Decoding Economic Forces: Understanding Inflation Dynamics

Deciphering Economic Forces: Understanding Inflation Dynamics

In the intricate tapestry of economics, inflation stands as a significant and often misunderstood force. This article aims to unravel the complexities of inflation dynamics, providing insights into the factors that drive inflation, its impact on economies, and strategies for navigating the challenges it presents.

The Basics: What is Inflation?

At its core, inflation refers to the sustained increase in the general price level of goods and services over time. While moderate inflation is a normal part of economic cycles, understanding the reasons behind its occurrence is crucial. Factors such as increased demand, supply chain disruptions, or changes in production costs can contribute to inflationary pressures.

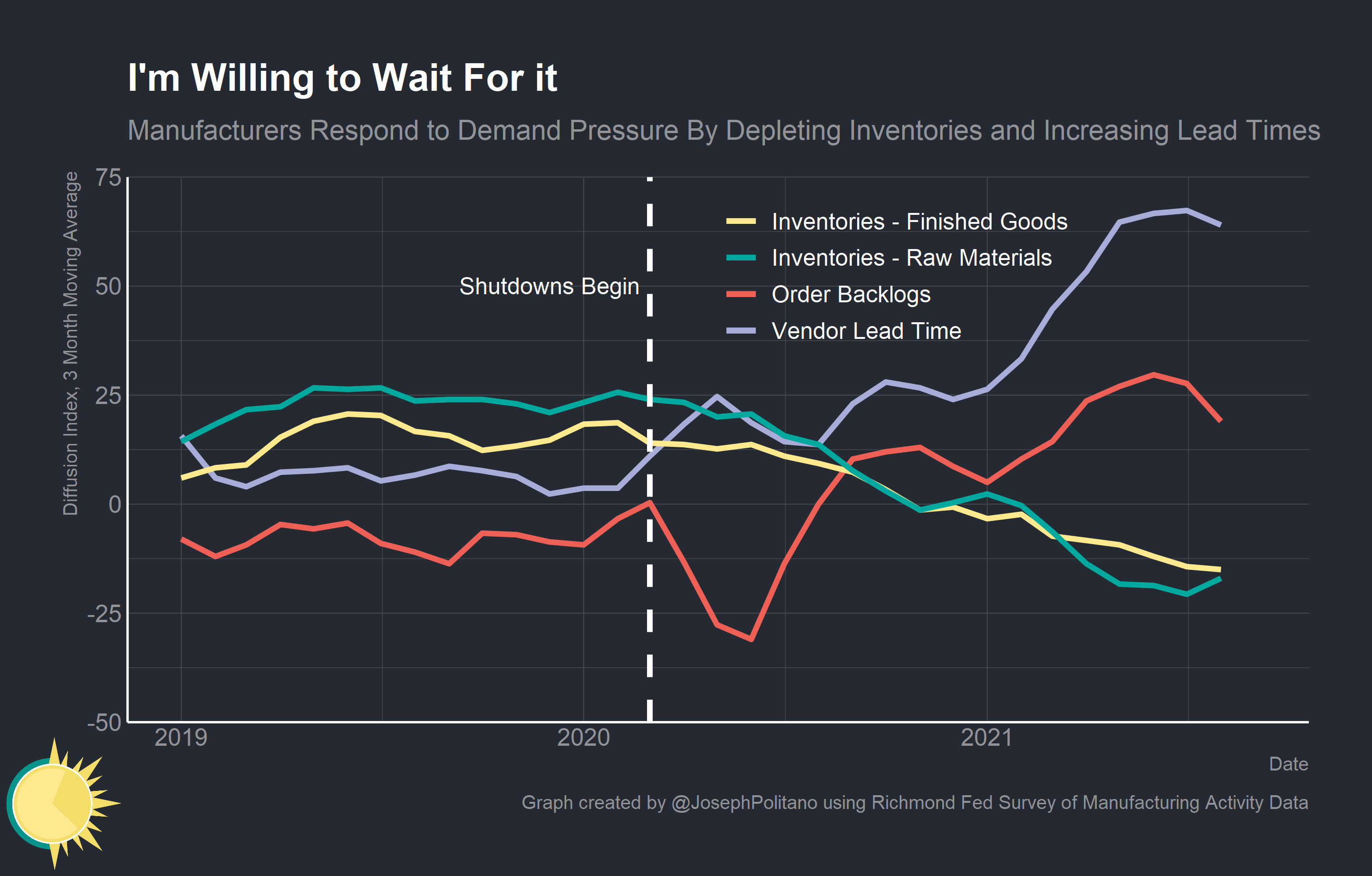

Drivers of Inflation: Supply and Demand Dynamics

Inflation dynamics are heavily influenced by the interplay of supply and demand in the economy. When demand for goods and services outstrips their supply, prices tend to rise. Conversely, when supply exceeds demand, prices may fall. Balancing these dynamics is a delicate task for policymakers, requiring a nuanced approach to maintain price stability.

The Role of Central Banks: Monetary Policy and Inflation

Central banks play a pivotal role in influencing inflation through monetary policy. By adjusting interest rates, managing money supply, and utilizing various tools, central banks aim to control inflation within a target range. Striking the right balance is crucial, as overly tight policies can stifle economic growth, while loose policies may lead to inflationary pressures.

Inflation Measurement: Unraveling the Indices

Measuring inflation accurately is essential for policymakers and businesses. Commonly used indices, such as the Consumer Price Index (CPI) and the Producer Price Index (PPI), track changes in the prices of goods and services at different stages of production. These indices help gauge inflation trends and inform decision-making.

Types of Inflation: Unpacking the Categories

Inflation is not a one-size-fits-all phenomenon; it comes in various forms. Cost-push inflation occurs when production costs rise, often due to increased raw material prices. Demand-pull inflation results from robust consumer demand. Hyperinflation, an extreme form, involves rapidly rising prices, often leading to economic instability.

Globalization and Inflation: A Complex Relationship

In a globally interconnected world, economic events in one part of the globe can influence inflation elsewhere. Fluctuations in exchange rates, international trade dynamics, and the interconnectedness of financial markets contribute to the complexity of inflation dynamics on a global scale. Understanding these global factors is crucial for a comprehensive view.

Inflation Expectations: The Psychological Element

Inflation dynamics are not solely driven by economic fundamentals; expectations also play a vital role. If individuals and businesses anticipate rising prices, they may adjust their behavior, leading to a self-fulfilling prophecy. Managing inflation expectations is a key challenge for central banks in maintaining price stability.

Adapting to New Realities: Technology and Inflation

Technological advancements have introduced new dimensions to inflation dynamics. Innovations in production processes, e-commerce, and automation can influence supply chains and pricing structures. Understanding the intersection of technology and inflation is essential for businesses and policymakers adapting to the realities of the digital age.