Benchmarking Inflation Rates: A Comparative Analysis

Navigating Economic Realities: A Comprehensive Exploration of Inflation Rate Comparisons

In the intricate tapestry of global economies, understanding and comparing inflation rates are fundamental to making informed decisions. This article delves into the significance of inflation rate comparisons, exploring their implications for businesses, investors, and policymakers alike.

The Basics: What Are Inflation Rate Comparisons?

Inflation rate comparisons involve evaluating and contrasting the inflation rates of different economies or time periods. This analysis provides insights into the relative price movements and economic stability of nations. Understanding these comparisons is vital for stakeholders seeking a nuanced view of economic performance.

Why Compare Inflation Rates?

Comparing inflation rates serves various purposes. It helps investors identify regions with stable economic conditions for potential investments. Policymakers utilize these comparisons to assess the effectiveness of monetary and fiscal policies. Businesses, meanwhile, can make strategic decisions based on the economic environments revealed through inflation rate analyses.

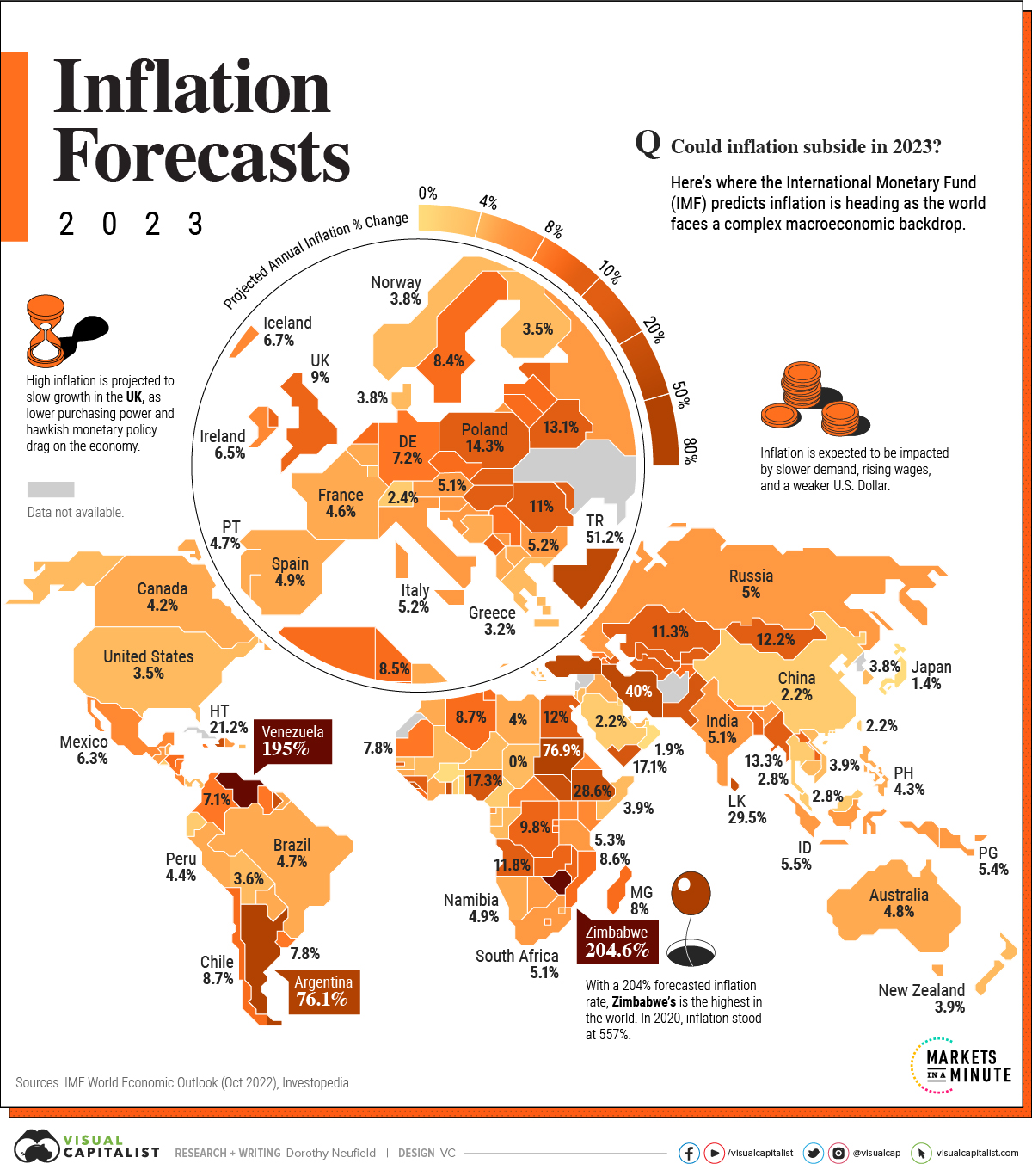

Regional Disparities: Analyzing Inflation Across Countries

One key aspect of inflation rate comparisons is understanding regional disparities. Different nations experience varying economic conditions, influenced by factors such as government policies, global trade dynamics, and internal market structures. Analyzing inflation across countries unveils these disparities, offering valuable insights for international business operations.

Time Horizons: Short-Term vs. Long-Term Inflation Rate Trends

Inflation rate comparisons extend beyond geographical boundaries to encompass different time horizons. Short-term trends may be influenced by immediate economic shocks or policy changes, while long-term trends reflect sustained economic conditions. Examining both timeframes provides a holistic understanding of inflation dynamics.

Implications for Investors: Making Informed Investment Decisions

For investors, inflation rate comparisons are integral to decision-making. Identifying regions with moderate and stable inflation rates can offer attractive investment opportunities. Understanding how inflation rates correlate with other economic indicators helps investors craft diversified and resilient portfolios.

Policy Considerations: Inflation Rate Impact on Government Strategies

Governments monitor inflation rate comparisons closely to formulate effective economic policies. High inflation rates may lead to monetary tightening, while low rates may prompt stimulus measures. The ability to compare inflation rates helps governments fine-tune policies to maintain price stability and sustainable economic growth.

Business Strategy: Adapting to Varied Inflation Environments

For businesses operating globally, inflation rate comparisons inform strategic decisions. From pricing strategies to supply chain management, understanding how inflation rates differ across regions guides businesses in adapting their operations to diverse economic environments. It also aids in assessing market potential and risk.

Inflation Rate Comparisons – A Link to Insights

For a more in-depth exploration of inflation rate comparisons, visit Inflation Rate Comparisons. This resource offers detailed insights, expert analyses, and discussions on the nuances of comparing inflation rates across different regions and timeframes. Accessing such information is crucial for staying ahead in a globally interconnected economic landscape.

Future Trends: Anticipating Inflation Trajectories

Inflation rate comparisons are not only retrospective but also forward-looking. Analysts use historical data and economic indicators to anticipate future inflation trajectories. Understanding these projections is valuable for businesses, investors, and policymakers in preparing for potential economic shifts.

Conclusion: Informed Decision-Making in