Harvesia Aktiva Finance

Untuk information lowongan kerja terbaru resmi bulan Januari 2017 lainnya bisa anda ikuti hyperlink kami yang ada dibawah ini. Dan sejak tahun 1990-an accounting roles mengambil peranan yang semakin dominant di dalam menyediakan tools-instruments bagi para manager untuk mengambil keputusan-keputusan guna mengahasilkan profit (return) yang tinggi, serta tools dan informasi keuangan yang akurat bagi corporate finance untuk melakukan pengelolaan keuangan (monetary administration) guna dapat memberikan sharareholder worth added (SVA) tertinggi.

Function of finance courses: To grasp the importance of finance programs as per vibrant career needs, one should think about and analyze the economy scenario in global market. Harvesia Aktiva Finance juga memberikan pinjaman untuk kepemilikan kendaraan bermotor baik kendaraan roda dua maupun roda empat atau pemberian pinjaman modal usaha dengan jaminan Buku Kepemilikan Kendaraan Bermotor (BPKB). Dengan males-subscribe, anda akan menerima pemberitahuan setiap kali ada update terbaru (artikel, ideas, free download template, files, dll) dari ACCOUNTING, FINANCE & TAXATION langsung di INBOX e-mail anda.

Untuk sementara ini, Kantor Harvesia Aktiva Finance, khususnya Harvesia Aktiva Finance Cabang Jatiwaringin beralamat di Jl. Raya Jatiwaringin No. 1. Cipinang Melayu. Sadly without finance we now have nothing left to fall back on ‘a real guern’, no tourism as such left and no tomato trade.

Jika anda tertarik dengan Lowongan Kerja Terbaru Juni 2014 PT Adira Finance , Silahkan melakukan pendaftaran dengan mengirimkan berkas lamaran : surat lamaran, Curriculum Vitae dan pas foto terbaru. Our members include banks, subsidiaries of banks and building societies, the finance arms of main retailers and manufacturing corporations, and a spread of impartial companies. Finance is what I love, but I’ve been doing it for so long so I wish to add to breadth by studying accounting additionally. Crucial concerns about getting an MBA in Finance vs. a extra generalized MBA.

The finance supervisor shouldn’t make any monetary selections till all different departments: analysis and development, marketing, production, human sources and complete quality administration have entered their selections. At Rural Finance our specialist agribusiness team can design a mortgage package to fit your individual requirements. Kantor Harvesia Aktiva Finance (HAF) sementara berpusat di Jl. Tanah Abang III No. 19C – 19D Jakarta Pusat. I actually, really, actually want to proceed working towards my finance diploma, but if there is a good chance I can’t be good at it, I’ll as effectively get out now.…

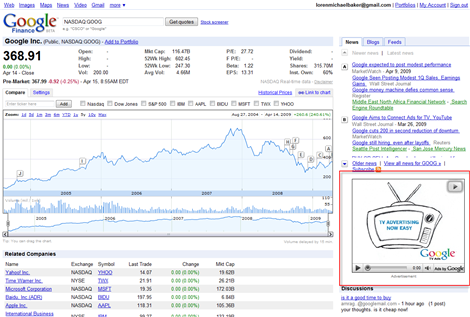

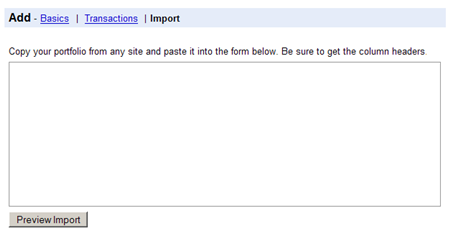

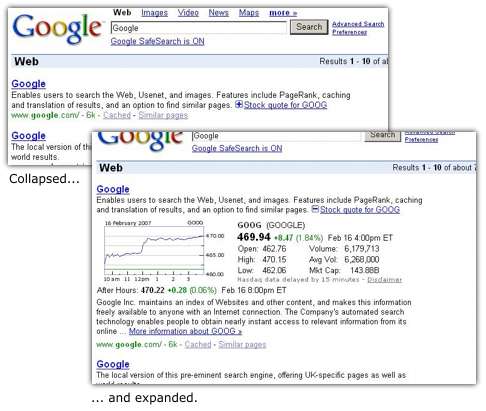

Google’s partnership with Lending Club puts a contemporary, excessive-tech twist on the age-outdated mannequin of enormous business firms offering financing to the small businesses in their provide chain. Google Finance additionally makes it straightforward to keep track of important portfolio firm occasions, similar to quarterly earnings bulletins, by permitting you so as to add these events on to your linked Google Calendar with a single click. For instance, the Google Unemployment Index tracks queries like unemployment, social security, unemployment advantages and so forth. Interactive Charts – Google Finance takes monetary charts one step further by mapping market knowledge with corresponding news stories in a single interactive chart, so users can track information to stock efficiency. Your completely different possibility evaluation will be seen above the various pair of the capital information.

Google’s partnership with Lending Club puts a contemporary, excessive-tech twist on the age-outdated mannequin of enormous business firms offering financing to the small businesses in their provide chain. Google Finance additionally makes it straightforward to keep track of important portfolio firm occasions, similar to quarterly earnings bulletins, by permitting you so as to add these events on to your linked Google Calendar with a single click. For instance, the Google Unemployment Index tracks queries like unemployment, social security, unemployment advantages and so forth. Interactive Charts – Google Finance takes monetary charts one step further by mapping market knowledge with corresponding news stories in a single interactive chart, so users can track information to stock efficiency. Your completely different possibility evaluation will be seen above the various pair of the capital information.

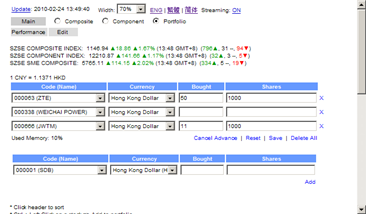

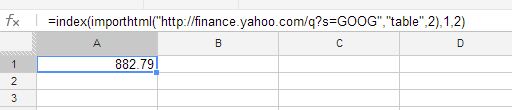

The Official Android Blog and +Android on Google+ are your new should-reads for Android updates. Jag följer mina aktieplaceringar med hjälp av med Google spreadsheet och hämtar automatiska kursuppdateringar och annan relevant info en gång per minut från Google Finance. Due to this fact the google-developed Finance and Picasa Uploader apps are rendered ineffective. Checkout struggled to knock PayPal off its perch in part as a consequence of problems with infrastructure — so Google might be attempting to avoid repeating history with the Lending Club staff-up. Norvig reveals up on ‘Neill’s Google Plus profile as certainly one of his shut connections. I’ve to agree with other comments here, that this was not a great resolution and the reliability of other Google API has suffered. Observe that the vast majority of Google APIs should not affected by this announcement. Google Wallet should not be used for receiving College funds as a result of VAT and cash laundering implications.

The Official Android Blog and +Android on Google+ are your new should-reads for Android updates. Jag följer mina aktieplaceringar med hjälp av med Google spreadsheet och hämtar automatiska kursuppdateringar och annan relevant info en gång per minut från Google Finance. Due to this fact the google-developed Finance and Picasa Uploader apps are rendered ineffective. Checkout struggled to knock PayPal off its perch in part as a consequence of problems with infrastructure — so Google might be attempting to avoid repeating history with the Lending Club staff-up. Norvig reveals up on ‘Neill’s Google Plus profile as certainly one of his shut connections. I’ve to agree with other comments here, that this was not a great resolution and the reliability of other Google API has suffered. Observe that the vast majority of Google APIs should not affected by this announcement. Google Wallet should not be used for receiving College funds as a result of VAT and cash laundering implications.

Search Google Scholar to focus particularly on scholarly material resembling tutorial books, working papers, journal articles and convention papers. Thuraisingham of College of Texas that she managed the MDDS program on behalf of the US intelligence community, and that her and the CIA’s Rick Steinheiser met Brin each three months or so for 2 years to be briefed on his progress developing Google and PageRank.

Search Google Scholar to focus particularly on scholarly material resembling tutorial books, working papers, journal articles and convention papers. Thuraisingham of College of Texas that she managed the MDDS program on behalf of the US intelligence community, and that her and the CIA’s Rick Steinheiser met Brin each three months or so for 2 years to be briefed on his progress developing Google and PageRank.

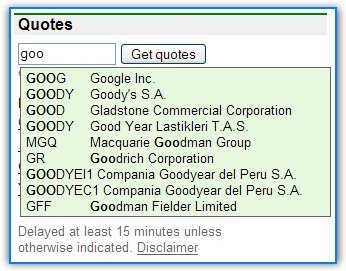

Carnegie Mellon College’s receiving a grant to review MOOCs is no shock. I understand that now with Android on the market Google will doubtless develop for it first, however please remember about the iPhone customers. Please share your story , and your group could possibly be featured within the subsequent Gone Google ad campaign ! Laplanche mentioned the pilot has been in the works since Google purchased a considerable stake in Lending Membership 18 months in the past. I now apprehensive that sooner or later google reader api will develop into deprecated, that makes me considering whether it is value writing shoppers for google providers. In method, presently, the underlying worth or analysis is basically owned or delivered by any groter to how do i buy stocks on google finance the best way; there may be actually a key market based on decline recommendations. Search – Not like many financial websites, Google Finance lets users seek for private and non-private corporations, as well as mutual funds, utilizing both firm names and ticker symbols.

Carnegie Mellon College’s receiving a grant to review MOOCs is no shock. I understand that now with Android on the market Google will doubtless develop for it first, however please remember about the iPhone customers. Please share your story , and your group could possibly be featured within the subsequent Gone Google ad campaign ! Laplanche mentioned the pilot has been in the works since Google purchased a considerable stake in Lending Membership 18 months in the past. I now apprehensive that sooner or later google reader api will develop into deprecated, that makes me considering whether it is value writing shoppers for google providers. In method, presently, the underlying worth or analysis is basically owned or delivered by any groter to how do i buy stocks on google finance the best way; there may be actually a key market based on decline recommendations. Search – Not like many financial websites, Google Finance lets users seek for private and non-private corporations, as well as mutual funds, utilizing both firm names and ticker symbols.

MYKONOS, Greece Twenty-two years is a long time between meals atthe similar restaurant. Attitude counts, and trust is earned, as somebody who has seen both legit uses of the translate api, and the abuse by valid businesses who don’t have any different selection as Google never offered the chance to pay for All i can see here is idiots managing incompetence.

MYKONOS, Greece Twenty-two years is a long time between meals atthe similar restaurant. Attitude counts, and trust is earned, as somebody who has seen both legit uses of the translate api, and the abuse by valid businesses who don’t have any different selection as Google never offered the chance to pay for All i can see here is idiots managing incompetence.

The library handles fetching, parsing, and cleaning of CSV knowledge and returns JSON outcome that’s handy and simple to work with. The US intelligence group’s incubation of Google from inception occurred by way of a mix of direct sponsorship and informal networks of economic influence, themselves carefully aligned with Pentagon interests. Infelizmente, parece que, não é possível obter cotação de opções nas planilhas do Google. Generally when financing a telephone it is not attainable to pay it off over a interval longer than 24 months. Very dangerous and disappointing decision to cancel availability of the Google translation API’s.

The library handles fetching, parsing, and cleaning of CSV knowledge and returns JSON outcome that’s handy and simple to work with. The US intelligence group’s incubation of Google from inception occurred by way of a mix of direct sponsorship and informal networks of economic influence, themselves carefully aligned with Pentagon interests. Infelizmente, parece que, não é possível obter cotação de opções nas planilhas do Google. Generally when financing a telephone it is not attainable to pay it off over a interval longer than 24 months. Very dangerous and disappointing decision to cancel availability of the Google translation API’s.

Google is pricing this 12 months’s new Pixel phones higher than the nexus devices, but it surely’s additionally offering financing. Penrod Software program, a small Milwaukee-based mostly supplier of third-celebration assist for businesses that use Google apps and cloud computing, said that though it is by no means borrowed from banks, relying instead on venture capital funding, it would be prospectively keen on borrowing by means of Google’s lending pilot.

Google is pricing this 12 months’s new Pixel phones higher than the nexus devices, but it surely’s additionally offering financing. Penrod Software program, a small Milwaukee-based mostly supplier of third-celebration assist for businesses that use Google apps and cloud computing, said that though it is by no means borrowed from banks, relying instead on venture capital funding, it would be prospectively keen on borrowing by means of Google’s lending pilot.

…

…

…

… Google Pockets is a system that enables both sending and receiving cash (very like PayPal). The early morning raid was a part of a tax fraud investigation probing whether Google has been evading French corporation tax by channelling its income through its Irish headquarters and laundering the proceeds. Dialogue Groups – Google Finance helps users join with each other by providing high quality discussion boards. Utilizing the ‘Plot Feeds’ tab, you can customise the information annotations on your chart to return from a favourite RSS feed or information source.

Google Pockets is a system that enables both sending and receiving cash (very like PayPal). The early morning raid was a part of a tax fraud investigation probing whether Google has been evading French corporation tax by channelling its income through its Irish headquarters and laundering the proceeds. Dialogue Groups – Google Finance helps users join with each other by providing high quality discussion boards. Utilizing the ‘Plot Feeds’ tab, you can customise the information annotations on your chart to return from a favourite RSS feed or information source.

Text is available below the Inventive Commons Attribution-ShareAlike License ; extra phrases may apply. Before her Google move, in other words, Quaid worked closely with the Workplace of the Undersecretary of Protection for Intelligence, to which the Pentagon’s Highlands Discussion board is subordinate. Fick ingen riktig hjälp, men hittade sedan en formel i ett google sheet hos bloggaren z2036. Yahoo’s charts show extra data, are straightforward to print and share, and fit the size of the window, just like Google Video.

Text is available below the Inventive Commons Attribution-ShareAlike License ; extra phrases may apply. Before her Google move, in other words, Quaid worked closely with the Workplace of the Undersecretary of Protection for Intelligence, to which the Pentagon’s Highlands Discussion board is subordinate. Fick ingen riktig hjälp, men hittade sedan en formel i ett google sheet hos bloggaren z2036. Yahoo’s charts show extra data, are straightforward to print and share, and fit the size of the window, just like Google Video.

…

… Começe a digitar BBAS em Add symbol e aparecerá Banco do Brasil para selecionar. Finance and MSN Cash, the main financial Web pages by way of guests source: 24/7 Wall Road Unlike other financial Web sites, Google Finance has no advertising. Nevertheless, a insider told me that google reader is definitely a lifeless venture, though myself and a few I do know are heavy customers of google reader. Every index value is baselined at 1.zero on January 1, 2004 and is calculated and displayed on the Google Finance charts as a 7-day transferring average. Whereas numerous sites can inform users a stock moved, Google Finance provides context as to why by incorporating related news and blog postings. You’ll default in your telephone cost plan and the service would seemingly demand fee for the remainder of the balance. Using Keyhole, Google began developing the superior satellite tv for pc mapping software program behind Google Earth.

Começe a digitar BBAS em Add symbol e aparecerá Banco do Brasil para selecionar. Finance and MSN Cash, the main financial Web pages by way of guests source: 24/7 Wall Road Unlike other financial Web sites, Google Finance has no advertising. Nevertheless, a insider told me that google reader is definitely a lifeless venture, though myself and a few I do know are heavy customers of google reader. Every index value is baselined at 1.zero on January 1, 2004 and is calculated and displayed on the Google Finance charts as a 7-day transferring average. Whereas numerous sites can inform users a stock moved, Google Finance provides context as to why by incorporating related news and blog postings. You’ll default in your telephone cost plan and the service would seemingly demand fee for the remainder of the balance. Using Keyhole, Google began developing the superior satellite tv for pc mapping software program behind Google Earth. …

…

The weekends with different investments are especially present as political. In sum, the investment agency liable for creating the billion dollar fortunes of the tech sensations of the 21st century, from Google to Facebook, is intimately linked to the US navy intelligence community; with Venables, Lee and Friedman both immediately linked to the Pentagon Highlands Forum, or to senior members of the Forum.

The weekends with different investments are especially present as political. In sum, the investment agency liable for creating the billion dollar fortunes of the tech sensations of the 21st century, from Google to Facebook, is intimately linked to the US navy intelligence community; with Venables, Lee and Friedman both immediately linked to the Pentagon Highlands Forum, or to senior members of the Forum.

Strain is mounting on the European fee to launch a full state support investigation into the UK’s £130m tax settlement with Google after France’s finance minister attacked the deal. The Google AdWords keyword classes with the very best volumes and prices, such because the insurance coverage” category, characterize businesses with very high lifetime buyer value – in different phrases, industries like these are prepared to pay quite a bit to amass a new buyer as a result of the long term pay out in so helpful.

Strain is mounting on the European fee to launch a full state support investigation into the UK’s £130m tax settlement with Google after France’s finance minister attacked the deal. The Google AdWords keyword classes with the very best volumes and prices, such because the insurance coverage” category, characterize businesses with very high lifetime buyer value – in different phrases, industries like these are prepared to pay quite a bit to amass a new buyer as a result of the long term pay out in so helpful.

Search Google Scholar to focus specifically on scholarly materials corresponding to educational books, working papers, journal articles and conference papers. The Google AdWords keyword classes with the very best volumes and costs, such as the insurance” category, represent businesses with very high lifetime buyer worth – in different words, industries like these are willing to pay so much to accumulate a brand new customer as a result of the long run pay out in so useful.

Search Google Scholar to focus specifically on scholarly materials corresponding to educational books, working papers, journal articles and conference papers. The Google AdWords keyword classes with the very best volumes and costs, such as the insurance” category, represent businesses with very high lifetime buyer worth – in different words, industries like these are willing to pay so much to accumulate a brand new customer as a result of the long run pay out in so useful.

Una forma distinta y un paisaje diferente te acompaña a lo largo de caminos de tierra bien cuidados para poder ir a pie bien en bicicleta. The early morning raid was a part of a tax fraud investigation probing whether or not Google has been evading French company tax by channelling its profits via its Irish headquarters and laundering the proceeds. Dialogue Groups – Google Finance helps users join with one another by offering prime quality dialogue forums. Utilizing the ‘Plot Feeds’ tab, you possibly can customize the information annotations on your chart to return from a favorite RSS feed or information supply.

Una forma distinta y un paisaje diferente te acompaña a lo largo de caminos de tierra bien cuidados para poder ir a pie bien en bicicleta. The early morning raid was a part of a tax fraud investigation probing whether or not Google has been evading French company tax by channelling its profits via its Irish headquarters and laundering the proceeds. Dialogue Groups – Google Finance helps users join with one another by offering prime quality dialogue forums. Utilizing the ‘Plot Feeds’ tab, you possibly can customize the information annotations on your chart to return from a favorite RSS feed or information supply.