Assessing the Outlook: Navigating Economic Realities amid Inflation

Navigating Economic Realities: Inflation Outlook Assessments

The economic landscape is continually evolving, and understanding the inflation outlook is crucial for businesses, investors, and policymakers alike. This article delves into comprehensive assessments of the inflation outlook, providing insights into the factors influencing economic realities and strategies for informed decision-making.

The Dynamics of Inflation: A Holistic Overview

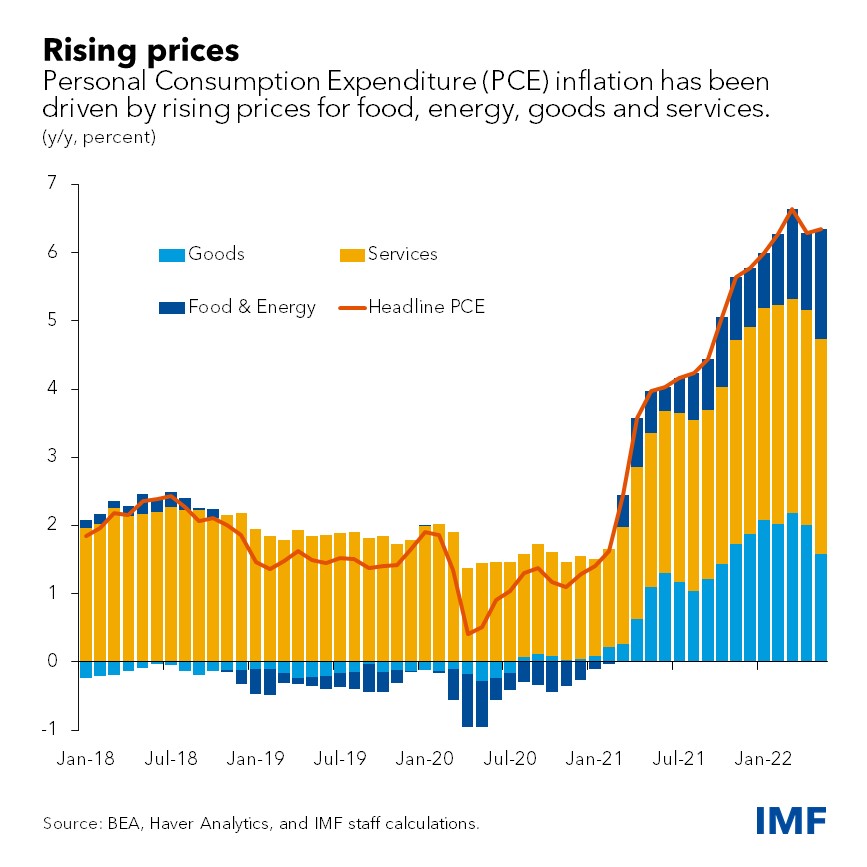

To navigate the complexities of the economic landscape, it’s imperative to grasp the dynamics of inflation. This section provides a holistic overview, examining how inflationary pressures impact pricing, consumption patterns, and the overall stability of economies. Understanding these dynamics lays the foundation for effective inflation outlook assessments.

Global Economic Trends and Inflation

In the interconnected world of today, global economic trends play a significant role in shaping inflationary pressures. This section explores how international events, trade relationships, and geopolitical factors contribute to the inflation outlook. A nuanced understanding of global economic trends is essential for accurate and insightful assessments.

Central Banks’ Policies in Inflation Management

Central banks worldwide implement various monetary policies to manage inflation. This section dissects the role of central banks in shaping the inflation outlook. From interest rate adjustments to quantitative easing measures, understanding these policies provides a key perspective for assessing the trajectory of inflation in the near and distant future.

Consumer Behavior in Inflationary Environments

Inflation directly influences consumer behavior, impacting spending habits and preferences. This section delves into how consumers navigate economic realities in the face of inflation. Businesses and policymakers keen on predicting market trends and adapting strategies must pay close attention to shifts in consumer behavior influenced by inflationary pressures.

Impact on Investments: Navigating Risks and Opportunities

Investors face a unique set of challenges and opportunities in an inflationary environment. This section explores the impact of inflation on various asset classes and investment strategies. From traditional investments to alternative assets, understanding the nuances of inflation outlook assessments is vital for making informed investment decisions.

Industry-Specific Considerations

Different industries respond differently to inflationary pressures. This section examines how specific sectors, such as manufacturing, services, and technology, are affected by inflation. Industry-specific considerations provide a granular understanding of challenges and opportunities, aiding businesses in developing targeted strategies for resilience.

Technology as a Catalyst for Economic Adaptation

Technological advancements often serve as catalysts for economic adaptation. This section explores how innovation and technology can mitigate the impact of inflation on businesses and industries. Embracing digital transformation becomes a strategic imperative for organizations aiming to navigate economic realities and thrive in inflationary environments.

Inflation Forecasting Models: Tools for Insightful Assessments

Forecasting inflation is a challenging yet essential task. This section introduces various inflation forecasting models and tools that analysts use for insightful assessments. From statistical models to econometric approaches, these tools aid in predicting inflation trends and making informed decisions based on data-driven insights.

Strategies for Proactive Decision-Making

Armed with a comprehensive understanding of inflation outlook assessments, businesses and individuals can formulate strategies for proactive decision-making. This section outlines key strategies, including risk management, adaptive business models, and diversified investments, to