Rising Markets And Wholesome Markets

The Housing Market is in turmoil as the worth of the British pound continues to say no resulting from uncertainty following the vote to leave the ecu union. An increasing variety of persons are concerned within the stock market, particularly for the reason that social safety and retirement plans are being more and more privatized and linked to stocks and bonds and other elements of the market. Just like the cease order the MIT order is executed if the market worth reaches the MIT price you may have elected. We must additionally understand that the California housing market might take down the complete US financial system. The main advice that I can give newcomers to the sport is to be as versatile as attainable, because the inventory market is continually changing. That is used by most traders due to the truth that inventory prices can change from second to second, however they usually have a sample of both going up or down that may be analyzed and adopted.

The Housing Market is in turmoil as the worth of the British pound continues to say no resulting from uncertainty following the vote to leave the ecu union. An increasing variety of persons are concerned within the stock market, particularly for the reason that social safety and retirement plans are being more and more privatized and linked to stocks and bonds and other elements of the market. Just like the cease order the MIT order is executed if the market worth reaches the MIT price you may have elected. We must additionally understand that the California housing market might take down the complete US financial system. The main advice that I can give newcomers to the sport is to be as versatile as attainable, because the inventory market is continually changing. That is used by most traders due to the truth that inventory prices can change from second to second, however they usually have a sample of both going up or down that may be analyzed and adopted.

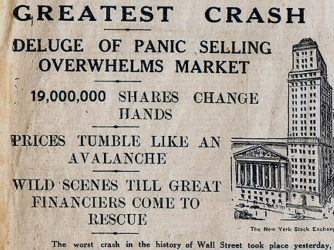

To somebody who is new to The Inventory Market Sport, I would primarily advise him or her to conduct research on each stock earlier than deciding to invest in it. Research, I imagine, is crucial consider successful investing. Very good evaluation of the connection between the Crash of ’29 and at present’s market circumstances. In different phrases, as soon as this sucker rally takes money from common Joe, the smart cash is going to get out of the inventory market ! You are not concerned about whether the market is going down or up. You aren’t concerned with market sentiments. If you see everyone promoting in a inventory market crash, you need to start to look for the purchase point. A buy stop could be positioned above the market to initiate a brand new long place or close an present quick place. For example, let’s say you acquire one share or inventory in the Disney® company for one greenback.

There may be an excessive amount of bold font, and the discussion is an assortment of issues, together with your tackle the Federal Reserve, some pundit’s tackle unemployment, references to the mysterious crash in Could, your opinion on whether the market was oversold and many others.

Even when a inventory appears to be sky-rocketing in value it could at any minute crash without discover. Within the United States the SEC launched several new measures of control into the stock market in an try to forestall a re-prevalence of the occasions of Black Monday. The biggest inventory market in the United States, by market capitalization, is the New York Inventory Change (NYSE). A purchase limit order is positioned beneath the present market price and states the best value the dealer is keen to pay for a purchase order. A latest article by me on the In search of Alpha website indicated that reverse repos might deliver the inventory market down and increase volatility. Treasury bonds are going up in value (yields are declining) as …

There are several different iPhone / iPad inventory market games that allow folks use a cellular application to simulate buying and selling stocks available on the market. You have to to sell for a profit in some unspecified time in the future although as a result of we are so near the height in the market that purchase and maintain is lifeless. The only factor you are able to do is, do sufficient analysis, achieve enough info and make proper prediction, earlier than you put money into penny stocks. Each investor together with you that’s studying this write-up is like the proverbial Oliver Twist, we at all times need extra at any time when we make earnings from our trading, and it is a human emotional weak point each investor should watch. These books about dividends will teach what to search for in steady dividend paying stocks. When a company performs trading in a inventory market of another country, their stocks are generally known as International stocks. If you want to know extra about The Best Penny Stocks then you might be at proper place.

There are several different iPhone / iPad inventory market games that allow folks use a cellular application to simulate buying and selling stocks available on the market. You have to to sell for a profit in some unspecified time in the future although as a result of we are so near the height in the market that purchase and maintain is lifeless. The only factor you are able to do is, do sufficient analysis, achieve enough info and make proper prediction, earlier than you put money into penny stocks. Each investor together with you that’s studying this write-up is like the proverbial Oliver Twist, we at all times need extra at any time when we make earnings from our trading, and it is a human emotional weak point each investor should watch. These books about dividends will teach what to search for in steady dividend paying stocks. When a company performs trading in a inventory market of another country, their stocks are generally known as International stocks. If you want to know extra about The Best Penny Stocks then you might be at proper place.