Forecasting Economic Trends: Inflation Rate Insights

Navigating Economic Uncertainties: Inflation Rate Forecasts

In the realm of economics, anticipating inflation rates is a crucial aspect of strategic decision-making. This article delves into the significance of inflation rate forecasts, providing insights and guidance for businesses, investors, and policymakers aiming to navigate the complexities of economic landscapes.

The Essence of Inflation Rate Forecasts: A Comprehensive Overview

Before exploring the specifics, it’s essential to grasp the essence of inflation rate forecasts. These forecasts are predictions of future inflation levels based on a thorough analysis of economic indicators, trends, and various contributing factors. They serve as a valuable tool for anticipating and preparing for economic shifts.

Global Economic Factors: Influencing Inflation Rate Forecasts

Inflation is not a localized phenomenon; it is influenced by global economic factors. Inflation rate forecasts take into account international trade dynamics, currency fluctuations, and geopolitical events. A comprehensive understanding of the interconnectedness of global economies is vital for accurate and insightful inflation rate forecasts.

Inflation Rate Forecasts – A Link to Strategic Decision-Making

For a deeper dive into inflation rate forecasts, visit Inflation Rate Forecasts. This resource offers expert analyses, discussions, and insights into the nuances of forecasting inflation rates. Accessing such information is crucial for businesses, investors, and policymakers striving for a proactive and informed approach.

Macroeconomic Indicators: Key Tools in Forecasting Inflation Rates

Forecasting inflation rates relies heavily on macroeconomic indicators. These include consumer price indices, employment data, interest rates, and GDP growth. Analyzing these indicators provides a holistic view of economic health and helps in predicting the potential trajectory of inflation rates.

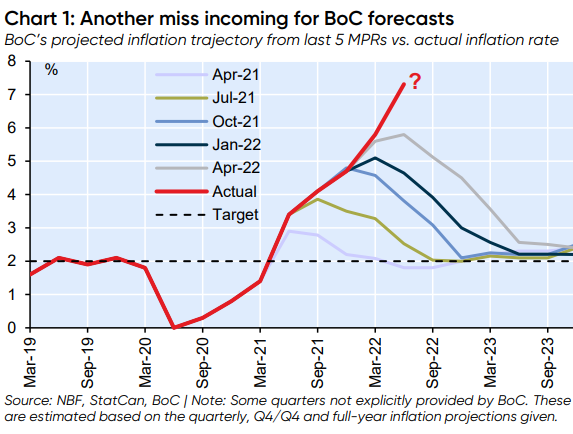

Central Bank Policies: Shaping Inflation Rate Forecasts

The policies enacted by central banks play a pivotal role in shaping inflation rate forecasts. Interest rate decisions, quantitative easing measures, and communication from central banks all contribute to the overall economic environment. Examining these policies provides valuable insights into the expected direction of inflation rates.

Consumer Behavior Dynamics: Affecting Inflation Rate Forecasts

Understanding consumer behavior is a critical component of accurate inflation rate forecasts. Consumer spending patterns, confidence levels, and responses to economic stimuli all impact inflation. Forecasters delve into consumer dynamics to gauge how these factors might influence the future inflationary landscape.

Investor Strategies: Adapting Portfolios Based on Forecasts

Investors rely on inflation rate forecasts to adapt their strategies and optimize portfolios. Anticipating inflation trends allows investors to allocate assets effectively, choose suitable investment vehicles, and adjust risk profiles. In a dynamic market, having insights into inflation rate forecasts is a valuable tool for making informed investment decisions.

Business Planning: Aligning Strategies with Forecasted Inflation Rates

For businesses, aligning strategies with forecasted inflation rates is essential. Pricing models, supply chain decisions, and overall financial planning are influenced by anticipated inflation levels. Businesses that integrate inflation rate forecasts into their planning are better equipped to navigate uncertainties and maintain competitiveness.

Policy Responses: Governments and Inflation Rate Forecasting

Governments, armed with inflation rate forecasts, can tailor policy responses accordingly. Fiscal measures, such as taxation and spending policies, may be adjusted to influence inflation rates.