Navigating the Global Inflationary Landscape: Trends and Strategies

Understanding the Global Inflationary Landscape

In the intricate web of global economics, the state of inflation holds significant implications for businesses, governments, and individuals alike. A comprehensive exploration of the global inflationary environment is crucial for navigating the challenges and capitalizing on opportunities.

Factors Shaping Global Inflation

Diverse factors contribute to the complex tapestry of global inflation. From fluctuations in commodity prices to geopolitical tensions and currency movements, understanding the multifaceted nature of these influences is essential. Analysts and policymakers alike need to dissect these factors to comprehend the nuances of the global inflationary landscape.

Impact on Global Markets

The ripples of inflation are felt across international markets, affecting trade, investment, and economic stability. Examining how inflationary pressures reverberate through different regions provides insights into the interconnected nature of the global economy. Market participants must stay vigilant, adjusting strategies based on the evolving dynamics of the inflationary environment.

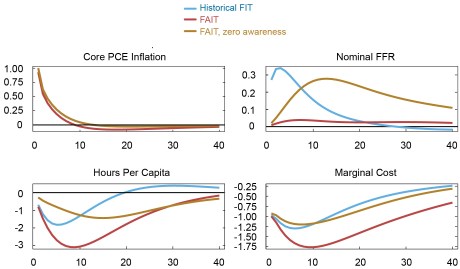

Central Banks’ Response Strategies

Central banks play a pivotal role in managing inflation on a global scale. Their response strategies, including interest rate adjustments and monetary policy shifts, shape the direction of inflation. Analyzing the approaches taken by major central banks provides a lens into the collective effort to maintain stability in the face of inflationary challenges.

Adapting Business Strategies to Global Inflation

For businesses operating on an international scale, adapting to the global inflationary environment is a strategic imperative. Pricing models, supply chain resilience, and risk mitigation strategies all require careful consideration. Navigating these aspects effectively positions businesses to weather the storm of inflationary pressures.

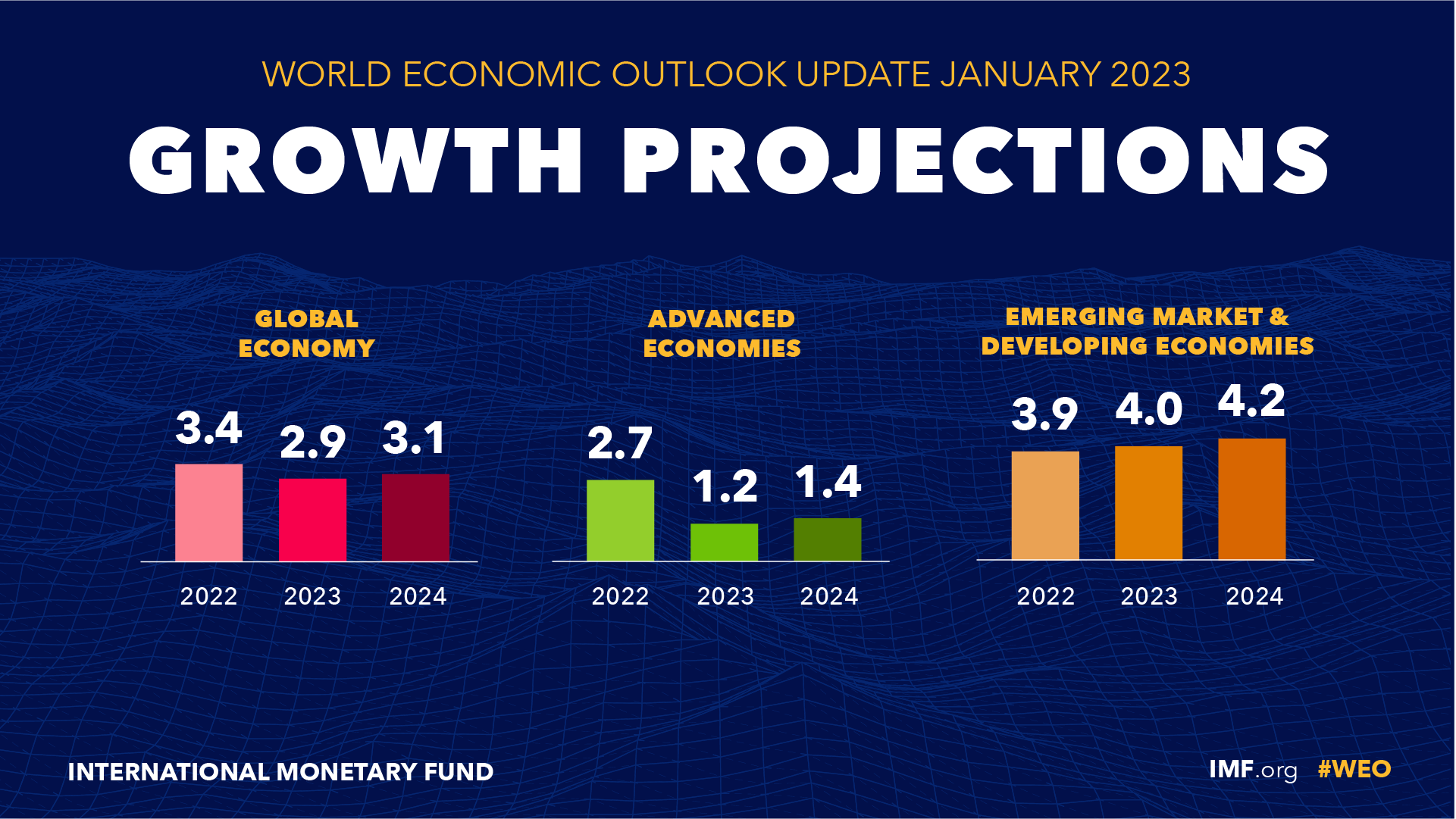

Challenges and Opportunities for Emerging Economies

Emerging economies face unique challenges and opportunities in the global inflationary landscape. Balancing growth aspirations with inflation management becomes a delicate act. Understanding the nuances of these economies provides valuable insights for investors, policymakers, and businesses seeking to engage with emerging markets.

Consumer Perspectives in the Face of Global Inflation

From purchasing power to everyday expenses, global inflation directly impacts consumers worldwide. Examining how inflation affects the cost of living and consumer behavior helps in crafting policies and business strategies that align with the needs and constraints of the global consumer base.

Strategies for Investment in Inflationary Environments

Investors globally grapple with the question of how to position their portfolios in the face of inflation. Diversification, hedging strategies, and a keen awareness of macroeconomic indicators become crucial elements of an effective investment strategy. Navigating the global inflationary environment demands a proactive and informed approach.

Real-time Insights and Information Access

Staying ahead in the dynamic world of global inflation requires access to real-time insights and information. Platforms such as rf-summit.com offer a valuable resource, providing analyses, trends, and expert opinions. Utilizing such platforms empowers individuals and organizations to make informed decisions in the ever-evolving landscape of global inflation.

Conclusion: Navigating the Path Ahead

In conclusion, understanding and navigating the global inflationary environment is a multifaceted challenge. From economic fundamentals to real-time insights, stakeholders must employ a holistic approach. By staying informed, adapting strategies, and leveraging available resources, individuals and organizations can