proactive in assessing and