Inflationary Forces Unveiled: A Comprehensive Overview

Inflationary Forces Unveiled: A Comprehensive Overview

In today’s dynamic economic landscape, understanding the intricacies of inflationary forces is essential for businesses, investors, and policymakers alike. This article provides a comprehensive overview of the various factors contributing to inflation, its impacts on the economy, and strategies to navigate through these challenging times.

The Nature of Inflationary Forces

Inflation, at its core, is a persistent increase in the general price level of goods and services in an economy over time. Several factors contribute to this phenomenon, and it’s crucial to delve into each to comprehend the complex web of inflationary forces.

One major driver is demand-pull inflation, where an increase in aggregate demand outpaces the economy’s ability to produce goods and services. This heightened demand can stem from factors such as robust consumer spending, increased business investments, or even government expenditure.

Conversely, cost-push inflation occurs when the costs of production rise, forcing businesses to pass these additional expenses onto consumers in the form of higher prices. Factors like rising raw material costs, increased wages, or supply chain disruptions can trigger cost-push inflation.

Global Influences on Inflation

In our interconnected world, global events and trends play a significant role in shaping inflationary forces. Fluctuations in currency exchange rates, geopolitical tensions, and disruptions in the global supply chain can have far-reaching impacts on inflation levels.

For businesses operating internationally, understanding and mitigating the risks associated with global inflationary forces is paramount. Developing strategies that account for currency fluctuations and diversifying supply chain sources can help navigate the challenges posed by a rapidly changing global economic landscape.

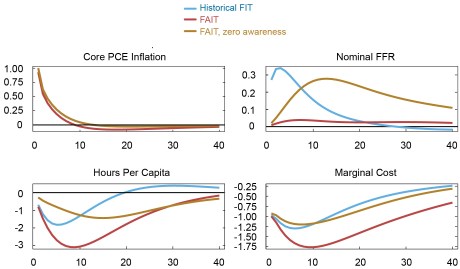

Central Bank Policies and Inflation Targets

Central banks play a pivotal role in managing inflation through monetary policy. By adjusting interest rates and employing various tools, central banks aim to achieve their inflation targets and maintain economic stability.

Explore the link between central bank policies and inflationary forces here for a deeper understanding of how these institutions navigate the delicate balance between stimulating economic growth and preventing runaway inflation.

Inflation’s Impact on Consumers and Businesses

As inflation erodes the purchasing power of a currency, consumers may experience a decline in their standard of living. Higher prices for everyday goods and services can strain household budgets, leading to changes in spending habits and saving patterns.

Businesses, on the other hand, must navigate the challenges of rising input costs and potentially reduced consumer spending. Crafting resilient business models, exploring cost-cutting measures, and adapting pricing strategies are essential components of managing the impact of inflation on business operations.

Strategies for Inflation Hedge

In the face of inflationary forces, individuals and businesses can adopt various strategies to hedge against its adverse effects. Investing in assets that traditionally perform well during inflationary periods, such as real estate, commodities, and certain stocks, can provide a safeguard against eroding purchasing power.

Additionally, exploring inflation-indexed bonds and other financial instruments specifically designed to adjust for inflation can be a prudent strategy for investors looking to mitigate the risks associated with rising prices.

Conclusion

In conclusion, navigating