Global Perspectives: Unraveling Inflation Trends Worldwide

Exploring the Global Landscape of Inflation Trends

In the interconnected tapestry of the world economy, understanding inflation trends on a global scale is essential for policymakers, businesses, and individuals alike. This article delves into the nuances of inflation trends worldwide, examining their origins, impact, and implications for diverse sectors.

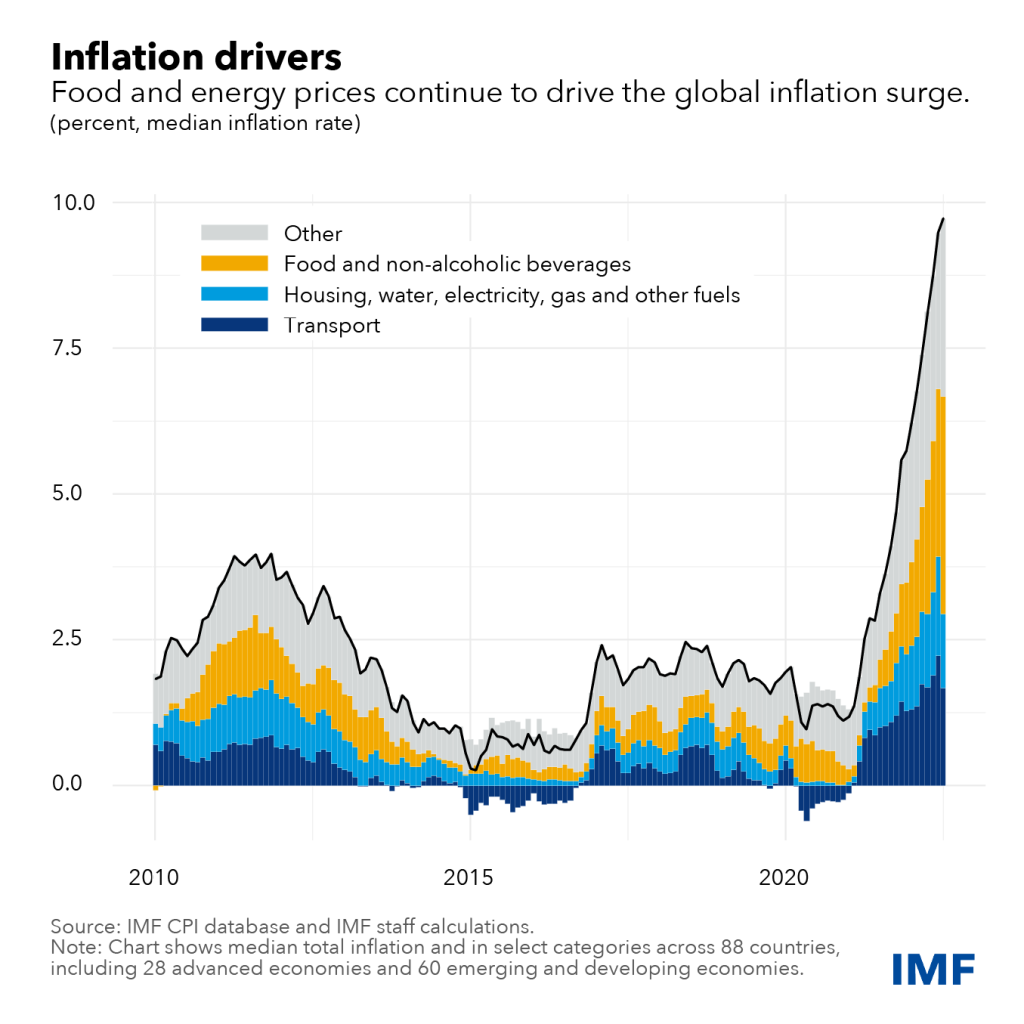

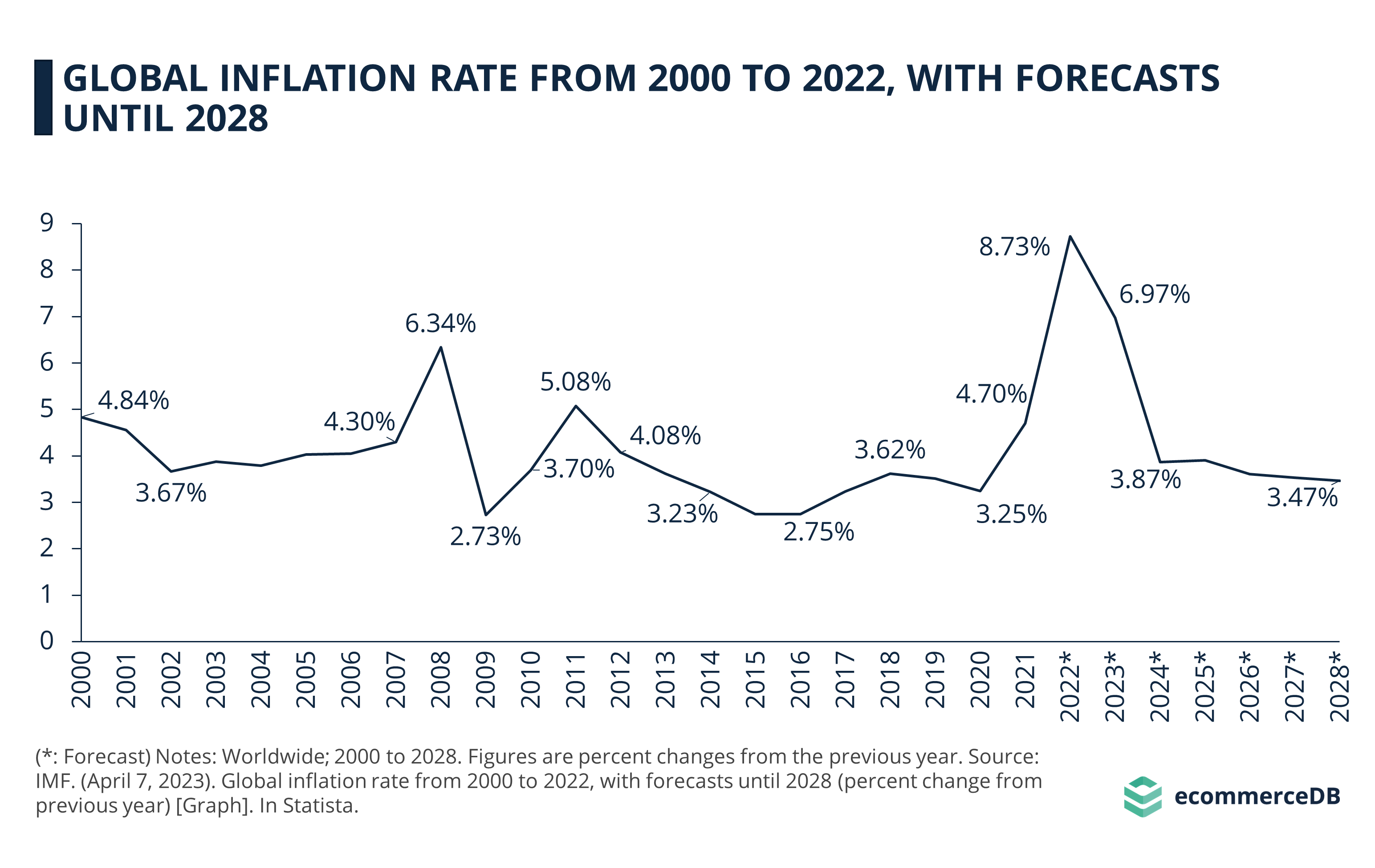

The Complex Factors Behind Global Inflation Trends

Inflation trends are influenced by a myriad of factors, both domestic and international. Supply and demand dynamics, monetary policies, geopolitical events, and global economic interdependencies all contribute to the complexity of understanding and predicting inflation trends worldwide. Examining these factors provides a foundation for comprehending the intricacies of the global economic landscape.

Regional Disparities and Common Threads

While inflation trends are a global phenomenon, they often manifest differently across regions. Disparities in economic structures, government policies, and cultural influences contribute to varied inflationary patterns. However, amidst these regional disparities, there are common threads that weave through global inflation trends, providing opportunities for shared insights and collaborative strategies.

Central Banks’ Role in Shaping Global Inflation

Central banks worldwide play a crucial role in shaping inflation trends through their monetary policies. Decisions on interest rates, money supply, and economic stimulus measures can have profound effects on inflation rates. The coordination and communication among central banks globally become paramount, especially in an era of heightened economic interdependence.

Global Economic Interconnectedness: A Double-Edged Sword

The interconnected nature of the global economy ensures that inflation trends in one part of the world can reverberate globally. While this interconnectedness facilitates trade, investment, and economic cooperation, it also means that economic challenges in one region can spill over into others. Striking a balance between collaboration and safeguarding against adverse global economic events is a continual challenge.

Consumer Behavior in the Face of Global Inflation

As inflation trends fluctuate globally, consumer behavior undergoes transformations. The purchasing power of individuals is directly influenced by inflation rates, impacting spending habits and lifestyle choices. Understanding how consumer behavior evolves in response to global inflation trends is crucial for businesses and policymakers in adapting their strategies.

Businesses’ Strategies for Navigating Global Inflation

Businesses operating in a global context must develop strategies that account for diverse inflationary environments. Supply chain resilience, pricing flexibility, and risk management become paramount considerations. Adapting to the ever-changing global inflation landscape requires businesses to stay agile and responsive to the challenges posed by fluctuating inflation trends.

Investment Opportunities and Risks

Global investors navigate a complex landscape shaped by diverse inflation trends. Different regions and asset classes respond differently to inflationary pressures. Identifying investment opportunities and mitigating risks amidst global inflation trends demand a nuanced understanding of market dynamics and a proactive approach to portfolio management.

Governments’ Collaborative Efforts for Stability

Governments worldwide engage in collaborative efforts to address the challenges posed by global inflation trends. International economic organizations, summit meetings, and diplomatic initiatives contribute to coordinated strategies aimed at achieving stability. The ability to foster global economic cooperation becomes crucial in mitigating the adverse effects of inflation trends on a broader scale.