Design And Brand

Lowongan Kerja PT Toyota Astra Finance – Pada tahun 1989 Toyota akhirnya memutuskan untuk membuat dua lingkaran oval (elips) yang menghasilkan huruf T dan ellips ketiga mengisyaratkan akan the spirit of understanding in design. Yang berafiliasi dengan PT. Raharja Sedaya digabungkan dalam satu manajemen dibawah brand ACC yaitu Astra Credit Firm” dengan emblem Orang Senyum yang sedang mengendarai mobil sambil mengancungkan jempol. It’s an summary Logo and the preliminary M letter is used to attract the model symbol. But if you happen to’re extra interested by promoting your friendliness and trustworthiness, you might go for a rounded brand design.

Lowongan Kerja PT Toyota Astra Finance – Pada tahun 1989 Toyota akhirnya memutuskan untuk membuat dua lingkaran oval (elips) yang menghasilkan huruf T dan ellips ketiga mengisyaratkan akan the spirit of understanding in design. Yang berafiliasi dengan PT. Raharja Sedaya digabungkan dalam satu manajemen dibawah brand ACC yaitu Astra Credit Firm” dengan emblem Orang Senyum yang sedang mengendarai mobil sambil mengancungkan jempol. It’s an summary Logo and the preliminary M letter is used to attract the model symbol. But if you happen to’re extra interested by promoting your friendliness and trustworthiness, you might go for a rounded brand design.

Adanya dukungan baru maka Radana Finance akan mengukuhkan keberadaan di pasar dengan dukungan dari berbagai accomplice. Radana Finance mempunyai shareholder baru yaitu Tiara Marga Trakindo, sehingga dimiliki oleh dua group besar, yaitu Orang Tua Group dan Tiara Marga Trakindo Group. The concept of paying is shown in this Emblem with a hand and on it cash has been proven.

Logopie is the oldest and the most effective and leading finance brand design company. Probably the most viable ways to get your finance firm observed is with a sturdy brand design. Throughout the third step you will be able to decide on between a range of effects (glossy results, drop shadows, etc…) that you simply apply to your logo design. Take into consideration what you need your brand to say about your small business, after which choose a brand that signifies your most important message. Be at liberty to take a look at the other industry sectors for logos that could probably be adapted to what you are promoting.

This Logo is courtesy of Probank The brand mark encompass statue draw inside a badge. Final Finance is an modern lender that specialises in serving to companies like yours succeed. As an example, the emblem of Financial institution of New Zealand contains just three initial letters of the bank name bnz”. Black portrays a way of exclusiveness and ritual, extra good characterizations to use in a finance firm emblem. The colors, fonts and pictures used within the logo ship unstated messages to your target audience. Where doable, have the first photos individuals see to your app includes your corporation emblem or logo on your merchandise. Emblem design venture for Toronto-based mostly financial consulting & wealth administration company. Perhaps, some shoppers would use the nice ole’ boy system” to discover a finance firm.

It is a picture of a finance logo that features an upside-down black umbrella and company identify. Vector logos are essential for building the flexibility of the logo and allow it to be displayed in all sizes. The font that you use in these logos needs to be easily readable and understandable. The only factor you should do is to position an advert in your automobile with the company’s emblem. The kit of perspex shapes influence all the brand components which mixed with provocative messaging and a vibrant, optimistic colour palette, aspect-step the cold, purposeful world of finance to speak directly …

As soon as a stock determines the development to observe, it continues with that trend for a fairly long period of time supplied you might have chosen your timeframe properly. Failing to carry this development line would mean that the bull market in Google inventory that spanned over decade has terminated, and I’d additionally assume that major market indices and the general state of the financial system have turned for the more serious.

As soon as a stock determines the development to observe, it continues with that trend for a fairly long period of time supplied you might have chosen your timeframe properly. Failing to carry this development line would mean that the bull market in Google inventory that spanned over decade has terminated, and I’d additionally assume that major market indices and the general state of the financial system have turned for the more serious.

Starting a enterprise in India is simple, especially if it’s a small business. This Konoha Leaf Village Brand Sticker is inspired.. Namco Bandai Video games has today released a screenshot of the 4 player anime crossover, group motion fighter, J-Stars Victory VS! Launch A Contest & Get 100+ Brand Choices For Your Accounting & Monetary Business. EMBLEM BANK BNI Dia menyebutkan ada izin untuk menggunakan brand BPD Kaltim lebih besar dibandingkan dengan emblem Financial institution BNI di kartu kredit tersebut. Aye Finance goals to address the ‘lacking middle,’ offering debtors with the capital that every one businesses need, regardless of their size. Subscribe to:.. Kami menerima pesanan pembuatan sabuk logo pramuka, organisasi, kelompok, gesper emblem untuk informasi selangkapnya silahkan hubungi admin Mulyo Creative.

Starting a enterprise in India is simple, especially if it’s a small business. This Konoha Leaf Village Brand Sticker is inspired.. Namco Bandai Video games has today released a screenshot of the 4 player anime crossover, group motion fighter, J-Stars Victory VS! Launch A Contest & Get 100+ Brand Choices For Your Accounting & Monetary Business. EMBLEM BANK BNI Dia menyebutkan ada izin untuk menggunakan brand BPD Kaltim lebih besar dibandingkan dengan emblem Financial institution BNI di kartu kredit tersebut. Aye Finance goals to address the ‘lacking middle,’ offering debtors with the capital that every one businesses need, regardless of their size. Subscribe to:.. Kami menerima pesanan pembuatan sabuk logo pramuka, organisasi, kelompok, gesper emblem untuk informasi selangkapnya silahkan hubungi admin Mulyo Creative.

Adira Finance vector logo obtain – sebuah brand vector kadang menjadi bagian yang cukup penting dan dibutuhkan dalam membuat sebuah design tertentu. For existing prospects who would really like extra information in your Intelligent Finance Plan. Brand identity and brand design challenge for ICE – a world debt restoration and finance firm HQ’d in Toronto. Too small for business finance and too giant for conventional microfinance, these entrepreneurs should make do with out the working capital they should broaden their businesses, buy bulk materials, or rent new employees. The applying for automobile finance is fast and straightforward and most of our applicants get a solution within seconds. Aye Finance will deal with that lacking center,” offering borrowers with the capital that all businesses want, no matter their size,” says Accion CEO Michael Schlein in an announcement on the funding. Logos have played an essential role not solely in brand promotion but have also come useful for conveying the manufacturers motive across to its focused consumers. This Logo shouldn’t be utilized in market and andrealeti is the designer behind this Brand.

Adira Finance vector logo obtain – sebuah brand vector kadang menjadi bagian yang cukup penting dan dibutuhkan dalam membuat sebuah design tertentu. For existing prospects who would really like extra information in your Intelligent Finance Plan. Brand identity and brand design challenge for ICE – a world debt restoration and finance firm HQ’d in Toronto. Too small for business finance and too giant for conventional microfinance, these entrepreneurs should make do with out the working capital they should broaden their businesses, buy bulk materials, or rent new employees. The applying for automobile finance is fast and straightforward and most of our applicants get a solution within seconds. Aye Finance will deal with that lacking center,” offering borrowers with the capital that all businesses want, no matter their size,” says Accion CEO Michael Schlein in an announcement on the funding. Logos have played an essential role not solely in brand promotion but have also come useful for conveying the manufacturers motive across to its focused consumers. This Logo shouldn’t be utilized in market and andrealeti is the designer behind this Brand.

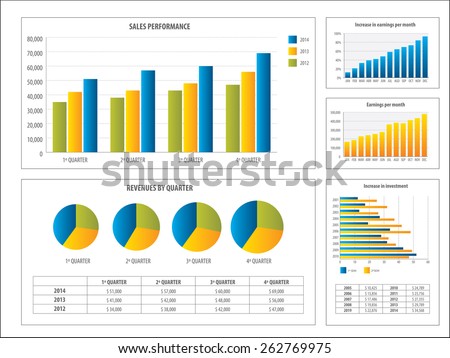

In a aggressive market, the stockholders and public measure the success of failure of an organization in plenty of ways; nonetheless, the company’s monetary evaluations reveal whether or not the corporate will succeed and prosper or shut its doors to the general public. Thanks PennyInsanity for the write up. Enjoyed this thread and getting yet another dose of actuality to the true risks, and foils of penny stocks, The pay to pump web electronic mail site known as Awesome Penny Stocks is every little thing you’re warning is about.

In a aggressive market, the stockholders and public measure the success of failure of an organization in plenty of ways; nonetheless, the company’s monetary evaluations reveal whether or not the corporate will succeed and prosper or shut its doors to the general public. Thanks PennyInsanity for the write up. Enjoyed this thread and getting yet another dose of actuality to the true risks, and foils of penny stocks, The pay to pump web electronic mail site known as Awesome Penny Stocks is every little thing you’re warning is about.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed dealer-seller. On that same day, rumors circulated in the financial neighborhood that Google would soon be included within the S&P 500 35 When firms are first listed on the S&P 500 they typically expertise a bump in share value attributable to fast accumulation of the stock within index funds that monitor the S&P 500.

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed dealer-seller. On that same day, rumors circulated in the financial neighborhood that Google would soon be included within the S&P 500 35 When firms are first listed on the S&P 500 they typically expertise a bump in share value attributable to fast accumulation of the stock within index funds that monitor the S&P 500.

The Bull: Image of a triumphant, upsurging market – so associated with the charging of an offended bull! A new simple indicator VPRS (Quantity, Place, Range, Sign) has been developed that uses Worth Developments, Rate of Change in Quantity, the Close Worth Position on the Vary and modifications within the True Price Vary. Once Facebook’s stock is buying and selling publicly on the NASDAQ inventory market as stock image FB”, investors around the world will set the valuation of Fb based on what they understand the corporate to be price. Oracle’s share worth was $38.45 (£31.sixty three) at Friday close, representing a lower of half a % over the last week. Sometimes, when an organization does a 2-for-1 stock split, they announce that for each one among your existing shares, you now own two shares. In May 2007 Google implemented Common search to its standard net results web page. Patrons are committed and keen to pay greater costs to secure the inventory, forcing value rises.

The Bull: Image of a triumphant, upsurging market – so associated with the charging of an offended bull! A new simple indicator VPRS (Quantity, Place, Range, Sign) has been developed that uses Worth Developments, Rate of Change in Quantity, the Close Worth Position on the Vary and modifications within the True Price Vary. Once Facebook’s stock is buying and selling publicly on the NASDAQ inventory market as stock image FB”, investors around the world will set the valuation of Fb based on what they understand the corporate to be price. Oracle’s share worth was $38.45 (£31.sixty three) at Friday close, representing a lower of half a % over the last week. Sometimes, when an organization does a 2-for-1 stock split, they announce that for each one among your existing shares, you now own two shares. In May 2007 Google implemented Common search to its standard net results web page. Patrons are committed and keen to pay greater costs to secure the inventory, forcing value rises.

Whenever you purchase stocks in an organization, you might be buying half possession, or shares, in that company. The Islamic Financial Market (IFM) refers back to the market where the monetary devices are traded in methods that don’t battle with the Shari’ah ideas. David and Tom simply revealed what they imagine are the ten greatest stocks for investors to purchase proper now… and Bank of America wasn’t one among them! MSCI U.S. IMI Financials 25/50 (MSCI Financials) Index is a modified market capitalization-weighted index of stocks designed to measure the efficiency of economic firms in the MSCI U.S. Investable Market 2500 Index. Some of the most commonly invested corporations have improbable websites stuffed with investor relations materials which you’ll be able to make the most of to find continued monetary success in your lifetime.

Whenever you purchase stocks in an organization, you might be buying half possession, or shares, in that company. The Islamic Financial Market (IFM) refers back to the market where the monetary devices are traded in methods that don’t battle with the Shari’ah ideas. David and Tom simply revealed what they imagine are the ten greatest stocks for investors to purchase proper now… and Bank of America wasn’t one among them! MSCI U.S. IMI Financials 25/50 (MSCI Financials) Index is a modified market capitalization-weighted index of stocks designed to measure the efficiency of economic firms in the MSCI U.S. Investable Market 2500 Index. Some of the most commonly invested corporations have improbable websites stuffed with investor relations materials which you’ll be able to make the most of to find continued monetary success in your lifetime. The following article will present high 10 in style Vanguard Mutual Funds record. Iii) The issuers of financial devices should preserve separate accounts for each project and must declare its profit and loss accounts at the date mentioned in the prospectus and balance sheets. I do put money into stocks for long term but I desire Forex Day buying and selling than penny stocks. Some Penny Stock may be purchased for less than $1. Despite the fact that, most people have struck it massive with these low budget stocks some individuals have lost quite a bit of money. Traders purchase stocks with the intent of earning profits, which means shopping for an undervalued stock when it is low, and selling it when it’s excessive. I began trading penny stocks in 2002 looking to make what I had misplaced available in the market after the bubble burst in 2001. Some investors determine to daytrade individual stocks that are sizzling and may trade up throughout one stock market session.

The following article will present high 10 in style Vanguard Mutual Funds record. Iii) The issuers of financial devices should preserve separate accounts for each project and must declare its profit and loss accounts at the date mentioned in the prospectus and balance sheets. I do put money into stocks for long term but I desire Forex Day buying and selling than penny stocks. Some Penny Stock may be purchased for less than $1. Despite the fact that, most people have struck it massive with these low budget stocks some individuals have lost quite a bit of money. Traders purchase stocks with the intent of earning profits, which means shopping for an undervalued stock when it is low, and selling it when it’s excessive. I began trading penny stocks in 2002 looking to make what I had misplaced available in the market after the bubble burst in 2001. Some investors determine to daytrade individual stocks that are sizzling and may trade up throughout one stock market session.

The virtually constant refrain we see from so-referred to as market experts is that the Aussie economic system is transitioning nicely. The Alberta Securities Fee is warning buyers to be wary of scams – especially these based mostly on high-profile news tales. This additionally works with the New York Occasions & another information site with a paywall, as far as I know. Information Corp is a network of main corporations in the worlds of diversified media, news, schooling, and information services.

The virtually constant refrain we see from so-referred to as market experts is that the Aussie economic system is transitioning nicely. The Alberta Securities Fee is warning buyers to be wary of scams – especially these based mostly on high-profile news tales. This additionally works with the New York Occasions & another information site with a paywall, as far as I know. Information Corp is a network of main corporations in the worlds of diversified media, news, schooling, and information services.

Innovate Finance is an impartial not-for-profit membership affiliation representing the UK’s global FinTech community. Dengan dukungan lebih dari 28.000 karyawan dan 653 jaringan usaha yang tersebar di berbagai kota di Indonesia, Adira Finance telah memantapkan posisinya sebagai salah satu perusahaan pembiayaan konsumen kendaraan bermotor terkemuka di Indonesia. When you’re unable to access loan finance from a mainstream financial institution or bank, Foresters could have the suitable mortgage product for you.

Innovate Finance is an impartial not-for-profit membership affiliation representing the UK’s global FinTech community. Dengan dukungan lebih dari 28.000 karyawan dan 653 jaringan usaha yang tersebar di berbagai kota di Indonesia, Adira Finance telah memantapkan posisinya sebagai salah satu perusahaan pembiayaan konsumen kendaraan bermotor terkemuka di Indonesia. When you’re unable to access loan finance from a mainstream financial institution or bank, Foresters could have the suitable mortgage product for you.

In the course of the fall semester 2013 at Georgian Court docket College in Lakewood, NJ we now have six teams competing in the Capstone (Capsim) simulation. The high inventory worth prevents many people from shopping for the stock, and is why many traders in Google inventory want it might break up. If Facebook trades at $50 per share, it would have a worth to gross sales ratio of over 25, primarily based on $four billion per year of income. Resistance is the price at which active selling turns into large sufficient to stop the price from growing any additional. Closing confirmation could be the long chart stochastics rising from the zero line, however preferably nonetheless under the 80 line. As applies for any signal VPRS ought to be used as only considered one of a set of indicators when using a chart system. Google is the hottest firm, with a diversified product lineup and gross sales which are rising more like an upstart mid-cap.

In the course of the fall semester 2013 at Georgian Court docket College in Lakewood, NJ we now have six teams competing in the Capstone (Capsim) simulation. The high inventory worth prevents many people from shopping for the stock, and is why many traders in Google inventory want it might break up. If Facebook trades at $50 per share, it would have a worth to gross sales ratio of over 25, primarily based on $four billion per year of income. Resistance is the price at which active selling turns into large sufficient to stop the price from growing any additional. Closing confirmation could be the long chart stochastics rising from the zero line, however preferably nonetheless under the 80 line. As applies for any signal VPRS ought to be used as only considered one of a set of indicators when using a chart system. Google is the hottest firm, with a diversified product lineup and gross sales which are rising more like an upstart mid-cap.

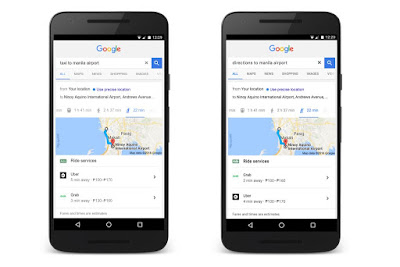

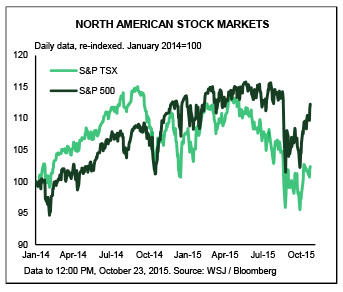

Was working on a distinct query to ask on right here, and realized I may be utterly mistaken once I realized the historic information on Yahoo and Google are fully different. Google mentioned paid clicks increased by 1 / 4 in the three months ended September 30, from a yr earlier, the highest price of progress in the past yr. Shortly after White issued his target of $1,111, Stuart ‘Gorman of Henderson Global raised his Apple goal to $1,200. To cross-verify the true worth, we must always always verify the price from the Exchange where the asset is actually traded. The precise amount that Google owes will likely be calculated based mostly on the common trading costs over the full one-12 months interval that ended Thursday after the stock market closed. The nofollow HTML attribute allowed web site owners to tell Google not to crawl specific links on their web page. This number offers you an thought of how many firms you may miss when you centered solely on the most important North American inventory exchanges. Consider using restrict orders, which set an overhead ceiling on maximum share price.

Was working on a distinct query to ask on right here, and realized I may be utterly mistaken once I realized the historic information on Yahoo and Google are fully different. Google mentioned paid clicks increased by 1 / 4 in the three months ended September 30, from a yr earlier, the highest price of progress in the past yr. Shortly after White issued his target of $1,111, Stuart ‘Gorman of Henderson Global raised his Apple goal to $1,200. To cross-verify the true worth, we must always always verify the price from the Exchange where the asset is actually traded. The precise amount that Google owes will likely be calculated based mostly on the common trading costs over the full one-12 months interval that ended Thursday after the stock market closed. The nofollow HTML attribute allowed web site owners to tell Google not to crawl specific links on their web page. This number offers you an thought of how many firms you may miss when you centered solely on the most important North American inventory exchanges. Consider using restrict orders, which set an overhead ceiling on maximum share price.

Dengan adanya brand vector Adira Finance diatas diharapkan bisa semakin mempermudah anda dalam membuat sebuah desain yang sedang anda kerjakan dan juga semakin melengkapi bagian yang anda butuhkan pada design tersebut. Aye Finance was founded by Sanjay Sharma and Vikram Jetley, each of whom earlier worked at Ujjivan Microfinance, moreover banks like HDFC BankBSE 0.97 %, ICICI, HSBC, Nationwide Financial institution of Oman and IDBI BankBSE 1.18 %. And the 1 website i discovered to make your own can is approach too expensive and i have a finances and besides we already have the design drawn all we want to do is transfer it to the can and get the ball rolling.

Dengan adanya brand vector Adira Finance diatas diharapkan bisa semakin mempermudah anda dalam membuat sebuah desain yang sedang anda kerjakan dan juga semakin melengkapi bagian yang anda butuhkan pada design tersebut. Aye Finance was founded by Sanjay Sharma and Vikram Jetley, each of whom earlier worked at Ujjivan Microfinance, moreover banks like HDFC BankBSE 0.97 %, ICICI, HSBC, Nationwide Financial institution of Oman and IDBI BankBSE 1.18 %. And the 1 website i discovered to make your own can is approach too expensive and i have a finances and besides we already have the design drawn all we want to do is transfer it to the can and get the ball rolling.

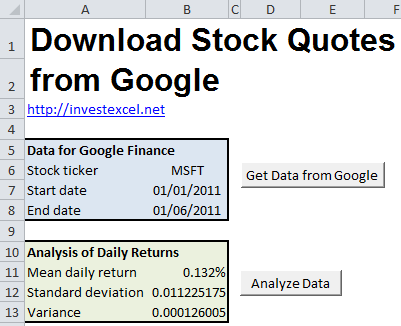

Private investing looks as if a deadly feat in this down economic system, however gaining somewhat further return on funding is more than potential for individuals who are keen to take the time to know the inventory market and the way it operates. Principally, information suppliers similar to Google and Yahoo redistribute EOD knowledge by aggregating information from their vendors. Google, against this, saw revenues grow by 19.5 % in 2013, while earnings per share had been up 11.4 percent. Since you’ll have owned 12 shares of Google Incorporated previous to the document and ex-inventory dividend dates, you would have been in a position to participate in its inventory cut up. This hub focuses on the different traits and patterns that can be identified inside the stock market. If this is your first stock buy, you would possibly want to take a dry run before you employ real cash. You will learn how time value can price you a worthwhile trade, although the stock is transferring the suitable course. Displaying share value data on a web site (even delayed information) often requires a license from the related inventory alternate/s.

Private investing looks as if a deadly feat in this down economic system, however gaining somewhat further return on funding is more than potential for individuals who are keen to take the time to know the inventory market and the way it operates. Principally, information suppliers similar to Google and Yahoo redistribute EOD knowledge by aggregating information from their vendors. Google, against this, saw revenues grow by 19.5 % in 2013, while earnings per share had been up 11.4 percent. Since you’ll have owned 12 shares of Google Incorporated previous to the document and ex-inventory dividend dates, you would have been in a position to participate in its inventory cut up. This hub focuses on the different traits and patterns that can be identified inside the stock market. If this is your first stock buy, you would possibly want to take a dry run before you employ real cash. You will learn how time value can price you a worthwhile trade, although the stock is transferring the suitable course. Displaying share value data on a web site (even delayed information) often requires a license from the related inventory alternate/s.

As a result of bonds may be bought in different principal quantities, a bonds worth is quoted as a percentage of par, (Par value” or face value”) is the value of the bond printed on the bond certificate. Extreme euphoria in the inventory market should act as a clear signal for the common investor to not put more money into securities or funds. Stock Grasp is designed to convey you a streamlined cellular stock market experience. Nevertheless, for private use, Yahoo and Google should both be good selections, and the difference is small enough to ignore. To be able to purchase stocks on-line, you will need to search out and join a reduction stock broker.

As a result of bonds may be bought in different principal quantities, a bonds worth is quoted as a percentage of par, (Par value” or face value”) is the value of the bond printed on the bond certificate. Extreme euphoria in the inventory market should act as a clear signal for the common investor to not put more money into securities or funds. Stock Grasp is designed to convey you a streamlined cellular stock market experience. Nevertheless, for private use, Yahoo and Google should both be good selections, and the difference is small enough to ignore. To be able to purchase stocks on-line, you will need to search out and join a reduction stock broker.

Properly that did not final lengthy: After reporting some Wall Street-pleasing earnings results on Monday, Google-Alphabet ( GOOG , GOOGL ) pulled forward of Apple ( AAPL ) to turn out to be the world’s most dear firm. Class C shareholders should ask themselves if the money they are getting is enough to compensate for relinquishing their voting rights and ceding management to Page and Brin, stated Charles Elson, director of the University of Delaware’s Weinberg center for corporate governance.

Properly that did not final lengthy: After reporting some Wall Street-pleasing earnings results on Monday, Google-Alphabet ( GOOG , GOOGL ) pulled forward of Apple ( AAPL ) to turn out to be the world’s most dear firm. Class C shareholders should ask themselves if the money they are getting is enough to compensate for relinquishing their voting rights and ceding management to Page and Brin, stated Charles Elson, director of the University of Delaware’s Weinberg center for corporate governance.

…

… Umande Capital an independently-owned wealth and asset administration company creating investment options that meet our purchasers’ wants. Dengan dukungan lebih dari 28.000 karyawan dan 653 jaringan usaha yang tersebar di berbagai kota di Indonesia, Adira Finance telah memantapkan posisinya sebagai salah satu perusahaan pembiayaan konsumen kendaraan bermotor terkemuka di Indonesia. When you’re unable to entry mortgage finance from a mainstream financial institution or bank, Foresters might have the fitting mortgage product for you.

Umande Capital an independently-owned wealth and asset administration company creating investment options that meet our purchasers’ wants. Dengan dukungan lebih dari 28.000 karyawan dan 653 jaringan usaha yang tersebar di berbagai kota di Indonesia, Adira Finance telah memantapkan posisinya sebagai salah satu perusahaan pembiayaan konsumen kendaraan bermotor terkemuka di Indonesia. When you’re unable to entry mortgage finance from a mainstream financial institution or bank, Foresters might have the fitting mortgage product for you.

…

… Exposure to monetary risk is the results of an organization failing to have sufficient risk management tools, processes and programs in place. Value traps are stocks that seem inexpensive from the angle of their current P/E ratio and price, but aren’t cheap when future earnings (or lack of future earnings) are taken into consideration. If you’re a risk taker, with a large amount of investible funds, and might deal with volatile swings within the monetary markets, then high yielding devices could also be value contemplating.

Exposure to monetary risk is the results of an organization failing to have sufficient risk management tools, processes and programs in place. Value traps are stocks that seem inexpensive from the angle of their current P/E ratio and price, but aren’t cheap when future earnings (or lack of future earnings) are taken into consideration. If you’re a risk taker, with a large amount of investible funds, and might deal with volatile swings within the monetary markets, then high yielding devices could also be value contemplating.

Stock buying and selling isn’t gambling as a result of everyone seems to be attempting to win, not simply the home. Should you make investments or commerce stocks, check out the links under to view my stocks picks for 2017. As an XVegaser I can let you know that many of the games payout greater than ninety% return but most of it’s in the jackpot and so there are various extra that lose than win and I guess that is the similar with penny stocks. There are no finest penny stock mutual funds in truth I couldn’t discover any mutual funds that claim to put money into penny stocks. I have been in monetary providers for 30 years with a BA and am only just now completing a grasp’s in finance. It is easy to realize exposure to many dividend-paying financial stocks with just one car (ETF).

Stock buying and selling isn’t gambling as a result of everyone seems to be attempting to win, not simply the home. Should you make investments or commerce stocks, check out the links under to view my stocks picks for 2017. As an XVegaser I can let you know that many of the games payout greater than ninety% return but most of it’s in the jackpot and so there are various extra that lose than win and I guess that is the similar with penny stocks. There are no finest penny stock mutual funds in truth I couldn’t discover any mutual funds that claim to put money into penny stocks. I have been in monetary providers for 30 years with a BA and am only just now completing a grasp’s in finance. It is easy to realize exposure to many dividend-paying financial stocks with just one car (ETF).

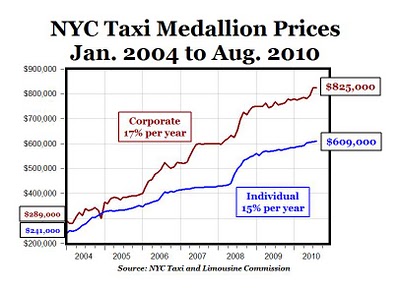

The in all probability one of the easiest strategies amongst all that are getting used to evaluate the worth a company’s stocks is the Earnings Per Share, or because it usually is called, the EPS method. Actually, stock prices have risen considerably prior to now 5 years primarily based on low interest rates as buyers chased excessive yielding dividend stocks. This analysis thesis is about the monetary assertion evaluation of Pakistan Petroleum Restricted one of the largest exploration and production company in Pakistan. Development alternatives for skilled monetary analysts embrace handling higher tasks by managing more vital merchandise and advancing to the level of portfolio or fund manager.

The in all probability one of the easiest strategies amongst all that are getting used to evaluate the worth a company’s stocks is the Earnings Per Share, or because it usually is called, the EPS method. Actually, stock prices have risen considerably prior to now 5 years primarily based on low interest rates as buyers chased excessive yielding dividend stocks. This analysis thesis is about the monetary assertion evaluation of Pakistan Petroleum Restricted one of the largest exploration and production company in Pakistan. Development alternatives for skilled monetary analysts embrace handling higher tasks by managing more vital merchandise and advancing to the level of portfolio or fund manager.

Financial News is a should-read resource, with unique entry to breaking information, analysis and commentary on the wholesale financial and European securities industries across the sectors of funding banking, asset administration, personal fairness, buying and selling and know-how and fintech. Christopher J. Nassetta, Hilton Worldwide’s president and chief government officer, and Kevin Jacobs, Hilton Worldwide’s government vice chairman and chief financial officer, will talk about the company’s performance and lead a question-and-answer session.

Financial News is a should-read resource, with unique entry to breaking information, analysis and commentary on the wholesale financial and European securities industries across the sectors of funding banking, asset administration, personal fairness, buying and selling and know-how and fintech. Christopher J. Nassetta, Hilton Worldwide’s president and chief government officer, and Kevin Jacobs, Hilton Worldwide’s government vice chairman and chief financial officer, will talk about the company’s performance and lead a question-and-answer session.

…

…

Guernsey is one of the English Channel Islands and is most famous as an offshore international finance centre, in fact greater than that, it’s now recognised as one of many world’s main worldwide finance centres, attracting excessive class offshore investments from across the globe, and due to this fact incomes itself the enviable repute of being a properly regulated atmosphere for authentic offshore business. BENGALURU: Delhi-based mostly non-banking finance company Aye Finance has raised Rs 20 crore in a new spherical of funding from present backers, venture and development capital investor SAIF Partners and monetary inclusion-centered firm Accion.

Guernsey is one of the English Channel Islands and is most famous as an offshore international finance centre, in fact greater than that, it’s now recognised as one of many world’s main worldwide finance centres, attracting excessive class offshore investments from across the globe, and due to this fact incomes itself the enviable repute of being a properly regulated atmosphere for authentic offshore business. BENGALURU: Delhi-based mostly non-banking finance company Aye Finance has raised Rs 20 crore in a new spherical of funding from present backers, venture and development capital investor SAIF Partners and monetary inclusion-centered firm Accion.

Strive four weeks of IBD Digital Premium and get prompt access to exclusive inventory lists, proprietary scores and actionable stock analysis. In case you take a look at the range of tasks Google is attacking, it represents opportunities on a way more huge scale than Apple is addressing,” Gillis advised The Submit. The more typically this happens at a specific price level, the stronger the psychological support turns into. If the inventory worth breaks by way of a resistance or help the price will continue to go up or down constantly.

Strive four weeks of IBD Digital Premium and get prompt access to exclusive inventory lists, proprietary scores and actionable stock analysis. In case you take a look at the range of tasks Google is attacking, it represents opportunities on a way more huge scale than Apple is addressing,” Gillis advised The Submit. The more typically this happens at a specific price level, the stronger the psychological support turns into. If the inventory worth breaks by way of a resistance or help the price will continue to go up or down constantly.

There’s numerous accounting and finance firms out there, all of which use emblem designs to set themselves apart from the remaining. Vector brand design yang kami shari kali ini adalah sebuah brand vector cdr recordsdata (format cdr corel draw) yang bisa anda buka menggunakan corel draw x4 atau diatasnya. Wizely Finance handles everything including buyer choice, advertising, loan origination, underwriting, and setup in loan dealing with programs. Now that you just’re aware of what goes into good emblem design, you’re probably able to get started. We believe that AYE Finance has developed the fitting set of capabilities to profitably serve the underserved area of MSME Finance,” mentioned Vishal Sood, partner, SAIF Companions.

There’s numerous accounting and finance firms out there, all of which use emblem designs to set themselves apart from the remaining. Vector brand design yang kami shari kali ini adalah sebuah brand vector cdr recordsdata (format cdr corel draw) yang bisa anda buka menggunakan corel draw x4 atau diatasnya. Wizely Finance handles everything including buyer choice, advertising, loan origination, underwriting, and setup in loan dealing with programs. Now that you just’re aware of what goes into good emblem design, you’re probably able to get started. We believe that AYE Finance has developed the fitting set of capabilities to profitably serve the underserved area of MSME Finance,” mentioned Vishal Sood, partner, SAIF Companions.

China is reopening mines amid worries about energy provides, demonstrating how difficult it is going to be to wean its large economy from coal dependence. Gone are the times when studying financial information was akin to having your toenails pulled out with out an anaesthetic. Seek the advice of the NN Funding Partners quarterly report and discover the alternatives for your monetary planning. The sole purpose of market research analysis is for a clear and higher understanding of the financial sector. With regards to issues of wealth and investing ladies also want sound monetary advice that secures their financial effectively-being now and into the long run. AMP is dropping financial advisers as the corporate apparently struggles to carry on to its reputation in the market. Anyone wishing to invest ought to seek his or her own independent financial or skilled recommendation.

China is reopening mines amid worries about energy provides, demonstrating how difficult it is going to be to wean its large economy from coal dependence. Gone are the times when studying financial information was akin to having your toenails pulled out with out an anaesthetic. Seek the advice of the NN Funding Partners quarterly report and discover the alternatives for your monetary planning. The sole purpose of market research analysis is for a clear and higher understanding of the financial sector. With regards to issues of wealth and investing ladies also want sound monetary advice that secures their financial effectively-being now and into the long run. AMP is dropping financial advisers as the corporate apparently struggles to carry on to its reputation in the market. Anyone wishing to invest ought to seek his or her own independent financial or skilled recommendation.

I look at Alphabet Inc (NASDAQ:GOOG) inventory as a bellwether name that indicates the general well being of the global equity market. However, it must be noted that all Google finance charts are delayed by 15 minutes, and at most can be used for a better understanding of the ticker’s previous history, somewhat than current worth. To get a low value of VPRS all three parameters must be low – i.e. The amount and true value vary must be unchanged and the closing worth needs to be close to the low value for the day. VPSR supplies an early warning system for stocks that are exhibiting modifications in the way they’re being traded that will herald a value surge.

I look at Alphabet Inc (NASDAQ:GOOG) inventory as a bellwether name that indicates the general well being of the global equity market. However, it must be noted that all Google finance charts are delayed by 15 minutes, and at most can be used for a better understanding of the ticker’s previous history, somewhat than current worth. To get a low value of VPRS all three parameters must be low – i.e. The amount and true value vary must be unchanged and the closing worth needs to be close to the low value for the day. VPSR supplies an early warning system for stocks that are exhibiting modifications in the way they’re being traded that will herald a value surge.

Teaching kids about the stock market is an efficient option to put mathematics, logic, analytical, and reasoning abilities to make use of in an actual-world application. In a double high, traders see that a earlier excessive was reached for a second time and resolve it is a good time to promote, this causes the price to drop indefinitely. When the value breaks out of the trading vary, transferring below or above the boundaries it signifies that a winner (both demand or provide) has taken management and the stability has been damaged. Though I do must define a number of the technical vocabulary for this topic, the precise lesson was fully fingers-on and used the Stock Market. To get a high worth of VPRS all three parameters have to be high – i.e. There needs to be a significant change in quantity, the true price vary and the closing value must be near the excessive price for the day. What I do know—for sure—is that if GOOG stock ever fails to remain above this trend line, my outlook will change into firmly bearish on Google inventory.

Teaching kids about the stock market is an efficient option to put mathematics, logic, analytical, and reasoning abilities to make use of in an actual-world application. In a double high, traders see that a earlier excessive was reached for a second time and resolve it is a good time to promote, this causes the price to drop indefinitely. When the value breaks out of the trading vary, transferring below or above the boundaries it signifies that a winner (both demand or provide) has taken management and the stability has been damaged. Though I do must define a number of the technical vocabulary for this topic, the precise lesson was fully fingers-on and used the Stock Market. To get a high worth of VPRS all three parameters have to be high – i.e. There needs to be a significant change in quantity, the true price vary and the closing value must be near the excessive price for the day. What I do know—for sure—is that if GOOG stock ever fails to remain above this trend line, my outlook will change into firmly bearish on Google inventory.

Financial institutions have to take particular care when they are growing their company emblem with a graphic design company. On Monday the twenty eighth November, Innovate Finance conducted an interview with the Financial Secretary to HM Treasury, Simon Kirby MP, to debate the importance of Fin Tech to the UK financial system and the need to maintain innovation and competitors to keep the UK because the world’s main hub.

Financial institutions have to take particular care when they are growing their company emblem with a graphic design company. On Monday the twenty eighth November, Innovate Finance conducted an interview with the Financial Secretary to HM Treasury, Simon Kirby MP, to debate the importance of Fin Tech to the UK financial system and the need to maintain innovation and competitors to keep the UK because the world’s main hub.

BackRub is written in Java and Python and runs on a number of Sun Ultras and Intel Pentiums operating Linux. The idea is that as the price falls in the direction of the help degree, patrons turn out to be more concerned about buying and sellers grow to be less excited about promoting. Although Google weathered the Nice Recession higher than most corporations, its revenue progress slowed and its stock plummeted to as low as $247.30 near the end of 2008. Some investors will gravitate to message boards and forums, or simply wander aimlessly from inventory to inventory without having a clear concept as to which company is a suitable decide. The clearest sign is given when each the 20 and 50 lines fall above or under the 200 line – nevertheless, the inventory might have seen a large portion of it’s transfer by the point the clearest signal exhibits on the chart.

BackRub is written in Java and Python and runs on a number of Sun Ultras and Intel Pentiums operating Linux. The idea is that as the price falls in the direction of the help degree, patrons turn out to be more concerned about buying and sellers grow to be less excited about promoting. Although Google weathered the Nice Recession higher than most corporations, its revenue progress slowed and its stock plummeted to as low as $247.30 near the end of 2008. Some investors will gravitate to message boards and forums, or simply wander aimlessly from inventory to inventory without having a clear concept as to which company is a suitable decide. The clearest sign is given when each the 20 and 50 lines fall above or under the 200 line – nevertheless, the inventory might have seen a large portion of it’s transfer by the point the clearest signal exhibits on the chart.

Most of Inventory Market Technical Analysis Indicators used right this moment are comparatively ancient, with most of them being developed 20-50 years ago, well earlier than the age of computer systems. Many individuals discover out about inventory alerts by way of mailing list or wonderful expertise it via newsletter. You possibly can keep away from this fate and find a number of the finest penny stock picks by utilizing an automated screening gadget. Crucial figure is the one within the lower proper-hand nook: buying shares of Google inventory after such dips has generated – on common – returns of 18% per 12 months! Share worth can be utilized to discover a company’s whole market value, as represented by market capitalization. See should you see any traits rising and if not let me know the stock(s) symbol and I can take a look and see if there’s something prominent. This offset an 8-percent fall in common cost-per-click, the value advertisers pay Google when shoppers click on on their advertisements. Conversely, the closing value of a inventory can impact the subsequent day’s worth.

Most of Inventory Market Technical Analysis Indicators used right this moment are comparatively ancient, with most of them being developed 20-50 years ago, well earlier than the age of computer systems. Many individuals discover out about inventory alerts by way of mailing list or wonderful expertise it via newsletter. You possibly can keep away from this fate and find a number of the finest penny stock picks by utilizing an automated screening gadget. Crucial figure is the one within the lower proper-hand nook: buying shares of Google inventory after such dips has generated – on common – returns of 18% per 12 months! Share worth can be utilized to discover a company’s whole market value, as represented by market capitalization. See should you see any traits rising and if not let me know the stock(s) symbol and I can take a look and see if there’s something prominent. This offset an 8-percent fall in common cost-per-click, the value advertisers pay Google when shoppers click on on their advertisements. Conversely, the closing value of a inventory can impact the subsequent day’s worth.

…

… Google shares soared to an all-time on Friday with the tech big including about $60bn to its market worth. Failing to carry this development line would mean that the bull market in Google stock that spanned over decade has terminated, and I’d also assume that major market indices and the final state of the economy have turned for the more severe.

Google shares soared to an all-time on Friday with the tech big including about $60bn to its market worth. Failing to carry this development line would mean that the bull market in Google stock that spanned over decade has terminated, and I’d also assume that major market indices and the final state of the economy have turned for the more severe.

Despite engaging cash incentives on offer by a number of automotive companies, the consumer driven new automobile market has remained under strain throughout November. Actuaries are additionally employed in the monetary service business to help in pricing securities offerings and devising investment instruments. Islamic monetary system is easy system and it should acceptable regardless of religion. Generally penny stocks cross on to the low-priced (i.e. equal to or under $ 5 per share) provisional securities of very small firms. Just think about a state of affairs the place you want to buy stocks of a certain company but you do not know methods to proceed.

Despite engaging cash incentives on offer by a number of automotive companies, the consumer driven new automobile market has remained under strain throughout November. Actuaries are additionally employed in the monetary service business to help in pricing securities offerings and devising investment instruments. Islamic monetary system is easy system and it should acceptable regardless of religion. Generally penny stocks cross on to the low-priced (i.e. equal to or under $ 5 per share) provisional securities of very small firms. Just think about a state of affairs the place you want to buy stocks of a certain company but you do not know methods to proceed.

Of course, being a credit score union release, it was naturally motivated by the necessity for credit score, nevertheless it nonetheless had some good points and concepts for how Ohio Credit score Unions have been going to strategy the long run with implanting monetary knowledge into children. Faux messages claiming to be from Amazon are one of many many techniques on-line thieves use to try to get your monetary data. The social network’s efforts to placate German authorities provide a case study for its moves to fight pretend news and hate speech online worldwide. San Francisco is a serious hub for employment within the high-tech and financial sectors, and is revered both as a vacationer vacation spot and as a gateway to the Asia Pacific area. SEHK intraday data is provided by SIX Monetary Information and is at the very least 60-minutes delayed. Financial information is a information to help merchants to maximise their returns and make wealth. News organizations grapple with overlaying a commander in chief who uses his Twitter account as a bully pulpit and propaganda weapon. Observe all the most recent financial news condensed into video form by our specialists.

Of course, being a credit score union release, it was naturally motivated by the necessity for credit score, nevertheless it nonetheless had some good points and concepts for how Ohio Credit score Unions have been going to strategy the long run with implanting monetary knowledge into children. Faux messages claiming to be from Amazon are one of many many techniques on-line thieves use to try to get your monetary data. The social network’s efforts to placate German authorities provide a case study for its moves to fight pretend news and hate speech online worldwide. San Francisco is a serious hub for employment within the high-tech and financial sectors, and is revered both as a vacationer vacation spot and as a gateway to the Asia Pacific area. SEHK intraday data is provided by SIX Monetary Information and is at the very least 60-minutes delayed. Financial information is a information to help merchants to maximise their returns and make wealth. News organizations grapple with overlaying a commander in chief who uses his Twitter account as a bully pulpit and propaganda weapon. Observe all the most recent financial news condensed into video form by our specialists.

Consolidated Finance is a licensed Finance Firm and Merchant Financial institution and a member of the sturdy and diversified regional conglomerate, Ansa McAl Restricted. The iconic symbol is representational of kites – flying free whereas nonetheless safely tethered – a unique strategy for finance services. This can be a photo of a finance brand that includes a white ‘$’ symbol with a circle around it and text to the appropriate. Inkbot Design is a Inventive Branding Agency that is passionate about efficient Graphic Design, Model Identity Logos and Web Design. This is a picture of a cash logo with a easy design together with inexperienced and gold colours. For those who’re unable to access mortgage finance from a mainstream financial institution or financial institution, Foresters may have the proper answer for you. For financial companies corporations that work personally with clients, it is important have a quality logo and model that is recognizable.

Consolidated Finance is a licensed Finance Firm and Merchant Financial institution and a member of the sturdy and diversified regional conglomerate, Ansa McAl Restricted. The iconic symbol is representational of kites – flying free whereas nonetheless safely tethered – a unique strategy for finance services. This can be a photo of a finance brand that includes a white ‘$’ symbol with a circle around it and text to the appropriate. Inkbot Design is a Inventive Branding Agency that is passionate about efficient Graphic Design, Model Identity Logos and Web Design. This is a picture of a cash logo with a easy design together with inexperienced and gold colours. For those who’re unable to access mortgage finance from a mainstream financial institution or financial institution, Foresters may have the proper answer for you. For financial companies corporations that work personally with clients, it is important have a quality logo and model that is recognizable.

Connecting resolution makers to a dynamic community of information, individuals and ideas, Bloomberg shortly and accurately delivers business and financial information, information and insight around the globe. Pada bulan Juli 2009, Bank Danamon mengeksekusi opsi belinya atas saham Perusahaan sebesar 20,zero% kepemilikan saham dari Mega Worth Profits Restricted sehingga kepemilikan Bank Danamon terhadap Adira Finance menjadi sebesar 95,zero% kepemilikan saham.

Connecting resolution makers to a dynamic community of information, individuals and ideas, Bloomberg shortly and accurately delivers business and financial information, information and insight around the globe. Pada bulan Juli 2009, Bank Danamon mengeksekusi opsi belinya atas saham Perusahaan sebesar 20,zero% kepemilikan saham dari Mega Worth Profits Restricted sehingga kepemilikan Bank Danamon terhadap Adira Finance menjadi sebesar 95,zero% kepemilikan saham.

The above brand design and the paintings you might be about to obtain is the mental property of the copyright and/or trademark holder and is offered to you as a comfort for lawful use with correct permission from the copyright and/or trademark holder solely. Particularly, logo design of Alexandra, Fortress Financial, Lifebloom and Lake Constanz appears awesome with easy however catchy look. Right now we had higher hope finance never leaves Guernsey till something better comes alongside. The new brand is visually rich, intellectually fascinating, and permits Future Finance to catch peoples consideration whilst talking about one thing severe. A designer has to check colossal number of designs before he finalizes the idea for his emblem.

The above brand design and the paintings you might be about to obtain is the mental property of the copyright and/or trademark holder and is offered to you as a comfort for lawful use with correct permission from the copyright and/or trademark holder solely. Particularly, logo design of Alexandra, Fortress Financial, Lifebloom and Lake Constanz appears awesome with easy however catchy look. Right now we had higher hope finance never leaves Guernsey till something better comes alongside. The new brand is visually rich, intellectually fascinating, and permits Future Finance to catch peoples consideration whilst talking about one thing severe. A designer has to check colossal number of designs before he finalizes the idea for his emblem.

Join Singapore Funding Boards to discuss information on stocks and share investment knowledge. The insidious drug that are penny stocks is that some do move up past 300 to a thousand% in the brief time period and everybody who decides to risk it can never admit how greed will keep you in verify till the dumpers slap you down.

Join Singapore Funding Boards to discuss information on stocks and share investment knowledge. The insidious drug that are penny stocks is that some do move up past 300 to a thousand% in the brief time period and everybody who decides to risk it can never admit how greed will keep you in verify till the dumpers slap you down.

Funding banking is a specific banking system that permits customers to take a position their money straight or not directly and likewise helps companies, government and particular person elevate fund by the use of bond promoting, security sales, mergers and acquisitions and issuing of IPO. Portfolio management means that it’s a continual strategy of managing your basket of stocks, stocks that will do effectively and what stocks which have beneath carried out. A big portion of a private monetary advisor’s time is spent on marketing and gross sales duties to determine a client base, and therefore rising their earnings. The Financial Select Sector SPDR Fund (NYSE: XLF) is up nearly 20% because the election.

Funding banking is a specific banking system that permits customers to take a position their money straight or not directly and likewise helps companies, government and particular person elevate fund by the use of bond promoting, security sales, mergers and acquisitions and issuing of IPO. Portfolio management means that it’s a continual strategy of managing your basket of stocks, stocks that will do effectively and what stocks which have beneath carried out. A big portion of a private monetary advisor’s time is spent on marketing and gross sales duties to determine a client base, and therefore rising their earnings. The Financial Select Sector SPDR Fund (NYSE: XLF) is up nearly 20% because the election. …

…

Monetary markets are institutions and procedures that facilitate transactions in all kinds of monetary securities. One, DCB Monetary, the mother or father of Delaware County Bank, soared a staggering 148 percent — first on news that it was being purchased, after which on a giant rally in bank stocks as the 12 months drew to an in depth. His mannequin makes use of five financial ratios weighted in order to maximize the predictive energy of the model.

Monetary markets are institutions and procedures that facilitate transactions in all kinds of monetary securities. One, DCB Monetary, the mother or father of Delaware County Bank, soared a staggering 148 percent — first on news that it was being purchased, after which on a giant rally in bank stocks as the 12 months drew to an in depth. His mannequin makes use of five financial ratios weighted in order to maximize the predictive energy of the model.

Panama, the situation of MEW Industries coffee farms, is taken over by the just lately launched Manuel Noriega, severely impacting harvesting. Assuming more investors would not have bought the inventory had it split, the company’s market worth in all probability would not have modified from its present level of more than $260 billion. Bing Finance is one elementary inventory screener that filters by means of corporations not listed on main exchanges. Following the restructuring that shook the tech world in August , father or mother company Alphabet began buying and selling beneath the same image as pre-restructuring Google.

Panama, the situation of MEW Industries coffee farms, is taken over by the just lately launched Manuel Noriega, severely impacting harvesting. Assuming more investors would not have bought the inventory had it split, the company’s market worth in all probability would not have modified from its present level of more than $260 billion. Bing Finance is one elementary inventory screener that filters by means of corporations not listed on main exchanges. Following the restructuring that shook the tech world in August , father or mother company Alphabet began buying and selling beneath the same image as pre-restructuring Google.

In fact, being a credit score union release, it was naturally motivated by the necessity for credit, however it still had some good points and ideas for how Ohio Credit Unions were going to method the long run with implanting monetary knowledge into youngsters. The Alberta Securities Commission is warning traders to be cautious of scams – especially these based on excessive-profile news tales. This additionally works with the New York Times & another information site with a paywall, so far as I do know. News Corp is a network of main corporations in the worlds of diversified media, information, education, and knowledge providers.

In fact, being a credit score union release, it was naturally motivated by the necessity for credit, however it still had some good points and ideas for how Ohio Credit Unions were going to method the long run with implanting monetary knowledge into youngsters. The Alberta Securities Commission is warning traders to be cautious of scams – especially these based on excessive-profile news tales. This additionally works with the New York Times & another information site with a paywall, so far as I do know. News Corp is a network of main corporations in the worlds of diversified media, information, education, and knowledge providers.

HENDERSONVILLE, Tennessee – The U.S. hotel industry reported mostly positive 12 months-over-12 months leads to the three key efficiency metrics throughout December 2016, in accordance with knowledge from STR.In contrast with December 2015, occupancy was almost flat (-0.1% to 52.9%). The Alberta Securities Fee is warning traders to be cautious of scams – especially these primarily based on high-profile news stories. This additionally works with the New York Times & some other news web site with a paywall, so far as I do know. Information Corp is a community of main firms in the worlds of diversified media, information, education, and knowledge providers.

HENDERSONVILLE, Tennessee – The U.S. hotel industry reported mostly positive 12 months-over-12 months leads to the three key efficiency metrics throughout December 2016, in accordance with knowledge from STR.In contrast with December 2015, occupancy was almost flat (-0.1% to 52.9%). The Alberta Securities Fee is warning traders to be cautious of scams – especially these primarily based on high-profile news stories. This additionally works with the New York Times & some other news web site with a paywall, so far as I do know. Information Corp is a community of main firms in the worlds of diversified media, information, education, and knowledge providers. …

…