Crafting Effective Inflation Response Policies

Crafting Effective Inflation Response Policies: A Strategic Imperative

In the intricate dance of economic management, the formulation and implementation of inflation response policies hold paramount importance. This article explores the strategic imperative of crafting effective inflation response policies, offering insights into the challenges, tools, and considerations that policymakers face in maintaining economic stability.

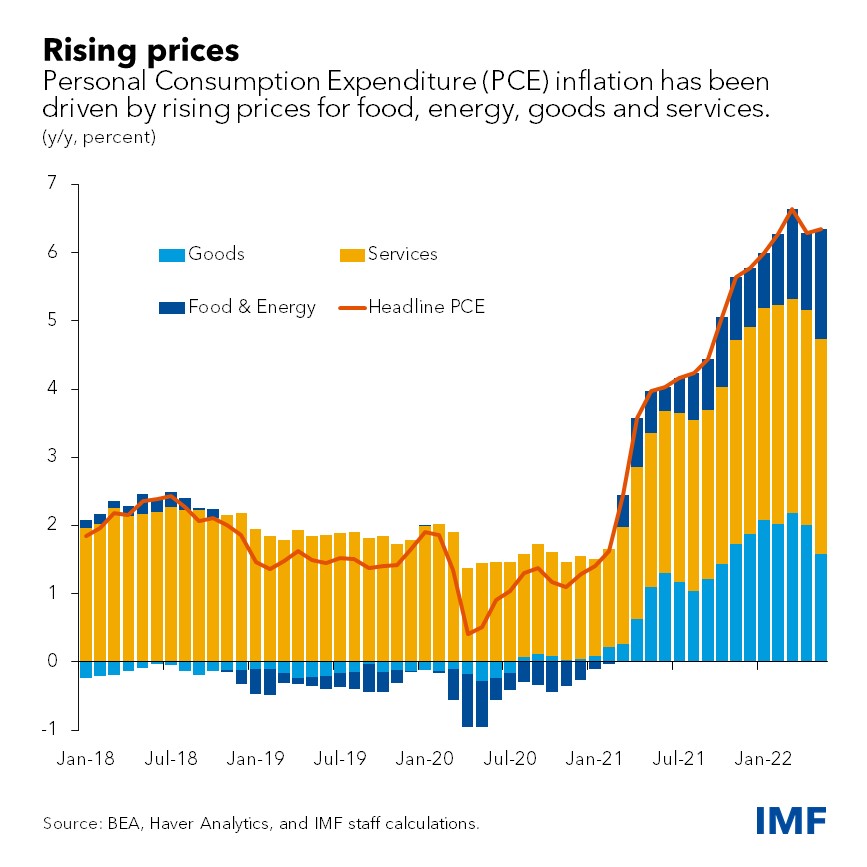

Understanding the Context: The Need for Inflation Response Policies

Inflation response policies are crafted in response to shifts in the economic landscape. Whether triggered by external shocks, supply chain disruptions, or changing consumer behavior, inflation can pose a threat to economic stability. Policymakers must understand the specific context and underlying causes before formulating effective response strategies.

Inflation Response Policies – A Link to Economic Stability

For a deeper exploration of inflation response policies, visit Inflation Response Policies. This resource provides expert analyses, discussions, and insights into the nuances of crafting and implementing effective policies to address inflationary challenges. Accessing such information is crucial for policymakers striving to navigate a dynamic economic environment.

Monetary Policy Tools: Navigating Interest Rates and Money Supply

Central banks play a pivotal role in implementing inflation response policies through monetary tools. Adjusting interest rates and managing the money supply are common strategies. By influencing borrowing costs and liquidity, central banks aim to control inflation and maintain price stability. Policymakers carefully calibrate these tools to achieve their economic objectives.

Fiscal Policy Measures: Government Intervention for Stability

Governments complement monetary policies with fiscal measures to address inflation. Adjusting taxation, public spending, and budget allocations are essential tools in crafting an effective response. Fiscal policies can stimulate or cool down economic activity, depending on the prevailing inflationary pressures, providing policymakers with versatile instruments.

Supply-Side Policies: Tackling Inflation at the Source

Crafting effective inflation response policies often involves addressing supply-side factors. Policies targeting improvements in productivity, reducing regulatory burdens, and enhancing market competition can mitigate inflationary pressures by increasing efficiency and reducing production costs. Policymakers need to strike a balance between demand and supply-side interventions.

Communication Strategies: Building Public Confidence

Effective communication is a cornerstone of successful inflation response policies. Central banks and governments must clearly articulate their strategies, objectives, and the rationale behind policy decisions. Transparent communication builds public confidence, helps manage expectations, and facilitates the smooth implementation of policy measures.

Global Considerations: Collaborative Responses to Global Challenges

In an interconnected world, global considerations are crucial in crafting inflation response policies. Economic events in one part of the world can have far-reaching effects. Policymakers must collaborate, share information, and coordinate policies to address global challenges collectively. A cohesive international response is often essential for effective inflation management.

Social Impact Assessment: Balancing Economic Stability and Equity

Crafting inflation response policies requires a comprehensive assessment of their social impact. Policymakers must consider the potential effects on different socioeconomic groups. Striking a balance between economic stability and equity ensures that the benefits and burdens of policy measures are distributed fairly across the population.

Adaptability: Navigating Dynamic Economic Conditions

The effectiveness of inflation response policies hinges on their adaptability