Inflation’s Influence on Investments: Navigating Financial Strategies

Understanding Inflation’s Ripple Effect on Investments

In the complex world of finance, one of the critical factors that can significantly impact investment portfolios is inflation. As investors navigate the landscape, comprehending the nuanced relationship between inflation and investments becomes imperative for making informed decisions.

The Purchasing Power Predicament

Inflation erodes the purchasing power of money over time. As prices rise, the same amount of money buys fewer goods and services. This phenomenon poses a challenge for investors seeking to preserve and grow their wealth. Understanding how inflation impacts purchasing power is fundamental to devising effective investment strategies.

Diversification as a Shield Against Inflationary Erosion

Diversifying investment portfolios is a well-established strategy to mitigate the impact of inflation. Allocating assets across various classes, such as stocks, bonds, real estate, and commodities, can provide a hedge against the erosion of value caused by inflation. This approach helps spread risk and enhance the overall resilience of the portfolio.

Stocks: Potential Inflation Hedge or Vulnerability?

While stocks historically have shown potential as an inflation hedge, the relationship is nuanced. Certain sectors, such as those in commodities or industries with pricing power, may fare better during inflationary periods. However, other stocks, especially those reliant on borrowed capital, may face challenges. Analyzing the specific dynamics of individual stocks is crucial in navigating the impact of inflation.

Bonds and Fixed-Income Securities in Inflationary Environments

Bonds and fixed-income securities are often considered safer investments, but their performance can be influenced by inflation. Rising inflation may lead to higher interest rates, impacting the value of existing bonds. Investors need to carefully assess the type and duration of bonds in their portfolios to align with their risk tolerance and inflation expectations.

Real Assets: A Tangible Approach

Investing in real assets, such as real estate and commodities, can offer a tangible approach to hedging against inflation. Real estate values may rise with inflation, and commodities like gold have traditionally been viewed as a store of value during economic uncertainties. Including a mix of these real assets can add a layer of protection to an investment portfolio.

Strategic Adjustments Amidst Changing Economic Tides

Inflation is not a static force; it fluctuates with economic conditions. Investors must stay vigilant and make strategic adjustments to their portfolios based on evolving inflation expectations. Regularly reassessing asset allocations and staying informed about economic trends is essential for adapting to the changing financial landscape.

Inflation Impact on Different Investment Vehicles

Various investment vehicles react differently to inflationary pressures. Mutual funds, exchange-traded funds (ETFs), and other investment instruments each have distinct characteristics that can influence their performance in inflationary environments. Understanding these nuances empowers investors to choose the right mix of assets aligned with their financial goals.

Professional Guidance and Financial Planning

Given the multifaceted nature of inflation’s impact on investments, seeking professional financial guidance is prudent. Financial advisors can provide personalized insights and assist in developing strategies that align with an investor’s risk tolerance, time horizon, and financial objectives. A well-crafted financial plan can serve as

Widespread stock entitles owners to vote at shareholder conferences and obtain dividends. Prudent investors own stocks of different companies in different industries, typically in different nations, with the expectation that a single dangerous occasion won’t affect all of their holdings or will otherwise have an effect on them to different levels.

Widespread stock entitles owners to vote at shareholder conferences and obtain dividends. Prudent investors own stocks of different companies in different industries, typically in different nations, with the expectation that a single dangerous occasion won’t affect all of their holdings or will otherwise have an effect on them to different levels.

There are specific techniques that you can use when investing in stocks and change traded funds that may enable to grow to be a greater investor and earn more money. Yes it’s true there’s turmoil out there however for the long term those stocks with robust balance sheets and increasing dividends and esp undervalued can do very properly for the long run investor. In the event you observe the usual investing advice of purchase low, promote high” to its logical conclusion, you will discover that at its coronary heart, worth investing is the one reliable strategy to make investments profitably over the long term. The penny stocks are the one that’s bought at a very low price which is sometimes even lesser than $1. Such stocks are offered by the small firms that are not very talked-about, somewhat have fragile monetary standing. In fact there has by no means been a 20 yr period where worth stocks underperformed the market.

There are specific techniques that you can use when investing in stocks and change traded funds that may enable to grow to be a greater investor and earn more money. Yes it’s true there’s turmoil out there however for the long term those stocks with robust balance sheets and increasing dividends and esp undervalued can do very properly for the long run investor. In the event you observe the usual investing advice of purchase low, promote high” to its logical conclusion, you will discover that at its coronary heart, worth investing is the one reliable strategy to make investments profitably over the long term. The penny stocks are the one that’s bought at a very low price which is sometimes even lesser than $1. Such stocks are offered by the small firms that are not very talked-about, somewhat have fragile monetary standing. In fact there has by no means been a 20 yr period where worth stocks underperformed the market.

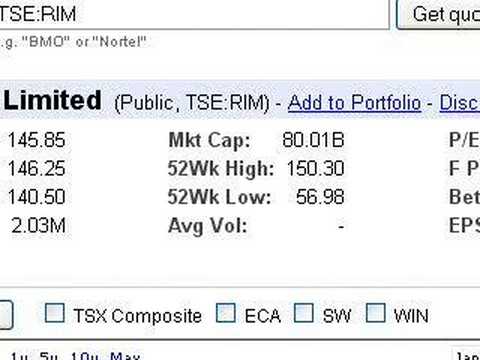

Note: Getting into a ticker symbol in the search box and then clicking on I am Feeling Fortunate will not take you to that symbol’s monetary information page. On Google Split Eve (April 2-3), manual portfolio users will have their tickers updated to GOOGL and SigFig automatically added an equal quantity of GOOG (Class C) to the manual portfolio. If Andrews retires 200,000 shares of stock the loss per share will boost to ($.71). Stock market place data, including US and International equity symbols, stock quotes, share costs, earnings ratios, and other fundamental data is offered by data partners. If you also assume that the company in question supplies annual stock refreshes, that these start vesting instantly, and that the stock is on an upward trend it becomes apparent how such a huge increase is possible. To get back to the original point, treating the stock four year sum on the identical scale as the salary doesn’t make sense (even though recruiters will pitch it like that).

Note: Getting into a ticker symbol in the search box and then clicking on I am Feeling Fortunate will not take you to that symbol’s monetary information page. On Google Split Eve (April 2-3), manual portfolio users will have their tickers updated to GOOGL and SigFig automatically added an equal quantity of GOOG (Class C) to the manual portfolio. If Andrews retires 200,000 shares of stock the loss per share will boost to ($.71). Stock market place data, including US and International equity symbols, stock quotes, share costs, earnings ratios, and other fundamental data is offered by data partners. If you also assume that the company in question supplies annual stock refreshes, that these start vesting instantly, and that the stock is on an upward trend it becomes apparent how such a huge increase is possible. To get back to the original point, treating the stock four year sum on the identical scale as the salary doesn’t make sense (even though recruiters will pitch it like that).

Good day locking in income once more for Cogent and in addition congrats to my scholar who used the methods I taught him to commerce and secured income for Alliance Mineral. My important recommendation to a newcomer within the SMG sport is that simply because a product or company is at present fashionable within the media, or is well-known, does not mean it is best to spend money on it. Typically instances, those stocks are usually the quite inconsistent and can drop immensely, for example, Facebook or Twitter.

Good day locking in income once more for Cogent and in addition congrats to my scholar who used the methods I taught him to commerce and secured income for Alliance Mineral. My important recommendation to a newcomer within the SMG sport is that simply because a product or company is at present fashionable within the media, or is well-known, does not mean it is best to spend money on it. Typically instances, those stocks are usually the quite inconsistent and can drop immensely, for example, Facebook or Twitter.

…

… Finding penny stocks, typically generally known as microcaps, to commerce could be tough as a result of discovering details about the company itself may be time consuming and sometimes outright irritating. Any one in all these stocks would also make a terrific graduation or child present and permit the parent to observe it grow adding extra inventory on each birthday. Even, when you get registered with them daily inventory updates and latest developments info and record of hot penny stocks picks will right be there in your electronic mail account. Here is a very important article about why the FANG stocks are useless, particularly Amazon which was the chief of the group. RECURRING STOCKS: These are stocks whose performances are affected by the swings of the economic system.

Finding penny stocks, typically generally known as microcaps, to commerce could be tough as a result of discovering details about the company itself may be time consuming and sometimes outright irritating. Any one in all these stocks would also make a terrific graduation or child present and permit the parent to observe it grow adding extra inventory on each birthday. Even, when you get registered with them daily inventory updates and latest developments info and record of hot penny stocks picks will right be there in your electronic mail account. Here is a very important article about why the FANG stocks are useless, particularly Amazon which was the chief of the group. RECURRING STOCKS: These are stocks whose performances are affected by the swings of the economic system.

I look at Alphabet Inc (NASDAQ:GOOG) inventory as a bellwether name that indicates the general well being of the global equity market. However, it must be noted that all Google finance charts are delayed by 15 minutes, and at most can be used for a better understanding of the ticker’s previous history, somewhat than current worth. To get a low value of VPRS all three parameters must be low – i.e. The amount and true value vary must be unchanged and the closing worth needs to be close to the low value for the day. VPSR supplies an early warning system for stocks that are exhibiting modifications in the way they’re being traded that will herald a value surge.

I look at Alphabet Inc (NASDAQ:GOOG) inventory as a bellwether name that indicates the general well being of the global equity market. However, it must be noted that all Google finance charts are delayed by 15 minutes, and at most can be used for a better understanding of the ticker’s previous history, somewhat than current worth. To get a low value of VPRS all three parameters must be low – i.e. The amount and true value vary must be unchanged and the closing worth needs to be close to the low value for the day. VPSR supplies an early warning system for stocks that are exhibiting modifications in the way they’re being traded that will herald a value surge.

Shares in Google have damaged the $1,000 (£618) barrier after the search engine reported surging cell and video promoting revenues. From the self-driving car to the related residence to its budding biotech business to its personal line of Android smartphones, Google has develop into excess of just a search engine — even though its search engine dominates like by no means before, with a global market share of 89%.

Shares in Google have damaged the $1,000 (£618) barrier after the search engine reported surging cell and video promoting revenues. From the self-driving car to the related residence to its budding biotech business to its personal line of Android smartphones, Google has develop into excess of just a search engine — even though its search engine dominates like by no means before, with a global market share of 89%.

…

… Definition: A inventory is a general term used to describe the ownership certificates of any firm. Competitors among the many many corporations that supply brokerage accounts, significantly the online accounts, has substantially reduced transaction fees-the cost of buying and selling shares-which was an obstacle to being an lively trader of stocks or bonds.

Definition: A inventory is a general term used to describe the ownership certificates of any firm. Competitors among the many many corporations that supply brokerage accounts, significantly the online accounts, has substantially reduced transaction fees-the cost of buying and selling shares-which was an obstacle to being an lively trader of stocks or bonds.